| |

Now playing: Slate V, a video-only site from the world's leading online magazine. Visit Slate V at www.slatev.com. Now playing: Slate V, a video-only site from the world's leading online magazine. Visit Slate V at www.slatev.com. | |

| Dear Prudence Bye-Bye Baby My sister is making a huge mistake by placing her child for adoption. Posted Thursday, Oct 20, 2011, at 11:17 AM ET  Get Dear Prudence delivered to your inbox each week; click here to sign up. Please send your questions for publication to prudence@slate.com. (Questions may be edited.) Got a burning question for Prudie? She'll be online at Washingtonpost.com to chat with readers each Monday at 1 p.m. Submit your questions and comments here before or during the live discussion. Dear Prudie, To continue reading, click here. Join the Fray: our reader discussion forum What did you think of this article? POST A MESSAGE | READ MESSAGES Also In Slate Does the Death of Qaddafi Vindicate Obama's Foreign Policy? NPR Freelancer Fired for Serving as Occupy Wall Street Spokeswoman Saletan: Does Perry Really Believe Christians Should Vote Only for Christian Candidates? | Advertisement |

| Manage your newsletters subscription: Unsubscribe | Forward to a Friend | Advertising Information | |

| Ideas on how to make something better? Send an e-mail to slatenewsletter@nl.slate.com. Copyright 2011 The Slate Group | Privacy Policy | |

No matter how carefully you plan your goals they will never be more that pipe dreams unless you pursue them with gusto. --- W. Clement Stone

Thursday, October 20, 2011

Dear Prudence: Bye-Bye Baby

Politics: Mr. Second Place

| |

Now playing: Slate V, a video-only site from the world's leading online magazine. Visit Slate V at www.slatev.com. Now playing: Slate V, a video-only site from the world's leading online magazine. Visit Slate V at www.slatev.com. | |

| Politics Mr. Second Place Why Ron Paul has other Republicans running scared in Nevada. By David Weigel Posted Thursday, Oct 20, 2011, at 02:01 AM ET  LAS VEGAS—The room seats 315 people, and Ron Paul's speech is scheduled to start at 12:30 p.m. Wednesday. The room is full at 12:20. There are middle-aged people with Ron Paul gear—vintage 2008 stuff, homemade designs with Paul wearing a surgical mask—and students from the University of Nevada Las Vegas. They keep themselves amused. "Socialism sucks!" yells one kid wearing a knit cap. "Ron Paul 2012!" yells another student. "Rand Paul 2016!" yells an older man cradling a tot. The show starts on time. Paul's wife Carol, a petite woman with big blonde hair, walks to a reserved seat and gets immediate cheers of recognition. Peter Tariche, a serious-looking computer programmer who directs Youth for Ron Paul in the Western states, rises for the introduction. "Only one man has defended liberty and the Constitution," says Tariche. "History will look back kindly on him, for our generation has the power, the will, and the courage to restore a free society. We, the youth of this campaign, will fuel this movement. We will fix the problems that now face this generation." That's Paul's cue. He strides onto the stage and begins with this: "A lot has happened the last couple of years." Thus begins a 35-minute lecture about Austrian economics, Keynesian economics, Randolph Bourne (who coined the idea that "war is the health of the state"), the origins of the housing crisis, and the road to serfdom. He talks up his new ... To continue reading, click here. Join the Fray: our reader discussion forum What did you think of this article? POST A MESSAGE | READ MESSAGES Also In Slate Does the Death of Qaddafi Vindicate Obama's Foreign Policy? NPR Freelancer Fired for Serving as Occupy Wall Street Spokeswoman Saletan: Does Perry Really Believe Christians Should Vote Only for Christian Candidates? | Advertisement |

| Manage your newsletters subscription: Unsubscribe | Forward to a Friend | Advertising Information | |

| Ideas on how to make something better? Send an e-mail to slatenewsletter@nl.slate.com. Copyright 2011 The Slate Group | Privacy Policy | |

