The Big Picture | |

- Networked Society ‘On the Brink’

- Media Appearance: Dylan Ratigan Show (11/7/11)

- Revolving credit outstanding falls to lowest since ’04

- Digital Media Consumer Behaviors

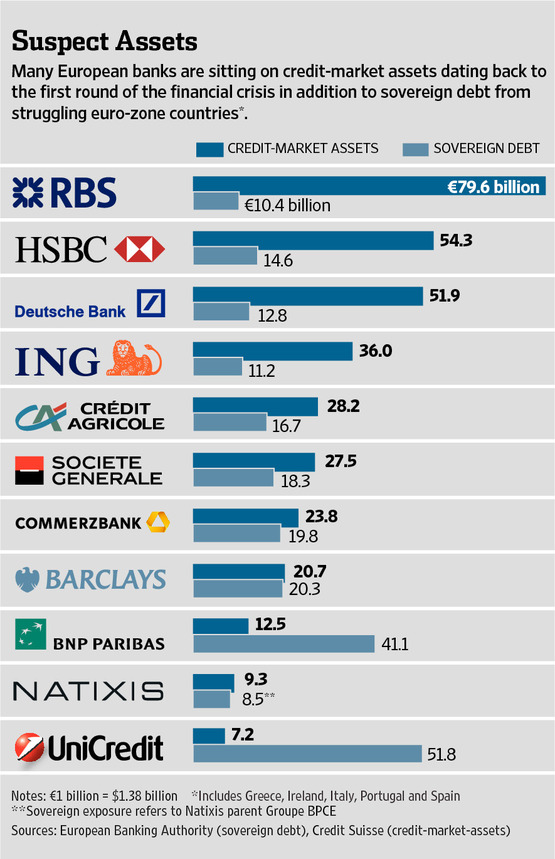

- European Bank Exposure to Risky Mortgage Assets

- Business Cycle Trends

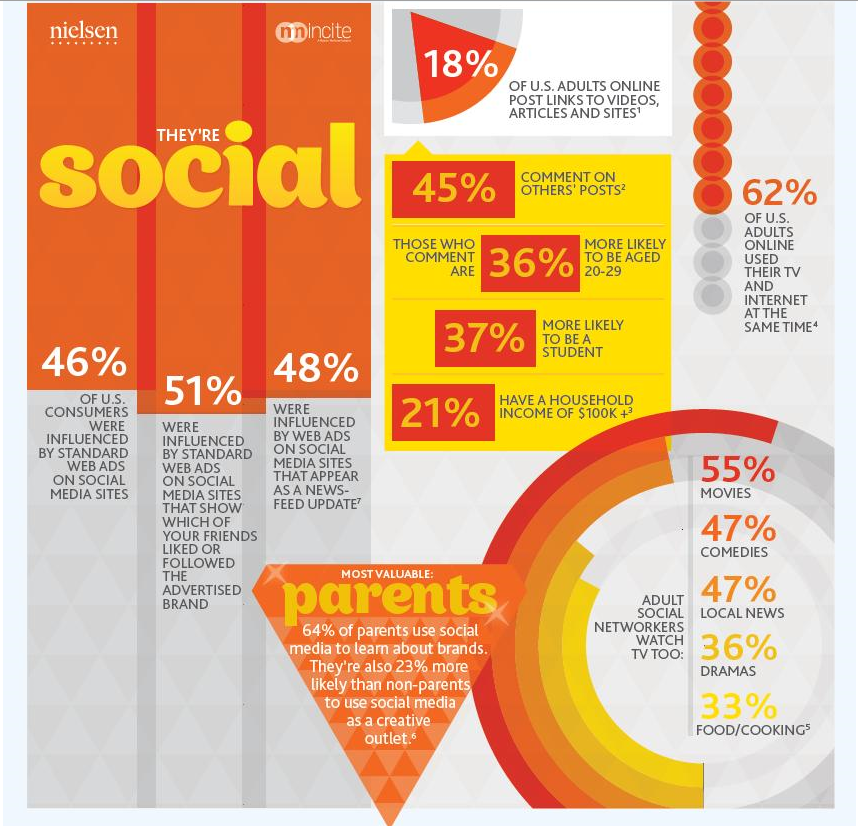

- What They Are Doing

- 4 Major Secular Bear Markets, 1900-2011

- Italian yields approach highs into close

- The Viral Big Lie

| Networked Society ‘On the Brink’ Posted: 07 Nov 2011 03:00 PM PST In On The Brink we discuss the past, present and future of connectivity with a mix of people including David Rowan, chief editor of Wired UK; Caterina Fake, founder of Flickr; and Eric Wahlforss, the co-founder of Soundcloud. Each of the interviewees discusses the emerging opportunities being enabled by technology as we enter the Networked Society. Concepts such as borderless opportunities and creativity, new open business models, and today’s ‘dumb society’ are brought up and discussed. http://ericsson.com/networkedsociety Hat tip GigaOm |

| Media Appearance: Dylan Ratigan Show (11/7/11) Posted: 07 Nov 2011 01:00 PM PST > I will be swinging by Dylan’s place this afternoon about 4:15pm to discuss the problems in the EuroZone, the possibility of a recession, and of course, the Big Lie in finance: A few bullet points:

More to come later. > |

| Revolving credit outstanding falls to lowest since ’04 Posted: 07 Nov 2011 12:52 PM PST Revolving consumer credit (mostly credit card debt) outstanding fell a slight $600mm in Sept from Aug but to the lowest level since Aug 2004 at $789.6b. Nonrevolving credit outstanding (mostly auto and student loans) rose by $8b. While nonrevolving debt outstanding has picked up coincident with the improvement in auto sales and persistent rise in student loan debt, through a combination of reduced credit lines, more use of debit cards and debt paydown, the amount of credit card debt taken on continues to decline. As a % of nominal GDP, revolving consumer credit outstanding is currently 5.2%, down from the peak of revolving debt in ’08 at 6.8%. At 5.2%, it’s the lowest since Q3 1995 but still remains above the level of 4.0% in 1990 and 2.9% in 1985. |

| Digital Media Consumer Behaviors Posted: 07 Nov 2011 12:00 PM PST |

| European Bank Exposure to Risky Mortgage Assets Posted: 07 Nov 2011 12:00 PM PST > Source: |

| Posted: 07 Nov 2011 11:26 AM PST |

| Posted: 07 Nov 2011 10:00 AM PST Frederick Sheehan is the co-author of Greenspan's Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for Power: The True Story of How Alan Greenspan Enriched Wall Street and Left a Legacy of Recession, was published by McGraw-Hill in November 2009. He was Director of Asset Allocation Services at John Hancock Financial Services in Boston. In this capacity, he set investment policy and asset allocation for institutional pension plans. ~~~ The Euro and You described a fundamental problem of world finance. The quantity of debt grows as the quality recedes. The problem of bad loans is no longer just the pre-2008 mortgages, CDOs, and LBOs. Debt issued after the bust is defaulting, such as Greek sovereign bonds, issued in June 2010. Some securities are born to part investors from their money, but it’s remarkable the extent and variety of such instruments issued in 2011. The world choked on similar bonds and derivatives only three years ago, many of which are still held at false prices on financial institutions’ books. Of all the past century’s downgrades, none has been greater than the borrower’s promise that stands behind a “security,” a word that once credibly described a paper contract backed by appropriate collateral. In Debt and Delusion, Peter Warburtin wrote: “It is easy to forget that, as recently as in the 1960s, the government budgets of the OECD countries were in approximate balance and that net issues of debt were comparatively rare. The outstanding stock of debt in public hands was a meager $800 billion at the end of 1970. At that time debt issue was typically reserved for the financing of large construction projects or investment by power generation companies by publicly owned companies.” Today, PIMCO’s Bill Gross manages $244 billion in a single bond fund. The starting pistol was sounded on August 15, 1971, 40 years ago. On that date, the United States broke its long-standing promise to pay one ounce of gold to a foreign government that redeemed $35 for the same. (The ability of American citizens to redeem dollars for gold with the U.S. government was modified during World War I and ceased after the War.) As a prelude to the loosy-goosy financial contracts today, it is worth reviewing the wording of the contractual relationship between the United States government and the holder of its currency before and after. (A book should be written on the parallels between the century-long degradation of language, the American legal system, money, credit, debt, and the American people.) The face of a $20 bill, a gold certificate, issued in 1882, stated: “This certifies that there have been deposited in the Treasury of the United States, twenty dollars in gold coin, repayable to the bearer on demand.” The bearer of $20.67 received one ounce of gold in exchange. This is a simple legal contract. It is easy to understand. There was no theory. No economists were employed to interpret what did not require interpretation. A 2011 Federal Reserve Note states: “This note is legal tender for all debts, public and private.” As contracts go, this makes no sense. Nor does it make sense to a three-year-old. My extensive survey of three-year-olds did not uncover a single child, who, in exchange for a $20 bill, preferred another $20 bill rather than receive a one-ounce gold coin. (The current value of the one-ounce coin versus that of the $20 bill is not germane to this survey.) The abstraction of money is related to the manner in which securities today are often backed by abstract or non-existent collateral. Contradictory theories employ at least 100,000 economists (probably multiples of this figure), among whom, there may not be a handful who ever write or think about money. Read (if you must) the theoretical papers or newspaper columns of these imposters. They retreated into a soothing bubble bath of differential calculus generations ago. Many of the malignant securities issued in 2010 and 2011 have fallen into disfavor. Credit markets have suffered loss of liquidity, momentary or protracted. These issues, collateralized by hope and imagination, are on the books though, often at institutions that already hold wads of securities still valued at wishful prices (for purposes of accounting, capital requirements, and falsifying the institutions’ dubious solvency). We should expect that when Federal Reserve Chairman Ben Bernanke revs up his money machine, more will flow. It is a safe bet that Ben is preparing to welcome more unmentionable securities on the Fed’s balance sheet. (“Federal Reserve officials are starting to build a case for a new program of buying mortgage-backed securities to boost the ailing economy….” – Wall Street Journal, October 21, 2011.) Guessing at why the Fed will splurge is a chicken-or-egg game. Is the Fed preparing for a downdraft in the stock market with its tried-and-false response: by creating more money? Or, is it preparing to transmit (by electronic keystroke) more dollars to absorb securities held at banks, insurance companies, money-market funds, and mutual funds that should be carried at a much lower value? The Fed washed its hands of credit analysis on January 6, 2011, when it issued its weekly H.4.1 “Factors Affecting Reserve Balances.” The federal agency that vaunts its “transparency” (i.e.: the Fed) implanted a note that transferred all capital losses to the taxpayer. The January 6, 2011, “Factors Affecting Reserve Balances” stated that beginning on January 1, 2011, all capital losses in the Federal Reserve’s mangy and non-transparent portfolio would henceforth be transferred to the Treasury Department. In a sense, this is only an accounting frivolity, since the taxpayer ultimately pays for the New York Fed’s reckless mismanagement of its highly leveraged portfolio (103:1); that could soon, absent the January 6 sleight-of-hand, mirror Enron’s jambalaya. After the 2008 credit meltdown, the Fed, led by Simple Ben, fought for greater regulatory control of the banking system. The cranks who warned against Federal Reserve regulatory authority have been vindicated, on a comically inflated scale. Wild-and-wooly securities that cratered after the credit cycle turned (circa 2007) are back, for instance: low doc, cov lite, payment-in-kind toggle notes, the proceeds of which pay private-equity firms up-front dividends. Century bonds (Mexico, the University of Southern California) sold swiftly, never a good sign. “Synthetic junk bonds” warned the Financial Times that “resemble transactions linked to U.S. mortgages, which proliferated before the crisis” and “staple deals” counseled the Wall Street Journal that “came under sharp criticism during the buyout boom for causing a number of conflicts of interest” have been structured by the banks that Ben Bernanke regulates. This highlights the greatest conflict of interest: the false claim that the Federal Reserve regulates the banks. One security in the pipeline (possibly on hold during the current market mayhem) is a “synthetic deutsche mark,” that would “create shadow trading in legacy currencies in a synthetic market.” Paul Volcker said somewhere the only financial advancement of the past 30 years is the ATM card. Comparing the collateral behind Peter Warburtin’s bond market to the absence of such behind the synthetic deutsche mark (a currency that ceased to exist over a decade ago) outlines the enormous waste of capital, human ingenuity, and savings over the past 40 years. With nothing learned, this will continue, until uncollateralized paper spawns a New Era in post-fiat origami. |

| 4 Major Secular Bear Markets, 1900-2011 Posted: 07 Nov 2011 09:00 AM PST Dow Jones Industrial Average 1900- present (log scale, monthly)Click for ginormous chart > I mentioned yesterday I had a long term chart of secular bear markets that was informative; the above chart (via Merrill Lynch) is what I was referring to. There are three issues worth noting here plus one important caveat: 1. The long 10-20 year secular bear moves seem to have lots of major rallies and sell offs; the ups and downs are intense, but make little in the way of net progress. After 15 years, the average secular bear is essentially unchanged. 2. The roller coaster ride leaves investors psychologically exhausted. They come to forget the good times of so long ago, and believe there is no way out of the morass. Naturally, they are reluctant to believe in the new bull market once it begins. 3. The major bottom seems to occur about halfway through; this implies that the March 2009 lows will not be revisited (note I only wrote IMPLY and not guarantee or forecast!) If we look at the current Bear versus the '66-'82 (with lows like '73-'74), it suggest that 8500-9000 on the Dow is possible, but barring another crisis 6500 is much less likely. And it also suggests that the next secular bull might begin around 2016-18. Now for the caveat: We have but one century of data, and within that 100 year span, only four examples of long term secular bear markets. We really need 500-1000 years of data, 20-40 secular bears during the era of modern capital markets. That would allow us greater confidence that these four patterns aren’t merely coincidences. See you around 2900 to validate the data . . . |

| Italian yields approach highs into close Posted: 07 Nov 2011 08:55 AM PST With minutes to go before the European close, Italian bond yields are moving back to near their highs of earlier this morning. The 10 yr in particular is at 6.65% vs the 3:30am intraday high of 6.68%. The 5 yr yield has broken out to new highs at 6.69%. The 2 yr yield though at 5.97%, up 50 bps on the day, is still below the intraday high of 6.19% at around 4:30am. |

| Posted: 07 Nov 2011 08:04 AM PST My Washington Post article, What caused the financial crisis? The Big Lie goes viral, was the single most popular article of the Sunday paper. Traffic migrated from the rest of the Post readers, and it generated 800+ comments Be sure to check it out |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |