The Big Picture | |

- How Italy Could Impact Your Portfolio

- 10 Tuesday PM Reads

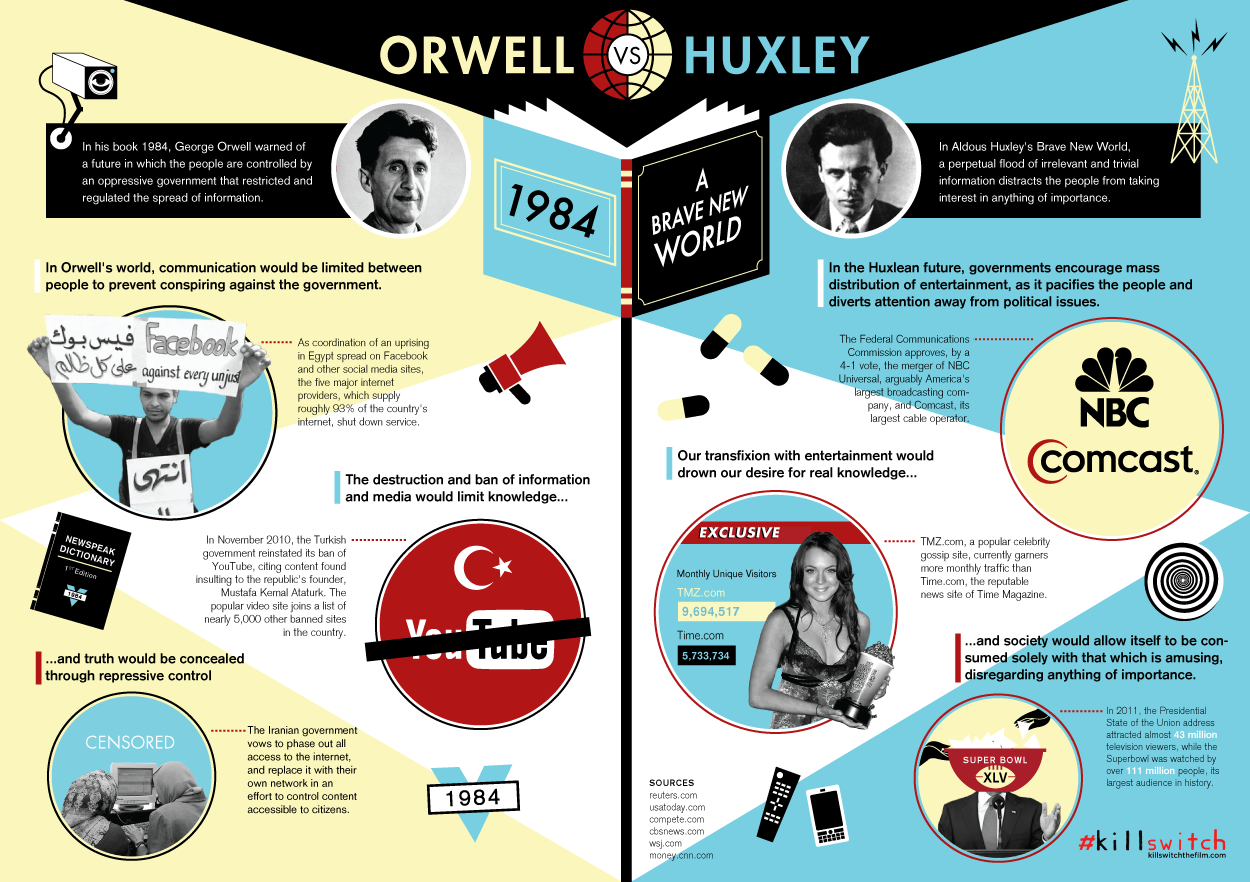

- Orwell vs Huxley: 1984 vs Brave New World

- Things That Make You Go Hmmm…

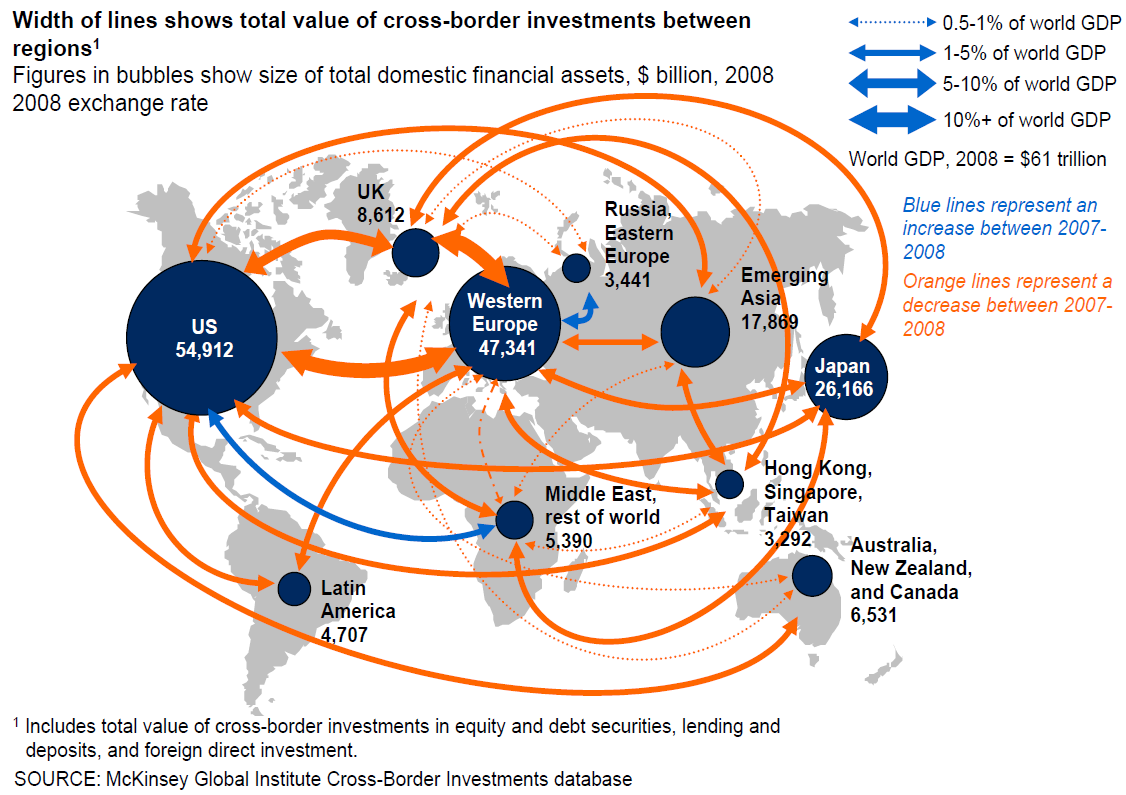