Sports Nut: Fake Me Out at the Ballgame

| |

Now playing: Slate V, a video-only site from the world's leading online magazine. Visit Slate V at www.slatev.com. Now playing: Slate V, a video-only site from the world's leading online magazine. Visit Slate V at www.slatev.com. | |

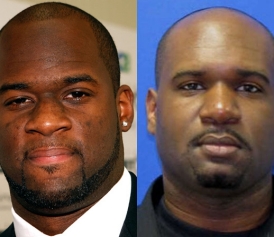

| Sports Nut Fake Me Out at the Ballgame Phony Vince Young, phony Derek Jeter, and more of history's greatest and most ridiculous sports impostors. By Matthew J.X. Malady Posted Thursday, Oct 20, 2011, at 11:17 AM ET  Stephan Pittman looks nothing like Vince Young. The former is a balding, 33-year-old registered sex offender living in Fort Washington, Md., who's been described in the press as "a little out of shape" and "not that athletic." The latter is a college football legend and the current backup quarterback for the Philadelphia Eagles. That disparity didn't stop Pittman from allegedly posing as Young in order to, among other things, pocket phony charitable donations and score free drinks at nightclubs. Pittman, who was arrested a few weeks ago in Maryland, followed a familiar playbook. Scam artists have been impersonating professional athletes for ages, and their tales are marked by two repeating themes. First, the impostors are almost always bumbling and shoddy. Second, the victims are usually willing to suspend disbelief to an outrageous extreme. In 2001, NFL receiver Jacquez Green, whose identity was pilfered by a Florida grifter, set forth a simple one-step plan for foiling sports scammers. "Ask yourself," the wealthy athlete implored, "Why would I need to be asking for money?" And yet, when a supposed pro athlete is in our midst, we seemingly lose all ability to distinguish between a wealthy football player and a random fat guy. In the distant past, when Notre Dame had a good football team and fans packed auditoriums to witness one outrageous basketball trick shot after another, the athlete impostor bit was most often used to obtain free hotel stays. Police arrested Charles A. Hart in the summer of 1963 ... To continue reading, click here. Join the Fray: our reader discussion forum What did you think of this article? POST A MESSAGE | READ MESSAGES Also In Slate Does the Death of Qaddafi Vindicate Obama's Foreign Policy? NPR Freelancer Fired for Serving as Occupy Wall Street Spokeswoman Saletan: Does Perry Really Believe Christians Should Vote Only for Christian Candidates? | Advertisement |

| Manage your newsletters subscription: Unsubscribe | Forward to a Friend | Advertising Information | |

| Ideas on how to make something better? Send an e-mail to slatenewsletter@nl.slate.com. Copyright 2011 The Slate Group | Privacy Policy | |

The Big Picture

The Big Picture | |

- Yet more chaos and confusion in the Euro Zone

- 10 Thursday PM Reads

- Occupy World St: From NYC to Everywhere

- First Look At US Pay Data, It’s Awful

- Economic data

- QOTD: Impressive Buildings, Bad Endings

- 10 Thursday AM Reads

- Heading into another weekend like 2008

- Understanding Federal Debt & Presidential Budgets, Fiscal Year Edition

- Today’s WTF Video: AIG Debuts Reputation Insurance

| Yet more chaos and confusion in the Euro Zone Posted: 20 Oct 2011 03:00 PM PDT Kiron Sarkar lives in London and Ireland where he works as a money manager. His full bio follows below. Apologies for being off line for a while – currently traveling in the US and don’t have my normal access to info etc + got the Boss (the wife) in tow – apparently shopping is far more important – well, she’s certainly helping out the US economy. I summarise below, the current situation in Europe, as I see it, though I must say it’s even more confused and chaotic than usual and a lot of the comments below involve (I hope educated) guesswork on my part. Earlier this week, an English newspaper (the Guardian) reported that the Euro Zone had agreed to a beefed up EFSF (up to E2tr) – has proved to be wildly incorrect. Generally, the FT/WSJ are much, much better and, in addition, beware of US based comments/ market moves re the Euro Zone situation; Germany is adamant (so far) that the EFSF will not be increased above E440bn. However, even the E440bn is illusory, in my humble opinion. It is clear that the Euro Zone is considering an insurance scheme. In accordance with this scheme, the majority of losses (shared approx 80%/20% by the EFSF and investors respectively, up to a cap of between 20% – 25% (probably 20% for Italian and Spanish bonds), though higher (say 40%) for Portuguese, Greek and Irish bonds), purchased in the primary markets, will be indemnified by the EFSF. This increases the EFSF’s “firepower” to a max of E1.15tr (5 times, E230bn, uncommitted by the EFSF). Basically, that’s not enough – the market wants E2tr at least and for this plan to work – quite frankly, even more than E2tr is necessary; To complicate matters, the French (BNP) have suggested that the EFSF issue CDS’s as an alternative to the insurance scheme. As the EU hate CDS’s, this proposal is going nowhere; The EFSF will be able to buy bonds, both in the primary and secondary markets. Leaked reports suggest that they will be entitled to buy up to 50% of any issue by the PIIGS countries, at the average auction price. However, the EFSF will only be able to buy bonds in the secondary markets, if the relevant Euro Zone country, has a sustainable debt level, meets its commitments to deficit reduction, has a sustainable current account and, finally, has no major insolvent banks (to be confirmed by the ECB/Euro Zone finance ministers – at least the start of a (long overdue) sensible fiscal regime, with teeth, if complied with – though bureaucratic and time consuming). Germany/the ECB is strongly opposed (at present) to granting the EFSF a banking licence which, if granted, would have enabled it to be leveraged significantly, thereby increasing its firepower much further. The ECB has, to date, refused to finance the EFSF. Sarkozy is trying to persuade Trichet/Merkel to change their minds in respect of this issue – he flew to Frankfurt yesterday, to attend the hand over ceremony to Draghi (as the next President of the ECB) from the (at Following a recent “deal”/Constitutional Court ruling, Merkel and her Finance Minister (Mr Schaeuble) need to obtain agreement from a Budget Committee of the German Parliament, before any “deal” they agree to can be approved/acted on – a major hurdle; A Euro Zone Finance Ministers meeting has been called for tomorrow, to be followed by the EU heads of State meeting on the 23rd. There were rumours that the 23rd meeting would be postponed, but these rumours were denied subsequently; Clearly Sarkozy is trying to get Lagarde to support (she will be Sarkozy’s real problem is that European (in his case French) banks need to be recapitalised and the amounts involved are extremely large; Forget the E100bn being talked about and/or the E200bn the IMF suggested is needed to recapitalise European banks – the number is much, much bigger, in my humble opinion – recall the amounts necessary to recap the Irish banks. However, the market will welcome an amount of E200bn, even though more will certainly be necessary later. A further problem is that Germany has insisted that the banks first try and raise the capital themselves. If they cant, they should seek help from their own Government and finally, if finance is not possible by their Governments, the EFSF – who will lend money to Euro Zone Governments to recapitalise their banks. Banks that seek financing from their Governments/EFSF will be subject to restructuring and possibly an orderly winding down, which will make banks reluctant to seek this solution. This is bad news, as banks will try to reduce their balance sheets and limit lending – the last thing you want, together with selling assets; However, lending to Governments by the EFSF (to recap European banks) will, presumably, reduce its firepower by a factor of 5 times (I would argue) for every E1 used in bank recaps – bad news, as it reduces the EFSF’s ability to buy PIIGS bonds/indemnify investors against losses on purchases of PIIGS bonds as discussed above; Sarkozy’s other major problem, is that any move by the French Government to bail out French banks, commit more funds etc, etc will result in an (virtually instant, in my opinion) DOWNGRADE of France’s AAA credit rating – arguably, France should not be rated AAA (certainly most peoples view, which I totally agree with). Moody’s warned of exactly this; OK so France gets downgraded – what’s the problem you say – after all, the market expects it and has (sort of) priced it in – though, in reality, it will still be a (very?) market negative event, given France’s importance in the Euro Zone. In addition and very importantly for Sarkozy, a loss of France’s AAA credit rating prior to the impending 2012 French Presidential election makes it virtually certain he will lose – a very major consideration in this game; Banks do not want to be forced to recapitalise, particularly given the above terms and, in addition, as their shares are trading well below current alleged “book value” – I remain highly sceptical as the the alleged book value.. They have suggested that they will raise some E1tr, through the sale of assets. Impossible, especially as there will just be sellers around and prices for assets will be well below “distressed sale” prices, even assuming that there are buyers around for this amount of assets – virtually impossible. Therefore they will try and shrink their balance sheets as quickly as possible, if they can; The banks have indeed threatened that they will shrink their balance sheets – OK, they will to a degree, but, in reality, they cannot reduce their balance sheets by enough and certainly not in the limited time available. Furthermore, European banks are sensitive to political influence/direction, far more than is the case in the US. In addition, remember, the EU/Germans etc want banks to raise sufficient capital to have a core Tier 1 ratio of 9.0%,(after marking to market their holdings of Sovereign Bonds), within 9 months; The European Banking authority is to report on new stress tests/level of capital required this week. I hope its far more credible the 1st 2, which resulted in Irish banks needing to be recapitalised shortly following the 1st Stress test (which claimed that everything was OK) and Dexia to seek refinancing, a short while post the 2nd Stress Test. The Troika’s (EU,ECB, IMF) reported on the Greek fiscal position – to be presented to the EcoFin meeting tomorrow. They have recommended that the next tranche of aid should be given to Greece asap. Amazing, since they admit that Greece will have missed every target – yet again and, surprise, surprise (I think not), that the amount of the bail out , negotiated just 3 months ago, will not be enough. Apparently Greece will do better in 2012 – oh yeah !!!!; Greece will clearly need to be financed until they no longer represent a threat to the Euro Zone, in spite of the certainty that Greece will never meet its targets, nor have any intention of doing so. I cant see how funding can be refused at this time, as refusal to finance Greece at present, will set off a chain reaction which could well destroy the Euro Zone. However, in due course, Greece (quite rightly) will be subject to fiscal targets – the free (souvalaki) lunch is over. Will Greece survive – quite frankly no one really cares. They just don’t want to avoid contagion spreading to the rest of the Euro Zone. The Greek Parliament will pass yet more (fictional) austerity measures this week, which will be ignored, as all the previous others have; It is almost certain that the previous (21%) haircut negotiated with financial institutions re Greek bonds will be re negotiated – reports suggest that the haircut will be increased to around 60%. However, as the Troika report was delayed, the deal on the haircuts may not be agreed this weekend. Oh dear. The banks are balking, but quite frankly the politicians are ignoring them – quite rightly. After all, if Greek bonds are marked to market, a write off of 60%+ will be required, in any event, given current market prices; Based on the above and given that there are only a few days left till the 23rd October EU heads of State meeting, it is unlikely that all the outstanding issues will be resolved and that the Euro Zone will (yet again) disappoint. However, the real key dates are the G20 Heads of State meeting on 3rd/4th November. Personally, I believe they cannot deliver the (over ambitious) market expectations, but something will be cobbled together, with the need to do more and more in due course – in other words, the 3rd/4th November deadline is unlikely to be the deadline for a comprehensive fix; I believe that Europe cannot resolve this issue unaided. For that reason, I believe that the only credible organisation that can make a difference is the IMF. The IMF clearly understand the problems only too well (and the potential contagion effects, globally). In addition, they have far more experience. The EU is, by contrast, clueless. For that reason, I believe some involvement by the IMF is more than likely. Furthermore, the IMF understands only too well the contagion effects for the global economy. There was a brief report (not followed EM’s are certainly extremely concerned about a potential failure in Europe. For example, Europe is China’s largest trading partner and China does not need any more problems at present – it has enough of its own. In addition, their is to be a major change in the leadership, next year – the Chinese are therefore desperate for stability to ensure a smooth handover from the current regime. As a result, it is in China’s and other EM’s self interest to stabilise Europe. It is also in the US’s interest that Europe does not implode. Essentially countries lend to the IMF, which then on lends to relevant Euro Zone countries. The IMF (through the IFC) could also play a part in the recap of European banks, though I accept a number of technical issues will need to be resolved. However, an IMF involvement is a 75% probability and positive for markets, given the shambles in the Euro Zone; All of the above will take time and is impossible to be sorted out by the 23rd October EU heads of State meeting, indeed also by the G20 meeting. The Germans have warned as much. However, unlike the EU/ECB/Euro Zone, the IMF retains credibility and their involvement will be viewed positively and will buy more time; There are numerous other issues, including fast deteriorating fiscal positions in Spain and Portugal – both will miss their targets. Summary I can go on, and on and…… However, the bottom line, in my humble view, is that: There will be no resolution of this crisis by the EU heads of State meeting on 23rd October – virtual certainty; The earliest date for any solution will be the G20 Heads of State meeting on 3rd/4th November, though a comprehensive fix by that date is also unlikely; Without IMF involvement, this is going to be a fiasco and very bad for markets, given that the Euro Zone will not deliver as much as was/still is expected – however, I believe the IMF will get involved; The Euro Zone will start introducing fiscal measures, together with verification, which (ultimately) will be positive and enable the issue of Euro Bonds – indeed, I would argue that Euro bonds already exist – after all, the EFSF is raising funding through the issue of bonds, guaranteed by the Euro Zone countries – I accept its not a joint and several guarantee, however; The key for the Euro Zone is to implement measures to stimulate growth The ECB is relaxing its collateral requirements even more – they are currently accepting used toilet paper, so I’m not sure what this means. Furthermore, the ECB will reduce rates by at least 50bps shortly – they should never have raised them in the 1st place and having made that mistake, should have corrected it by now – However, as usual, Trichet was more concerned about his reputation/legacy; As stated above, in due course (earlier than people think, in my humble view), Euro Zone countries will issue Euro Bonds, (through an Euro Zone Debt Management Agency) to ensure appropriate fiscal control, together with constant verification. This will be a game changer for the global economy. Personally, there is a possibility that after all the pain, the Euro Zone will emerge from this much stronger and fiscally much better positioned – though that’s some time in the future; I’ll leave you with this – Mrs Merkel reported last Tuesday that it was time to take “unconventional measures” – what can she mean – surely not QE !!!!. In my opinion, Euro Zone QE is a very strong possibility, in spite of the very real objections/opposition at present, particularly from the Germans/ECB. Whilst the situation looks bleak, indeed dreadful, the Euro Zone has, in the past, come up with the goods when their feet are placed firmly in front of the fire. I, on balance, believe this will happen again, but I’m really counting on the IMF. However, this is a truly dangerous game. Be very, very careful. ~~~~ A qualified UK accountant, Kiron joined the M&A dept of N M Rothschild in London. He was then appointed head of M&A of Rothschild (Hong Kong). On his return to the UK, he was a founding member of the Rothschild international privatisation team. Subsequently headed up the Central and Eastern European ("CEE") team – rated No 1 in 4 out of 5 years (Privatisation International). On leaving Rothschild, he worked as privatisation adviser to the UK Governments Know How Fund, which was established to advise Governments in CEE on policy, privatisation, economic, financial, regulatory and other issues. Subsequently European Head of Media, Tech and Telecoms at CIBC World markets. Following CIBC, Kiron advised on telecoms and energy deals in CEE. Kiron has acted as a lead adviser in respect of over US$150bn of deals and has worked globally in both developed and emerging markets. |

| Posted: 20 Oct 2011 01:30 PM PDT My train reading for today:

What are you reading? |

| Occupy World St: From NYC to Everywhere Posted: 20 Oct 2011 11:28 AM PDT |

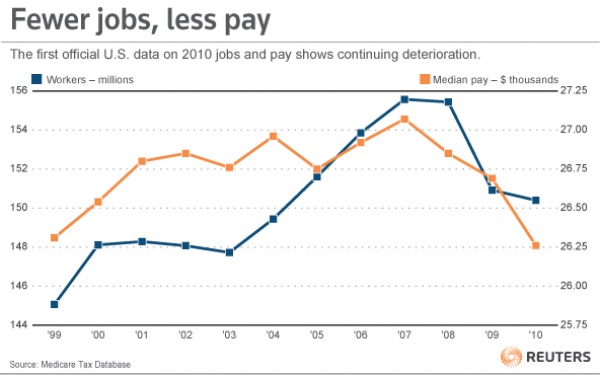

| First Look At US Pay Data, It’s Awful Posted: 20 Oct 2011 09:00 AM PDT The latest long term update on employment and wage data is out, and its not remotely pretty:

The chart shows the specifics of changes in employment and income; If you want to know why the OWS protests are finding resonance, look no further than this: > Source: |

| Posted: 20 Oct 2011 07:32 AM PDT Existing Home Sales in Sept totaled 4.91mm annualized, exactly in line with estimates and Aug was revised up a touch to 5.06mm. Closings of single family homes fell by 3.6% m/o/m while condos/co-op sales were up 1.8%. Even though the absolute amount of homes for sale fell to the lowest since Jan, because of the sluggish sales figure, months supply ticked up to 8.5 from 8.4. The median home price fell 3.5% y/o/y. Distressed sales totaled 30% of sales vs 31% in Aug. Contract failures, defined as “declined mortgage apps, failures in loan underwriting from appraised values coming in below the negotiated price, or other problems including home inspections and employment losses,” totaled 18%, unchanged from Aug but well above 9% one year ago. Outside of the continued issues that are well known with closings, recently the loan limits of mortgages that FNM and FRE can buy or guarantee have been lowered, particularly in more expensive housing markets. This fact also likely pulled closings into the month of Aug as people took advantage before the limits were lowered. Outside of the barriers of a tough labor market, difficult access to credit and accurate appraisals, we have the secular decline in the homeownership rate. As of Q2 it was 65.9%, down from the record high of 69.2% in Q2 ’04 and compares with the record (since record keeping started in Q1 ’65) low of 62.9% in 1965 and the 45 year average of 65.4%. The Oct Philly Fed mfr’g survey was well above expectations at +8.7 vs the estimate of -9.4 and up from -17.5. After sharply negative readings in Aug and Sept, New Orders rose 19 pts to +7.8 and Backlogs rose by 13 pts to +3.4. Shipments went from -22.8 to +13.6 while Inventories fell to -7.7 from +10.2. Employment was the key drag as it fell to 1.4 from 5.8 but the Avg Workweek rose to +3.1 from -13.7. Prices Paid and Received both fell slightly. The 6 month outlook rose to 27.2 from 21.4 in Sept and 1.4 in Aug. Bottom line, a pleasant surprise in the positive data but comes off sharp declines in Aug and Sept and the figures measure the direction of change rather than the degree. It does follow a poor NY figure on Monday and means that we need to see more regional survey’s and the national ISM number in order to get a more confirmed conclusion on the state of mfr’g. |

| QOTD: Impressive Buildings, Bad Endings Posted: 20 Oct 2011 07:30 AM PDT Quote of the Day:

From “Thirteen Observations made by Lemony Snicket while watching Occupy Wall Street from a Discreet Distance” |

| Posted: 20 Oct 2011 06:45 AM PDT Some morning reading goodness for you:

> This is likely to be my last Steve Jobs mention for the foreseeable future:: |

| Heading into another weekend like 2008 Posted: 20 Oct 2011 04:16 AM PDT Just as we did too many times in 2008, we are about to enter into a weekend where all eyes are on government officials and their attempt to deal with a major financial problem. All the big European guns are in Frankfurt to settle differences and come to an agreement: Draghi, Trichet, Van Rompuy, Barroso, Schaeuble, Baroin, Juncker, Sarkozy, Merkel, and Lagarde. The French want to turn the EFSF into a bank that can tap ECB funding, the Germans don’t. The Germans want a 50%+ cut in the value of Greek bonds, European banks don’t. Some want to create country credit lines, the Germans don’t. European banks want to improve their capital ratios by shrinking, EU officials want them to raise private capital now irrespective of stockholder dilution. What soup is going to be made out of this? As I’ve said before, the Germans will get what they want at the same time France fights to keep its AAA credit rating. Bottom line, since the EFSF can’t be leveraged thru direct loan guarantees because of legal reasons and the Germans don’t want the ECB involved, the parties are coalescing around a plan to have bond issuing countries borrow money from the EFSF that will then be put into escrow and would cover a % of principal in case of default. So yes, Italy for example would borrow even more money to partially backstop the borrowing of more money. It’s another example of taking on more debt to tackle a problem of too much debt but again, it’s all about buying time. Also, having the EFSF buy bonds of countries directly at auction is being discussed. In the mean time, bond yields in Italy and Spain continue higher. In Asia, the Shanghai index closed at the lowest level since Mar ’09 and helped to drag down the entire region on growth concerns. Brazil last night cut interest rates by 25 bps to 11.5% over concerns with slowing growth. |

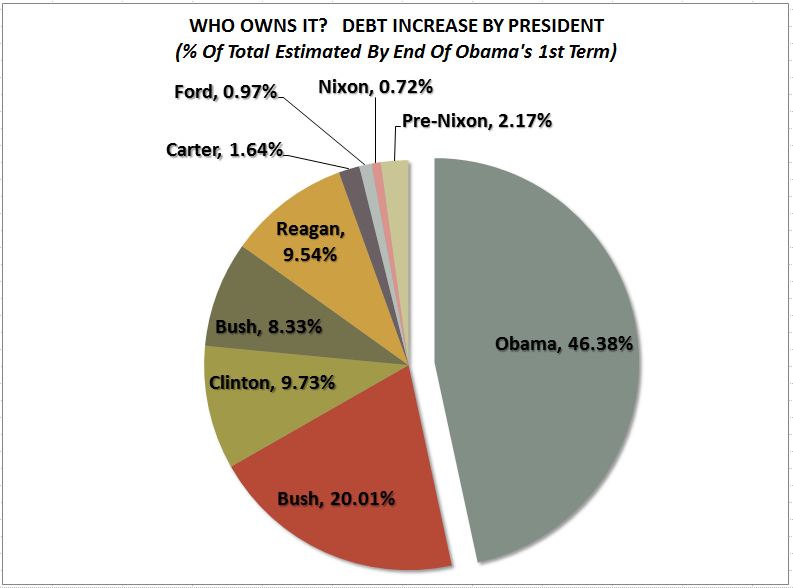

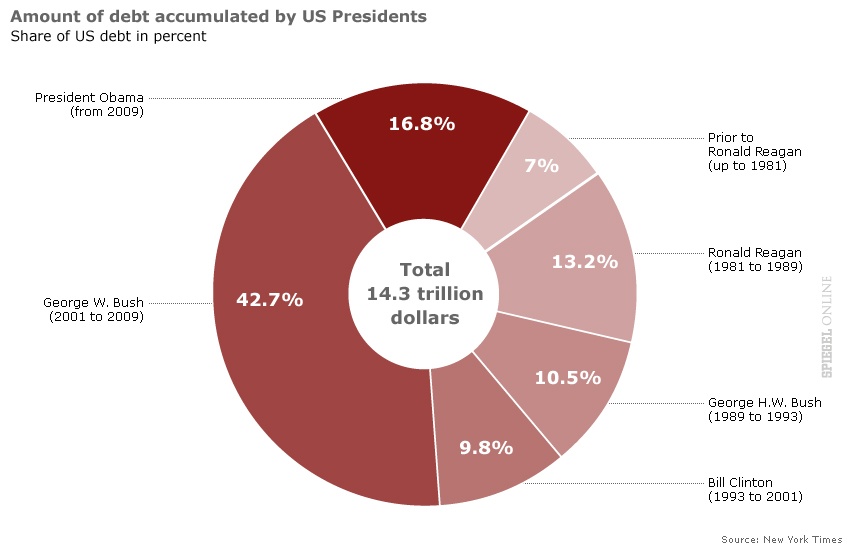

| Understanding Federal Debt & Presidential Budgets, Fiscal Year Edition Posted: 20 Oct 2011 04:00 AM PDT Over at DShort (and SA), Lance Roberts had a commentary about the Presidential budgets we discussed this past weekend (US Debt Accumulation by President). As did many commenters on the original post, he took issue with the numbers assembled by Spiegel (sourced from the NYT). Unfortunately, some people seem to be repeating a significant error in assembling this data. It reflects a common misunderstanding of how Presidents execute the Federal budget. Blame the Fiscal Year versus the calendar year for the misunderstanding. The data was assembled in the original post is not by each President's first day in office to his last, but rather, by the budgets each President submits to Congress that gets passed. (Congress may change the budget, but rarely appropriates more than what the President requests). I cannot imagine that any fair-minded person would look at this data any other way: The debt each President creates is a function of the budgets each President submits to congress. It is not based upon the literal time they spend in office. Therefore the only objective way to view the data is BY EACH PRESIDENTS BUDGET. This is not an insignificant point. So, rather than indulge in irrelevant measures that mislead the reader, let's go to the actual fiscal numbers of each President's budgets to see what there is to see. On January 20th, 2001, George W. Bush was sworn into office – but the budget for most of the rest of that year was Bill Clinton's, passed by the prior Congress. Barack Obama was sworn in on January 20th, 2009 – but the budget for most of that year was that of George W. Bush. Why are these so? Because the Federal government’s fiscal year runs from October 1 (of the previous calendar year) to September 30. Hence, the FY 2001 is Clinton’s and FY 2002 is Bush’s. FY2009 is Bush’s, FY 2010 is Obama’s. The actual budgets of the Presidents and their deficits — that's what this is about, right? — are as follows:

Of the $14.8 trillion in total debt as of September 30, 2011, the Bush budgets generated $6.1 trillion in deficits versus the $2.9 trillion of Obama deficits. That's 41.2% vs 19.6% by a reasonable methodology of measuring presidential debt. These are the actual Presidential Budget deficits — not time in office, which is simply an irrelevant measure that no fair minded, mathematically literate person would use. (Thank you to my readers who schooled me in the details of the federal government's Fiscal Year). A few other details worth noting: First, these are nominal numbers, not inflation adjusted. So as time goes on, each previous presidents’ numbers appear to be smaller. (As true for Nixon as it is for Clinton). Feel free to inflation adjust them yourselves. Second, every president's share of the deficit goes down once they leave office. As their successors' add more debt to the total, it makes the predecessor Presidents’ share smaller. Happened with Reagan, is happening with Bush, will happen with Obama. Third, Obama's share of the deficit will (obviously) go up over the next few years. An offsetting factor is he inherited an economy in recession (dated to December 2007) and a stock market in collapse. Fourth, Bush's total percentage of deficit creation will go down (see item #2). His mitigating factors: He inherited a dotcom collapse; And we cannot hold him responsible for the recession that started a month after he was sworn in. On the other hand, he did inherit a surplus, and made it a policy objective to get rid of that surplus. (Mission accomplished) All data sourced from Treasury: Debt to the Penny (Daily History Search Application) The charts below show how that simple change — from each President’s actual submitted budget versus their official term in office — change the outcome of this analysis.

US Debt Accumulation by President: Based on time each President is in office (Erroneous Calendar Year)> US Debt Accumulation by President: Based on time each President’s submitted budget (Accurate Fiscal Year) |

| Today’s WTF Video: AIG Debuts Reputation Insurance Posted: 20 Oct 2011 03:00 AM PDT |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |