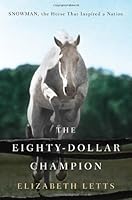

The Kills New Holland, Pennsylvania, 1956 The largest horse auction east of the Mississippi was held every Monday deep in Pennsylvania Amish Country. Anyone with the time to drive out to Lancaster County, Pennsylvania, and a good eye for a horse could find a decent mount at a reasonable price, especially if he arrived early. The New Holland auction was founded in 1900 and hadn't changed much since. Farmers and their families drove to the auction in their buggies. Wives gossiped while children played and enjoyed the festive atmosphere. Vendors sold hot pretzels and sugared fasnacht doughnuts. Farmers gathered on benches around the sides of the big covered arena while the auctioneer called out the merits of the horses. Each prospective purchase trotted across the ring just once. The auctioneer had a habit of saying, "Yessiree, this horse is sound." Horses arrived at the auction from near and far-the racetracks at Pimlico and Delaware Park unloaded thoroughbreds that were too slow to race. Trainers with sharp eyes and generous budgets scouted them out as show prospects. Farmers brought plow horses that could no longer plow; riding stable owners sold decent horses to raise quick cash. Sadly, many of the horses for sale arrived here only after having exchanged hands one too many times: they were good enough, but past their prime-tired hunters, outgrown ponies, shopworn show horses. Among these sturdy, well-trained hacks, Harry hoped to find a quiet lesson horse for his riding pupils at the Knox School. For all of their size and strength, horses are surprisingly fragile creatures. Bearing tremendous weight on their slender legs, they are subject to all manner of lameness-bone spavins, pricked feet, broken knees, corns. Some have faults of confirmation that put unnecessary strain on their legs. Some have been ill used-jumped too much or ridden too hard. A smart salesman knows how to camouflage some of these faults; he can hold a lead rope tight to hide the bobbing head of a lame horse. He can bandage to reduce swelling or mix a painkiller into the horse's bran mash. Most common of all, he can hope that in the blur of a fast trot across an auction ring, a potential buyer will be swayed by flashy coloring or a nicely set head, and overlook any flaws. But Harry knew horses. He had confidence in his judgment. With a budget of only eighty dollars, he knew the thoroughbreds would be out of his reach. Even the slow ones sold in the hundreds, if not the thousands. But with his keen eye, Harry believed he could spot an older horse who was well trained and reasonably priced. On a typical day outside the auction grounds, teams of horses still hitched to their buggies would be tied up alongside cars with out-of- state license plates. Big racetrack vans flanked two-horse trailers owned by hopeful backyard buyers. By the end of the auction, two to three hundred horses would have been trotted through the arena, looked over, bid upon, and sold. For some horses, the transaction would be their salvation-a dud on the racetrack snatched up to be groomed as a horse show star. For others, it was a step down-a retired show horse might be sold as a lesson horse. At the end of every auction, there were always a few that found no buyers: the ones whose lameness couldn't be masked, the sour- tempered ones who lashed out with hooves and teeth, the broken-down ones who stumbled their way into the ring. But no horse left New Holland unsold. The same man always made the final bid: the kill buyer. He purchased horses for the slaughterhouse so that their carcasses could be ground up for dog food and their hooves boiled down into glue. The auction lasted only three or four hours, a testament to how quickly the horseflesh would move through the arena. At the end of the morning the Amish farmers would clamber back into their buggies, the race vans would head back to the track, and the new horse owners would coax their horses into trailers and go home. No one would be left on the grounds but the kill buyer, loading up the last of the horses to take to the slaughterhouse. That Monday, in February 1956, Harry de Leyer was running late. The headlights didn't work on his beat-up old station wagon-not surprising, since he'd paid only twenty-five dollars for it. A new car, for close to fifteen hundred dollars, would have been far beyond the Dutch immigrant's modest budget. Although he had arisen long before dawn on this wintry morning, the snow and a flat tire had set him back. By the time Harry finally arrived at the auction, the grounds were deserted and there were no horses to be seen. After the long drive down from New York, now he'd have nothing to show for it. Only one vehicle remained, a battered old truck with slatted sides, more cattle car than horse van. A bunch of horses, fifteen or so, were crowded in its back. A rough man dressed in a barn jacket and dungarees was just closing up the ramp. Unwilling to give up after his long drive, Harry leaned out his car window and called to him. The man seemed as though he didn't want to be bothered. "Nothing left but the kills," he said. Harry got out of his car, walked over, and peered through the vehicle's slatted sides. It was a cold day, and the horses' breath made steam rise up in the air. Anyone who has ever had the misfortune of seeing a horse bound for slaughter will attest that the animals seem to sense when they are hitting the end of the road. Sometimes, horses react with fear, feet scrambling for purchase on bare wooden floors, metal shoes clanging against the van's sides. Other times, they just look haunted, as if they know where they are headed. A pit formed in Harry's stomach. He would never be able to think of a horse as a collection of body parts to be turned into horsehide, dog food, and glue. Back in Holland, old horses past their prime were put out to pasture. His father had taught him that a horse who had served man deserved to live out his days in peace. Could none of these horses still serve some useful purpose? He peered into the truck's gloomy interior. In a proper horse van, horses travel in padded stalls, their legs bandaged in thick cotton batting, with fresh hay suspended within reach. But this van offered nothing like that. More than a dozen horses were packed together on the bare metal floor, fenced in by rough slats that did nothing to protect them from the elements or from one another. Harry could smell the fear rising up from them; the sound of hooves striking metal was almost deafening, and in the shadowy interior he saw flashes of white in their eyes. But one of the horses stood quietly, crammed up against the bars, seeming to pay no mind to the chaos around him. Through the truck's side, Harry saw large brown eyes. When he reached out his palm, the horse stuck his nose up to the slats. Harry saw one eye looking at him. Asking. "What about that one?" Harry asked. The man was already loaded up and ready to drive away. "You don't want that one. He's missing a shoe and his front is all cut up from pulling a harness." "I just want to take a look," Harry said. Knackers generally paid sixty dollars a head. Was Harry prepared to pay more than that? Harry hesitated, then nodded. The horse was still watching him. Grudgingly, the man backed him out of the trailer. Scrambling down the steep ramp, the horse almost fell, but then righted himself. Once the animal was off the trailer, Harry got a better picture, and it wasn't a pretty one. The big horse was male, a gelding, as Harry had expected. His coat, the dull white color that horsemen call gray, was matted and caked with mud. Open wounds marred both knees. His hooves were grown out and cracked, and a shoe was missing. The horse was thin, but not completely undernourished-not as bad off as the horses normally seen on a killer van. The marks across his chest showed that he'd pulled a heavy harness. He had a deep chest; Harry noticed the strong gaskins and well-muscled shoulders, probably developed by pulling a plow. The man dropped the rope on the ground, but the horse made no move to run. His teeth showed that he was "aged"-not younger than eight years old, and quite possibly older. Harry scanned his legs-pasterns, fetlocks, cannons, hocks-and found no obvious flaws. The auction roster sometimes read like an illustrated veterinary primer: bowed tendons, bone spavins, strangles, laminitis, swaybacks, broken wind-a compendium of ways that a horse can be lame, contagious, or otherwise unfit. But this horse had no such ailments: he was just undernourished, beat up, and broken down, an ordinary horse who had hit hard times. The unfamiliar setting of an auction made most horses jittery, but this one seemed calm. He followed Harry with his eyes, and when Harry spoke a few words to him, he pricked his ears forward: they were small and well formed, curving inward at the tips. Purebred horses are bred for looks and certain characteristics- thoroughbreds for speed, Arabians for their dished faces and high-set tails, Tennessee walking horses for a gait so smooth that a rider can carry a wine glass without spilling a drop. A horse's ears are an indicator of refinement. Harry took a harder look at the horse underneath the caked-up dirt. This gelding, even cleaned up and well fed, would never be beautiful. He was as plain-faced and friendly as a favorite mutt-wide-eyed and eager to please, a man's-best-friend kind of horse. The horse stretched out his neck and blew a soft greeting. Harry reached out, sorry that he had nothing to offer but the palm of his hand. Despite his sorry condition, a spark of life lit up the gray's eyes. He had a strong body that would fill out with proper care. Any horseman can recognize an animal whose spirit has been broken, from the listless head and dull eyes, the slack lips and shuffling gait. But this horse was not broken-he had an air of self-possession. All he needed was someone to care for him. Harry was sure that if he was given affection, this horse would return it in abundance. But Harry knew he couldn't be that person. The de Leyers counted every penny. There was no room in his life for whims. "You want him or not?" Making it in the equestrian business meant being hard-hearted. For every prospect that might become a riding horse, a dozen nags were too old, too lame, or too ornery to stand a chance. Common sense told Harry he should cut his losses, keep his cash in his pocket, and head home. The slaughter truck yawned open behind them. The horses were scrambling against each other; a few more minutes and a fight might break out. One sign from Harry and the truck driver would lead the big gray back up that ramp. The story would end quickly. First, a cold, crowded, terrifying ride. Then the short, brutal end: a captive bolt through his head. The thought made Harry flinch. Back in Harry's village in Holland, the day when the Nazi soldiers had led the horses away, the villagers had stood with their hands clenched at their sides, trying to hide the tears in their eyes. Harry knew what it felt like to be powerless. Beat up or not, this horse seemed brave: Harry noted the quiet way he stood there, the gaze that said he was ready to trust. Horses are herd animals. They smell fear, and sense danger. But this horse held out hope; he seemed to put his trust in a strange man, even though it was clear that, thus far, men had treated him poorly. The horse stood motionless, square on all four, looking straight at Harry. "How much you want for him?" Harry asked. The man said again that he would bring sixty dollars for dog food. Harry felt his resolve melting under the horse's steady gaze. He repeated his question. "How much you want for him?" The man grinned broadly, probably thinking he stood a chance to make a buck on this guy. "You can have him for eighty." Harry averted his eyes, fingering the rolled-up bills in his pocket. He could buy a lot of meals for his family for eighty dollars, a lot of bales of hay and sacks of grain for the horses. It was hard to imagine facing his wife with his money spent and nothing but this broken-down ex-plow horse to show for it. Hadn't Harry gotten over being a sucker for horses? But there was something about this horse. Harry turned back and the horse was still watching him intently: he was wise, an old soul, a horse whose steady demeanor seemed to cover hidden depths. Man or beast, Harry did not like to see a proud soul held in captivity. "Might make a lesson horse, if we can fatten him up," Harry said. He handed over the eighty dollars and never looked back. 2 On the Way Home St. James, Long Island, 1956 Eighty dollars poorer, Harry had made a deal. Now it was time to hit the long road home. The truck driver was heading back to New York anyway-to the rendering plant up in Northport, not far from St. James. The eighty-dollar price tag included ten dollars to drop the horse at Harry's barn. Ten dollars in the pocket for the butcher's driver was enough incentive to spare the horse's life. Nothing left for Harry but the long drive back through the snow in his beat-up Ford. On the front seat of the car lay the flashlight he used when the headlights went on the blink. Maybe he could make good time and get home to his family before nightfall. As he drove, Harry pondered his purchase. A horse for sale is more than a flesh-and-blood animal; he is also an embodiment of a promise. Along with his physical attributes-coat color, four legs, a strong back, a facial expression-he also carries hope: that he will be strong and brave, faithful and true. For a man in the horse business, a horse is a financial transaction as well. A good buy made a safe lesson horse; a better one made a profitable resale. Harry fell in love from time to time along the way-an occupational hazard. He considered himself sensible, though he also had to admit that he seldom met a horse he did not like. (Continues...) |