- Web of Cross-Border Investments

- Ponzi: Giving Fraud a Bad Name

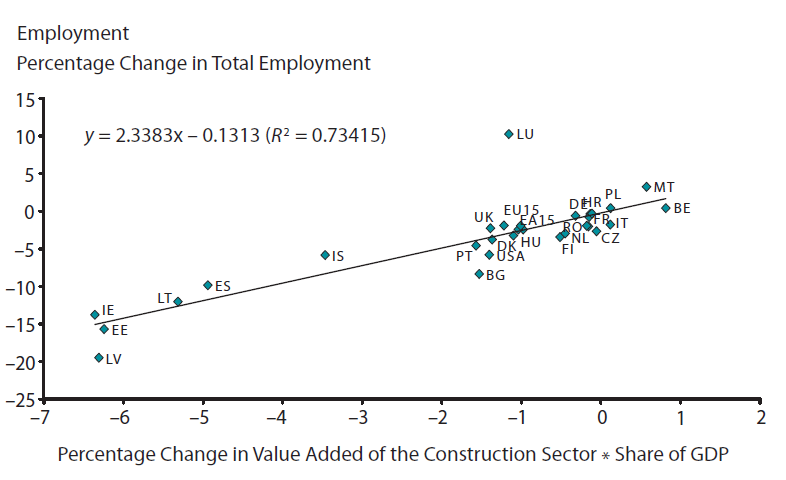

- Construction Boom in 31 Countries & the Great Recession

- Economic data

- MERS: Genius, Shell Game, or Invitation to Fraud?

- I’m watching you

| How Italy Could Impact Your Portfolio Posted: 15 Nov 2011 01:00 PM PST |

| Posted: 15 Nov 2011 01:00 PM PST Interesting day, to say the least. Here is my reading for the train ride home:

What are you reading? |

| Orwell vs Huxley: 1984 vs Brave New World Posted: 15 Nov 2011 10:00 AM PST Here is the smackdown between Orwell and Huxley . . . between Nineteen Eighty-Four vs Brave New World. I think Huxley got the better of Orwell! > Source: |

| Posted: 15 Nov 2011 10:00 AM PST Things That Make You Go Hmmm… ~~~ What do the "Big Fitz," the largest ship ever to sail the Great Lakes, and the Eurozone have in common? Hint: the former sank without a trace. Or, as Grant Williams so eloquently puts it, in his Things That Make You Go Hmmm… for Nov. 13 (this week's Outside the Box), "One can't help but think … that this week may well have brought us to the wall at the end of the road down which Europe has been kicking the can for quite some time now." Grant inspects the SS Europe from bow to stern and concludes: "The smoke has pretty much cleared now and those in charge of the SS Europe are left with a stark choice – print money or allow the break-up of the Eurozone and the end of the common currency known as the Euro. At this point it really IS that simple." So come on along as Grant takes us on an eye-opening and at times jaw-dropping ride – there are some real insights here. From his perch in Singapore he sees the same problems I do, just from the other side of the globe. And that perspective is worth your time. As you read this, I am on my way to Capitol Hill to meet with a member of the Super-Committee. If there is anything I can report, you will get it this weekend. I hope I can bring good news at some point. Then it's back to the UBS Wealth Management Conference in time to hear Ken Rogoff (and Alan Greenspan) on a panel. I am looking forward to that. Tomorrow night in my own bed again. And be looking for a special note from me on Thursday. Your trying to figure out how we get out of this mess analyst, John Mauldin, Editor Things That Make You Go Hmmm…Grant Williams | Nov. 13, 2011

Big Fitz sounds like the name of a Heavyweight Champ – or the affectionate nickname given to the regular in a neighbourhood bar whom everybody knows. Big Fitz doesn't ordinarily sound like the name of a boat. In the mid-1970s though, the only Big Fitz anybody spoke about in Duluth, Minnesota was the Great Lakes freighter that carried taconite from Duluth to the iron works in the then-thriving Detroit, Michigan and Toledo, Ohio. When she was launched in 1958, the SS Edmund Fitzgerald was the largest boat on the Great Lakes. 729 feet long with a 75ft beam and a 25 foot draft, she could carry 26,000 DWT in her 33' 4" deep hold. Powered by a Coal fired Westinghouse Electric Corporation steam turbine 2 cylinder, she had a top speed of 14 knots and carried a crew of 29. For 17 years, the floating workhorse ploughed back and forth across Lake Superior, setting seasonal haul records six times and became a firm favourite with boatwatchers (yes, they do exist) due to her size and her record-breaking exploits. Besides her affectionate soubriquet, the SS Edmund Fitzgerald was also known as The Titanic Of The Great Lakes. On November 9, 1975, Big Fitz was loaded with 26,116 tons of taconite iron ore pellets in Superior, Wisconsin and embarked on what would tragically turn out to be her final voyage – a routine crossing of Lake Superior, bound for a steel mill in Detroit, Michigan. The next day, November 10th, Big Fitz found herself caught in the midst of a massive winter storm, with 35 ft waves and hurricane force winds. Captain Ernest McSorely, a 44-year veteran, made contact with the Avafor, a nearby ship, and reported that he had encountered "one of the worst seas he had ever been in". A couple of hours later, with Big Fitz roughly 17 miles from the relative safety of Whitefish Bay at the northeastern tip of Michigan's Upper Peninsula, another ship made contact and was told that the Titanic of The Great Lakes was holding her own. Then something strange happened. (History Channel): …minutes afterward, the Fitzgerald disappeared from radar screens. A subsequent investigation showed that the sinking of the Fitzgerald occurred very suddenly; no distress signal was sent and the condition of the lifeboats suggested that little or no attempt was made to abandon the ship. Subsequently, many theories on what caused the SS Edmund Fitzgerald to capsize and sink 530 feet to the lake bed almost instantly were put forward. (History Channel): One possible reason for the wreck is that the Fitzgerald was carrying too much cargo. This made the ship sit low in the water and made it more vulnerable to being overwhelmed by a sudden large wave. The official report also cited the possibility that the hatches to the cargo area may have been faulty, leading to a sudden shift of the cargo that capsized the boat. Either way, it didn't matter. Big Fitz sank – quickly. So quickly in fact that nobody was saved and all 29 crew members perished in the icy waters of Lake Superior. Big Fitz had been battling the odds for several hours and things had looked bleak but she was managing to stay above water until, suddenly, without warning, she didn't. This week's anniversary of the tragic sinking of Big Fitz got me thinking about the Euro – another behemoth currently navigating some extremely choppy waters but managing to keep herself above water. Holding her own, if you will. The odds have been stacked heavily against the common currency for some time now and yet, despite a clearly unsustainable level of debt, several countries who should never have been allowed through the doors of the Eurozone, rapidly slowing growth and a group of basket-case politicians who have redefined the meaning of ineptitude, if you had shorted the Euro on January 7th of this year, you would now be staring at a loss of roughly 6% on your investment (chart, below).

To have sat and read the headlines these past 10 months and yet to be losing money on a short Euro position would have doubtless sent even the most stoic of investors in search of a stiff drink or some heavy counselling – but that's the way these things go sometimes. Things stay afloat against all the odds – until, suddenly, they don't.

One can't help but think, however, that this week may well have brought us to the wall at the end of the road down which Europe has been kicking the can for quite some time now. With the long-expected demise last week of the Papandreou government and now the swift fall of Silvio Berlusconi's administration in Italy, events in Europe picked up speed as they move rapidly towards the kind of definitive end that we have needed for some time now, but that the prevaricating of the various bureaucrats in Brussels and beyond have denied us. The smoke has pretty much cleared now and those in charge of the SS Europe are left with a stark choice – print money or allow the break-up of the Eurozone and the end of the common currency known as the Euro. At this point it really IS that simple. The impediment to a EuroTARP or QEU program remains Germany. That's pretty much it. Sure, the Dutch and the Finns and even the Austrians all pay lip service to a hard line on monetary easing, but, as oneby- one the formerly 'strong' countries get dragged into the maelstrom of the peripherals leaving a new country exposed on the outer fringes of the 'core', it becomes more and more obvious that somehow, some way, Germany has to find a way of justifying an action that is anathema to the citizens of Europe's powerhouse economy. The blowout in the spread between Austrian and German 10yr bonds this week highlights that perfectly (chart, below).

Weimar hyperinflation is still a very vivid memory for many Germans and, as Adam Fergusson explained in his seminal work 'When Money Dies, the reasons why Germany is so set against the idea of money-printing are clear: Over most of Germany the lead was beginning to disappear overnight from roofs. Petrol was syphoned from the tanks of motor cars. Barter was already a usual form of exchange; but now commodities such as brass and fuel were becoming the currency of ordinary purchase and payment. A cinema seat cost a lump of coal. With a bottle of paraffin one might buy a shirt; with that shirt, the potatoes needed by one's family. Herr von der Osten kept a girl friend in the provincial Capital, for whose room in 1922 he had paid half a pound of butter a month: by the summer of 1923 it was costing him a whole pound. 'The Middle Ages came back,' Erna von Pustau said. Communities printed their own money, based on goods, on a certain amount of potatoes, or rye, for instance. Shoe factories paid their workers in bonds for shoes which they could exchange at the bakery for bread or the meat market for meat. Those with foreign currency, becoming easily the most acceptable paper medium, had the greatest scope for finding bargains. The power of the dollar, in particular, far exceeded its nominal rate of exchange. Finding himself with a single dollar bill early in 1923, von der Osten got hold of six friends and went to Berlin one evening determined to blow the lot; but early the next morning, long after dinner, and many nightclubs later, they still had change in their pockets. There were stories of Americans in the greatest difficulties in Berlin because no-one had enough marks to change a five-dollar bill: of others who ran up accounts (to be paid off later in depreciated currency) on the strength of even bigger foreign notes which, after meals or services had been obtained, could not be changed; and of foreign students who bought up whole rows of houses out of their allowances. There were stories of shoppers who found that thieves had stolen the baskets and suitcases in which they carried their money, leaving the money itself behind on the ground; and of life supported by selling every day or so a single tiny link from a long gold crucifix chain. There were stories (many of them, as the summer wore on and as exchange rates altered several times a day) of restaurant meals which cost more when the bills came than when they were ordered. A 5,000-mark cup of coffee would cost 8,000 marks by the time it was drunk. Stories like these still live and breathe in Germany so it is no surprise that the language of Mrs. Merkel and Messrs. Schauble, Wiedmann et al have been defiant whenever the subject of money-printing has arisen. But this week, as the Eurozone threatened to spiral out of control, it became abundantly clear that the Euro has reached the point of no-return. The ECB now has to either become the lender of last resort that Europe so desperately needs (and trample over Germany's sensitivities in the process), or the Euro must fall. There is no other choice. On Thursday, Italy's 10-year bond yield spiked to 7.5%. Presumably the only thing that stopped it shooting higher still was aggressive buying on the part of the SMP (we shall hopefully find out on Monday when the weekly totals are updated on the ECB website), but whatever the reason for the sudden and sharp retracement to 6.5% on Friday (surely it wasn't due to the news that Massimo Monti had been touted as Prime Minister in Berlusconi's stead? Surely?), you can be certain the bond market has not finished with Italy just yet.

BUT….. Italy is running a primary surplus. The only thing sending her over the edge is the simple fact that the Italian government cannot borrow at low-enough rates. At 4% (where rates were a year ago), they can gradually begin to adjust their debt ratios and still finance their borrowing – it will not be easy, but they, unlike their spendthrift cousins in the Aegean, have one of the highest savings rates in the OECD (although, as you can see from the chart, below, that savings rate has been eaten into rapidly over the past five years).

But what of that other 'Big Fitz', the Euro? Any attempt to make a significant change to either the treaties that surround the common currency or the constituent members of the union would require a hellacious amount of maneuvering in order to pull them off and, like the notion of Greece (or any weakened EU member) ever being allowed to leave the Euro, the idea of either a fiscal union, the ECB becoming the lender of last resort or, God forbid, Germany exiting, stage left, was strictly verboten – at least until this week: (UK Daily Telegraph): German and French officials have discussed plans for a radical overhaul of the European Union that would involve setting up a more integrated and potentially smaller eurozone, EU sources say. "France and Germany have had intense consultations on this issue over the last months, at all levels," a senior EU official in Brussels told Reuters, speaking on condition of anonymity because of the sensitivity of the discussions. "We need to move very cautiously, but the truth is that we need to establish exactly the list of those who don't want to be part of the club and those who simply cannot be part," the official said. French President Nicolas Sarkozy gave some flavour of his thinking during an address to students in the eastern French city of Strasbourg on Tuesday, when he said a two-speed Europe – the eurozone moving ahead more rapidly than all 27 countries in the EU – was the only model for the future. Pretty conclusive. Naturally, any such plan was immediately denied by 'a spokesman': A French finance ministry spokesman denied there was any project in the works to reduce the currency bloc's membership. "There have been no conversations between French and German authorities at any level on decreasing the size of the eurozone," the spokesman said. But this time it really WAS different as the Germans, too, were talking about the possibility of exits from the Eurozone: One senior German government official said it was a case of pruning the eurozone to make it stronger. "You'll still call it the euro, but it will be fewer countries," he said, without identifying those that would have to drop out. "We won't be able to speak with one voice and make the tough decisions in the eurozone as it is today. You can't have one country, one vote," he said, referring to rules that have made decisionmaking complex and slow, exacerbating the crisis. If you listen very carefully, you can hear the subtle changes that make it pretty clear that German officials are now trying to find a way to make 'temporary' money-printing palatable to the German electorate. The tabling of possible exits from the Eurozone was the first flare sent up, next was the discussion of a breakaway union featuring the 'strong' countries, but immediately, Frau Merkel dropped the hammer with this stark warning to her constituents (delivered at just the right degree of arm's length, of course): (Businessweek): Germany will resist any attempt to reduce the euro region to its strongest members to increase its stability, the parliamentary finance spokesman for Chancellor Angela Merkel's Christian Democratic Union said. "Such a shrinking process would be deadly for Germany because we would end up in a mini-euro zone with all the effects you can see in Switzerland," Michael Meister, who is also a CDU deputy floor leader, said today in a phone interview in Berlin. "It would be a deadly development for an export country like Germany. It can't be in our interest at all and if it's not in our interest, we should do everything to keep it from happening." Once more, with feeling: It would be a deadly development for an export country like Germany. It can't be in our interest at all and if it's not in our interest, we should do everything to keep it from happening."

There it is. That is the first step in a move to persuade the German people that a EuroTARP or some form of QEU will be 'manageable' and will not cause the runaway inflation of which Germans are terrified. It will probably be proposed as a program designed to alleviate the pressure facing the likes of Italy, Spain and Portugal and its architects will point to the (relatively) benign US CPI numbers in the wake of repeated Quantitative Easing as testament to the fact that money printing doesn't necessarily lead to hyperinflation – although, very quietly, US CPI has almost quadrupled since the beginning of QE2 and its trajectory remains solidly bottom-left to top-right.

They WON'T mention the US' adjusted monetary base (chart above), nor will they bring up UK CPI (chart, below) which is moving ever faster away from its target rate of 2% – currently standing at a breathtaking 5.2% – and will assure the citizens of Germany that there will be a cap on inflation past which the ECB WILL NOT go – either that or it will be a program that will be wound back after, say, two years by which time everything will be on the mend again.

Mach dir keine Sorgen. Wir haben alles unter Kontrolle. Don't worry. We've got it all under control. Of course, this assumes that the vagaries of a vastly expanded money supply can be controlled once released into the wild and, as Weimar Germany, the Zimbabwe of Gideon Gono, Eduardo Duhalde's Argentina and, to a lesser extent, even the America of Paul Volcker in the 1980s bear witness, once this particular beast is unleashed it can take some pretty drastic tranquilizers to get it back in the cage again. No matter for now though, as Europe's problems are both immediate and pressing. The Eurocrats will eschew the potential pitfalls of runaway inflation in favour of the short-term fix of money-printing. Lots and lots of money-printing. In addition to Frau Merkel's Michael Meister's dire warning, other headlines this week have been very carefully laying the groundwork for a speech I dare say we'll be seeing soon about how, much as it is against the original concept of the Euro, a temporary bout of Quantitative Easing is necessary to save Europe and the Euro from destruction. We will be in 'desperate times', will require 'bold action' and can have 'confidence' in the ability of Europe's leaders to ensure there is no inflationary impact from any monetization. The gang is definitely all here…: (NY Times): Europe's economic outlook received a fresh dose of gloom Thursday, when the European Commission warned that the Continent's economies were stalled and faced the risk of a double-dip recession. "The recovery in the European Union has now come to a standstill, and there is a risk of a new recession," Olli Rehn, the European commissioner for economic and monetary affairs, told reporters in Brussels. "This forecast is in fact the last wake-up call," he added. (UK Daily Telegraph): Barack Obama, the US President, tonight urged Europe to provide "strong" assurances that countries like Italy will be able to finance their debt. "We are not going to see massive growth out of Europe until the problem is resolved and that will have a dampening effect on the overall global economy." Speaking at the Asia Pacific Economic Cooperation (APEC) summit, Mr Obama said: "It's not going to be addressed over night. So it is important that Europe as a whole stands behind its Eurozone members." (UK Daily Telegraph): Europe must "move quickly" to control its spreading debt crisis, because the volatility it is causing is the "central challenge" to global growth, US Treasury Secretary Timothy Geithner said. "We are all directly affected by the crisis in Europe, but the economies gathered here are in a better position than most to take steps to strengthen growth in the face of these pressures from Europe." Mr Geithner added that the basic framework for the European recovery was good. "But we need to see it put in place with the speed that markets require and with the force that restores confidence," he said. "They're moving ahead. We just need to see them move a little more quickly and with a little more force behind it." (Todayonline): The global economy could suffer a "lost decade" unless nations act together to counter threats to growth, International Monetary Fund managing director Christine Lagarde warned yesterday. Speaking at a financial forum, Ms Lagarde said: "There are clearly clouds on the horizon … particularly in the advanced economies and particularly so in the European Union and the United States." Said Ms Lagarde: "If we do not act, and act together, we could enter a downward spiral of uncertainty, financial instability and a collapse in global demand. Ultimately, we could face a lost decade of low growth and high unemployment." Let's see…. is that everybody pulling in the same direction? US President? Check. US Treasury Secretary? Check. EU commissioner for monetary & economic affairs? Check. Head of the IMF? Check. German and French heads of state? Check. Anybody else? (Reuters): "I refuse to even speculate about so-called two-speed Europe," Czech Finance Minister Miroslav Kalousek said in response to Reuters questions on the matter. "That would go against the Czech Republic's interests." Czechs? Check. Hell, they're not even IN the Eurozone yet. I guess that just leaves the big dog, China: (Brecorder): Chinese President Hu Jintao warned on Saturday that the global economy recovery was under threat and called for efforts to boost growth and liberalize trade. "The global economic recovery is fraught with greater instability and uncertainty," Hu said during a speech in Honolulu ahead of a summit of Asia-Pacific leaders. Referring to Europe's sovereign debt crisis, he said the world must remain committed to "ensuring strong growth in order to add momentum to the economic development of the Asia-Pacific and beyond." So there we have it. A carefully crafted scenario which will give Germany the ability to stand astride the world stage by giving up its objections to money-printing (temporarily, you understand) in the interests of the global good; the all-new Committee To Save The World. Judging by the Daily Telegraph story on page 20 of this week's Things That Make You Go Hmmm….. this cunning plan comes not a moment too soon (can you say 'Ponzi'?): (UK Daily Telegraph): Europe's €1 trillion (£854bn) rescue fund has been forced to buy its own debt as outside investors become increasingly concerned about the worsening eurozone sovereign debt crisis. The European Financial Stability Facility (EFSF) last week announced it had successfully sold a €3bn 10-year bond in support of Ireland. However, The Sunday Telegraph can reveal that target was only met after the EFSF resorted to buying up several hundred million euros worth of the bonds. Sources said the EFSF had spent more than €100m buying up its own bonds to help it achieve its funding target after the banks leading the deal were only able to find about €2.7bn of outside demand for the debt. Speechless.

But before we finish for today, we return to our own 'Big Fitz' of the currency markets – the Euro – as it struggles to stay afloat against all the odds. So far, it has been managing quite nicely, although the technical picture has been deteriorating rather dramatically (see chart, above). Once the now-inevitable European money-printing begins, it's hard to make a case for a strong Euro – particularly in light of weakening economic data across the core of the region – from the French trade balance (which showed a €6.303 billion deficit in September – the seventh largest single-month deficit in French history and a staggering 46% m-o-m decline), to a plunge in French exports that matched the lows seen in 2008-9, to Germany's Industrial output (which fell almost 3% in September) and Industrial Orders (which fell 3.6% m-o-m) and on to the rise in unemployment in Germany – the first such increase for 28 months. Mario Draghi's rate cut is just the beginning. Interest rates in the EU are heading below 1% in a hurry if the recent data are anything to go by and, once QEU or the EuroTARP commence, Europe's Big Fitz , which has stayed afloat for so long against all the odds, will likely sink – suddenly and without warning. You have been… oh, wait…

|

| Web of Cross-Border Investments Posted: 15 Nov 2011 09:00 AM PST |

| Ponzi: Giving Fraud a Bad Name Posted: 15 Nov 2011 08:48 AM PST Charles Ponzi didn't invent his eponymous pyramid scheme — but he lent star power to one of the oldest scams in the book. He also believed that his plan could have become a legitimate business. > Source: |

| Construction Boom in 31 Countries & the Great Recession Posted: 15 Nov 2011 07:00 AM PST Yesterday, we took a global view of the Housing boom & bust; Today, we take a somewhat wonkier view of Home construction’s contribution to Employment Growth and GDP in Europe. As the charts from then Federal Reserve Bank of St. Louis below show, the construction boom was global. It occurred in countries that have home mortgage deductions and those that didn’t; those whose governments have home ownership targets and those that did not. The one consistent causal element in ALL of these nations was the Community Reinvestment Act, Barney Frank, Fannie & Freddie Ultra low interest rates had made the cost of buying a home much cheaper, and helped set off a boom in prices. > ~~~

|

| Posted: 15 Nov 2011 06:15 AM PST Oct PPI fell .3% m/o/m but is still up 5.9% y/o/y. Both are less than expected as energy prices fell 1.4% and food prices were up just .1%. Also keeping a lid on wholesale prices was an .8% fall in the prices of passenger cars and 1.6% drop in light truck prices. Inflation in the pipeline moderated as intermediate goods prices fell by 1.1% m/o/m and crude goods prices were down by 2.5%. On a y/o/y basis though, both are still solidly higher, up by 8.3% and 12.6% respectively. Bottom line, while PPI is certainly a focus, tomorrow’s CPI will be the key inflation data point of the week. The Nov NY mfr’g Fed survey, the 1st Nov industrial figure out, was +.6, a touch above estimates of -2.0 and an improvement from the -8.5 reading in Oct. The components though don’t point to much improvement as New Orders fell from flat to -2.0, Backlogs fell to -7.3 from -4.5, and Employment fell to -3.7 from +3.4. Inventories fell 3 pts to near a one year low, a set up for a rebuild but reflecting mfr’g reluctance to add inventories. Prices Paid fell 4 pts to the lowest since Nov ’09 but Prices Received rose 1.6 pts. The outlook 6 months out was a bright spot as it rose to 39.0 from 6.7. This measures the direction of change, not the degree of it but seems to point to confidence that things will get better in the 1st half of 2012 Oct Retail Sales were above expectations with the core rate (ex auto’s, gasoline and building materials) rising .6% m/o/m. Headline sales rose .5% vs an expected gain of .3% and sales were higher by .7% ex auto’s and gasoline vs a forecasted rise of .2%. The breakdown of the sales however seemed mixed. Online sales rose a strong 1.5% and are up 10.5% y/o/y. Sales also rose at restaurants/bars, sporting goods, health/personal care, food/beverages, electronics, auto’s and building materials. Sales though fell at clothing stores, furniture, department stores and gas stations. Bottom line, while retail sales in the aggregate were better than expected, the real test of consumer habits is now upon us with black Friday just a little more than a week away. |

| MERS: Genius, Shell Game, or Invitation to Fraud? Posted: 15 Nov 2011 05:30 AM PST From Rockwell P. Ludden, Esq. of the Ludden Kramer Law firm, by way of 4ClosureFraud.com: One of the first challenges facing the industry was to decide the capacity in which MERS would hold the mortgage. Should it do so as the mortgagee—which, in Massachusetts would be the owner of legal title to the secured property—or should it do so in a representative capacity? Then, too, there was the question of the note itself. If MERS were to act solely on the lender's behalf, should it have the authority to assign both the mortgage and the note, and perhaps even to The problem lies not so much with the idea itself but with the fact that every effort to place the MERS model within the framework of existing law reveals itself to be something we might have expected from Procrustes, that rascally giant of Attica given, as he was, to seizing travelers and either stretching them or cutting off their legs in order to make them fit in his iron bed. The down-side is that many courts have satisfied themselves with the fact that there is a pea to every shell and have not bothered to question the legality of the game itself; they have, in other … A "continuity" made of smoke and mirrors. In the MERS model, the mortgage doesn't pass by assignment from one owner to the next by formal assignment; in fact, it really doesn't pass at all, There is a point about which we must be very clear from the outset, and it is one that has been overlooked in a number of foreclosure cases: what is "common" to MERS members is the Putting absurdity aside, let us nonetheless assume for argument's sake that the opposite is true. There is yet a further problem: the MERS model, like our venn diagram, is spatial, but the twin realities of ownership and representation are both spatial and temporal; thus the MERS model is unavoidably static, while the transactional reality it seeks to control is dynamic. Stated However, the MERS model turns the reality on its head by asserting that ownership of the mortgage passes without the need A somewhat overlapping problem is this: In the MERS model, there is again no need for a written assignment anytime the mortgage changes hands—unless the mortgage is going to be Because Lender A remains the mortgagee of record, any subsequent assignment of the mortgage must name Lender A as the grantor in order not to memorialize a discontinuity in the There is yet another wrench in spokes of the MERS model. Even if the "common agency" mechanism could somehow allow Lender A's role as mortgagee to survive multiple transfers of the note on the secondary market, and if, as Arnold has said, the mortgage follows the note, the agency relationship vis-à-vis the mortgage ends when the note is transferred; like Lender A's status as mortgagee, it cannot survive the transfer. This owes itself to a few basic principles of agency law. Without an interest to assign, the agency relationship between MERS and Lender A that was established in order to act with regard to that mortgage interest necessarily ends; Lender A's circle is in effect removed from the Venn diagram previously mentioned. What has happened is that the purpose for which the agency relationship was created no longer exists with regard to that particular mortgage; there has been "an occurrence" the effect of … The persistence of MERS as Lender A's agent in the public record in effect accomplished with smoke and mirrors—and it conjures a host of evils. Yes, every MERS member establishes What this all boils down to it this: in order for MERS to remain the mortgagee of record That's only a few excerpts up to page 14 and there are a total of 42.

|

| Posted: 15 Nov 2011 05:22 AM PST With another day of sharply rising bond yields in Italy, Spain, Austria, Belgium and France after Spain sold 12 and 18 month debt at yields about 140 bps above similar maturities sold one month ago, European eyes still remain largely fixed on Italy. EU Pres Rompuy said “the problems of one country have become the problems of the euro zone as a whole” and the IMF, ECB and EC are watching and will be measuring fiscal austerity in Italy “very closely”. See Tumblr. Germany’s ZEW investor confidence 6 months out in their economy fell to the lowest since Oct ’08 (almost 3 pts weaker than expected) and the current outlook dropped to the weakest since July ’10 (2 pts better than estimated). Q3 GDP in the euro zone rose .2% m/o/m and thus less than 1% annualized both in line with forecasts as the German economy rose 2% annualized while the Netherlands saw an outright contraction. The cost of swapping euros for US$’s as measured by the euro basis swap is rising to the most since Dec ’08. US$ 3 month LIBOR rose again and hasn’t fallen since late July. In US markets, three of the last six trading days have been the slowest of the year and its clear that European debt issues are paralyzing investing decisions, a rational response it seems as the unprecedented nature of what is ailing us can’t be modeled. |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |