The Big Picture | |

- October 19, 1987: Dow Down 22%

- The Effects of the Great Recession on Central Bank Doctrine and Practice

- Wednesday PM Reads

- Bank debt guarantee too?

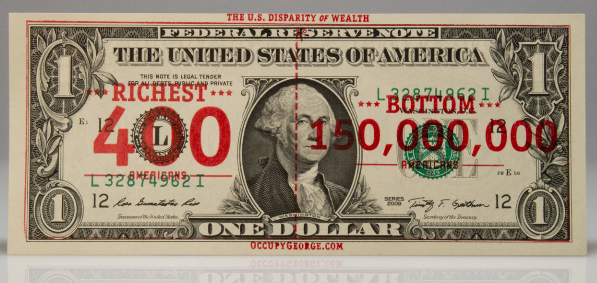

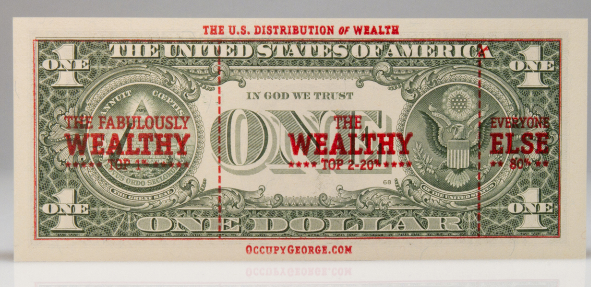

- Occupy George Turns Dollars Into Infographics

- SNL on Internet trolls

- Michael Winslow: Whole Lotta Love

- Not with a Bang, but a Whimper: BofA’s Death Rattle

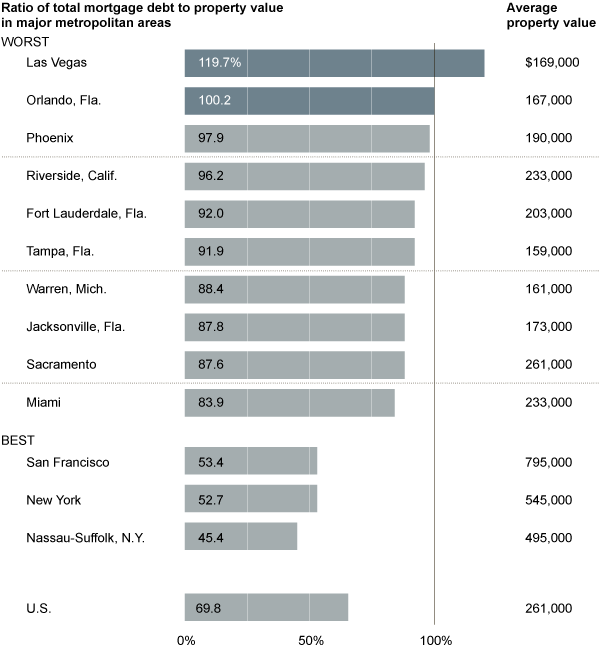

- What Cities’ Homeowners Are the Most Underwater?

- Mid-Week AM Reads

| October 19, 1987: Dow Down 22% Posted: 19 Oct 2011 04:00 PM PDT Art Cashin of UBS reminds us: On this day in 1987, the stock market suffered its worst crash of the 20th Century, even worse than 1929. The Dow lost 22% in a single day. Each year as the anniversary of the great '87 crash approaches, I get requests from what has become a steadily dwindling number of '87 veterans to repeat my follow-up poem, "The Insurer". For survivors of October '87, the memories are seared into our psyches not unlike veterans Anyway, below we repeat the poem. It was written in the manner of Edgar Allen Poe's, "The Raven", though it lacks even a scintilla of his talent and clarity…..somewhat like a stick figure rendering of the Mona Lisa. But…..you do the best you can. While all of the references will be familiar to veterans of '87, I have learned some folks who read these "Comments" were in Pampers at that time. So we'll give a quick one paragraph synopsis of the background to the '87 crash. A Brief 1987 Recap – Even if there had been no "October Surprise", the year 1987 would have been a remarkable one for Wall Street. The Dow started the year below 2000 and ran to 2722 by early Fall. (A gain of nearly 38%.) The rally was breaking all the old rules. A group of guys in Chicago came up with a new rule called Portfolio Insurance ( or Dynamic Hedging) which might be synopsized as buy strength/sell weakness (we'll explain another day). The U.S. dollar was weak and the subject of controversy. There was some conflict and confrontation in Iran (U.S. bombing Iranian oil platforms). The President's wife and right hand had gone into the hospital for a rumored cancer operation. And there was a new SEC chairman who was misquoted in the midst of the free-fall suggesting that maybe markets should close. The misquote greased the skids. Okay, that's enough background. Now – "The Insurer" (after the jump)

Once upon a Monday dreary Greenback’s value falling quickly So on the open there came selling Specialists were inundated Futures dipped below the cash now Then news reporters often shrewder Bethesda had a guest named Nancy Throughout the day as prices melted The bell, it rang to end the sorrow Two dozen years have since gone by * The Dow now stands full six times higher * This anniversary, headlines new * Yet chills we get from déjà vu * But keep your faith it's a new day * |

| The Effects of the Great Recession on Central Bank Doctrine and Practice Posted: 19 Oct 2011 03:30 PM PDT Speech by Chairman Ben S. Bernanke ~~~ The Effects of the Great Recession on Central Bank Doctrine and Practice The financial crisis of 2008 and 2009, together with the associated deep recession, was a historic event–historic in the sense that its severity and economic consequences were enormous, but also in the sense that, as the papers at this conference document, the crisis seems certain to have profound and long-lasting effects on our economy, our society, and our politics. More subtle, but of possibly great importance in the long run, will be the effects of the crisis on intellectual frameworks, including the ways in which economists analyze macroeconomic and financial phenomena. In particular, the crisis has already influenced the theory and practice of modern central banking and no doubt will continue to do so. Although it is too early to know the full implications of recent events for central bank doctrine and operations, I thought it would be worthwhile today to highlight and put into context some of the changes, as well as the continuities, that are already evident. My remarks will focus on how central banks responded to recent challenges related to the conduct of both monetary policy and the promotion of financial stability and how, as a result of that experience, the analysis and execution of these two key functions may change. The Monetary Policy Framework During the two decades preceding the crisis, central bankers and academics achieved a substantial degree of consensus on the intellectual and institutional framework for monetary policy. This consensus policy framework was characterized by a strong commitment to medium-term price stability and a high degree of transparency about central banks’ policy objectives and economic forecasts. The adoption of this approach helped central banks anchor longer-term inflation expectations, which in turn increased the effective scope of monetary policy to stabilize output and employment in the short run. This broad framework is often called flexible inflation targeting, as it combines commitment to a medium-run inflation objective with the flexibility to respond to economic shocks as needed to moderate deviations of output from its potential, or “full employment,” level. The combination of short-run policy flexibility with the discipline imposed by the medium-term inflation target has also been characterized as a framework of “constrained discretion.” Many central banks in both advanced and emerging market economies consider themselves to be inflation targeters, prominent examples including those in Australia, Brazil, Canada, Mexico, New Zealand, Norway, Sweden, and the United Kingdom. Although they differ somewhat in the details of their policy strategies, policy tools, and communication practices, today virtually all inflation-targeting central banks interpret their mandate flexibly–that is, they treat the stabilization of employment and output in the short term as an important policy objective even as they seek to hit their inflation targets over the medium term. Several other major central banks, such as the European Central Bank (ECB) and the Swiss National Bank, do not label themselves as inflation targeters; however, they have incorporated key features of that framework, including a numerical definition of price stability, a central role for communications about the economic outlook, and a willingness to accommodate short-run economic stabilization objectives so long as these objectives do not jeopardize the primary goal of price stability. How does the Federal Reserve fit into this range of policy frameworks? The Federal Reserve is accountable to the Congress for two objectives–maximum employment and price stability, on an equal footing–and it does not have a formal, numerical inflation target. But, as a practical matter, the Federal Reserve’s policy framework has many of the elements of flexible inflation targeting. In particular, like flexible inflation targeters, the Federal Open Market Committee (FOMC) is committed to stabilizing inflation over the medium run while retaining the flexibility to help offset cyclical fluctuations in economic activity and employment. Also, like the formal inflation targeters, over time the Federal Reserve has become much more transparent about its outlook, objectives, and policy strategy. For example, since early 2009, the Federal Reserve’s “Summary of Economic Projections” has included the FOMC’s longer-run projections, which represent Committee participants’ assessments of the rates to which economic growth, unemployment, and inflation will converge over time. These projections are conditioned on the assumptions of appropriate monetary policy and no further shocks to the economy; consequently, the longer-run projections for inflation in particular can be interpreted as indicating the rate of inflation that FOMC participants judge to be most consistent, over time, with the Federal Reserve’s mandate to foster maximum employment and stable prices. These longer-run inflation projections are thus analogous to targets although, importantly, they represent the Committee participants’ individual assessments of the mandate-consistent inflation rate, not a formal inflation goal of the Committee as a whole.1 To what extent, if at all, has the pre-crisis consensus framework for monetary policy been changed by recent events? In part because they recognized the benefits of continuity and familiarity during a period of upheaval, central banks generally retained their established approaches to monetary policy during the crisis; and, in many respects, the existing frameworks proved effective. Notably, well-anchored longer-term inflation expectations moderated both inflation and deflation risks, as price-setters and market participants remained confident in the ability of central banks to keep inflation near target in the medium term. The medium-term focus of flexible inflation targeting also offered central banks latitude to cushion the effects of the financial shocks on output and employment in the face of transitory swings in inflation. In particular, they were able to avoid significant policy tightening in mid-2008 and early 2011, when sharp increases in commodity prices temporarily drove headline inflation rates above target levels. Finally, for central banks with policy rates near the zero lower bound, influencing the public’s expectations about future policy actions became a critical tool, as I will discuss further shortly. The commitment to a policy framework that is transparent about objectives and forecasts was helpful, in many instances, in managing those expectations and thus in making monetary policy both more predictable and more effective during the past few years than it might otherwise have been. However, the recent experience did raise at least one important question about the flexible inflation-targeting framework–namely, that although that framework had helped produce a long period of macroeconomic stability, it ultimately, by itself, was not enough to ensure financial stability. Some observers have argued that this failure should lead to modifications, or even a replacement, of the inflation targeting approach. For example, since financial excesses tend to develop over a relatively longer time frame and can have significant effects on inflation when they ultimately unwind, it has been suggested that monetary policy should be conducted with reference to a longer horizon to take appropriate account of financial stability concerns.2 My guess is that the current framework for monetary policy–with innovations, no doubt, to further improve the ability of central banks to communicate with the public–will remain the standard approach, as its benefits in terms of macroeconomic stabilization have been demonstrated. However, central banks are also heeding the broader lesson, that the maintenance of financial stability is an equally critical responsibility. Central banks certainly did not ignore issues of financial stability in the decades before the recent crisis, but financial stability policy was often viewed as the junior partner to monetary policy. One of the most important legacies of the crisis will be the restoration of financial stability policy to co-equal status with monetary policy. Monetary Policy Tools While central banks may have left their monetary policy frameworks largely unchanged through the Great Recession, they have considerably widened their set of tools for implementing those frameworks. Following the crisis and the downturn in the global economy that started in 2008, central banks responded with a forceful application of their usual policy tools, most prominently sharp reductions in short-term interest rates. Then, as policy rates approached the zero lower bound, central banks began to employ an increasingly wide range of less conventional tools, including forward policy guidance and operations to alter the scale and composition of their balance sheets. Forward guidance about the future path of policy rates, already used before the crisis, took on greater importance as policy rates neared zero. A prominent example was the Bank of Canada’s commitment in April 2009 to keep its policy rate unchanged at 1/4percent until the end of the second quarter of 2010, depending on the outlook for inflation.3 This commitment was successful in clarifying for market participants the bank’s views on the likely path of policy rates and appears to have helped reduce longer-term interest rates, thus providing additional policy accommodation. In 2010, the Bank of Japan, which faced ongoing deflation in consumer prices, also used conditional forward guidance, saying that “The Bank will maintain the virtually zero interest rate policy until it judges, on the basis of the 'understanding of medium- to long-term price stability,’ that price stability is in sight, on condition that no problem will be identified in examining risk factors, including the accumulation of financial imbalances.”4 Some central banks provide forward guidance directly by releasing forecasts or projections of their policy rate. This practice had already been adopted by the Reserve Bank of New Zealand (in 1997), the Norges Bank (in 2005), and the Swedish Riksbank (in 2007). Each of these central banks used those projections during the financial crisis to indicate that they were likely to keep rates at low levels for at least a year. In the United States, the FOMC introduced language in its March 2009 statement indicating that it anticipated rates to remain at low levels for an “extended period,” and at its August 2011 meeting the Committee elaborated by indicating that it anticipated rates would remain low at least through mid-2013.5 The FOMC continues to explore ways to further increase transparency about its forecasts and policy plans. In addition to forward guidance about short-term rates, a number of central banks have also used changes in the size and composition of their balance sheets as tools of monetary policy. In particular, the Federal Reserve has both greatly increased its holdings of longer-term Treasury securities and broadened its portfolio to include agency debt and agency mortgage-backed securities. Its goal in doing so was to provide additional monetary accommodation by putting downward pressure on longer-term Treasury and agency yields while inducing investors to shift their portfolios toward alternative assets such as corporate bonds and equities. These actions also served to improve the functioning of some stressed financial markets, especially in 2008 and 2009, through the provision of market liquidity. Other central banks have also used their balance sheets more actively than before the crisis, with some differences in their motivations and emphasis, in part reflecting differing financial structures across countries. For example, the Bank of England has used large-scale purchases of medium- and long-term government securities as its preferred tool for providing additional stimulus; it expanded the size of its asset purchase program earlier this month out of concern about possible slowing of domestic and global economic growth. The Bank of Japan has acquired a wide range of assets, including government and corporate bonds, commercial paper, exchange-traded equity funds, and equity issued by real estate investment corporations. The ECB purchased privately issued covered bonds between July 2009 and June 2010 to improve liquidity in a key market segment; it recently announced plans to resume such purchases in November. The ECB has also bought the sovereign bonds of some vulnerable euro-area countries, “to ensure depth and liquidity in those market segments which are dysfunctional,” although the monetary effects of these purchases have been sterilized through offsetting operations.6 In most cases, the use of balance sheet policies for macroeconomic stabilization purposes has reflected the constraints on more-conventional policies as short-term nominal interest rates reach very low levels. In more normal times, when short-term policy rates are not constrained, I expect that balance sheet policies will be rarely used. By contrast, forward guidance and other forms of communication about policy can be valuable even when the zero lower bound is not relevant, and I expect to see increasing use of such tools in the future. Financial Stability Policy Even as central banks were innovative in the operation of their monetary policies, they were forced to be equally innovative in restoring and maintaining financial stability. Serving as a lender of last resort–standing ready in a crisis to lend to solvent but illiquid financial institutions that have adequate collateral–is, of course, a traditional function of central banks. Indeed, the need for an institution that could serve this function was a primary motivation for the creation of the Federal Reserve in 1913. The Federal Reserve’s discount window is an example of a facility that operates in normal times to provide very short-term liquidity to depository institutions. Most other central banks have facilities with similar features that are generally aimed at banks that find themselves with temporary liquidity needs. During the crisis, as short-term funding markets failed to function normally, central banks around the world acted forcefully to channel liquidity to institutions and markets by lengthening the terms of their lending, increasing the range of collateral accepted, and expanding the set of counterparties with which they would undertake operations. To help stabilize the financial system and facilitate the flow of credit to households and businesses, the Federal Reserve responded to the dislocations in funding and securitization markets by dramatically increasing the amount of term funding that it provided to banks, establishing new lending facilities for nonbanks, and providing funding to support the operation of key markets. Elsewhere, including Canada, the euro area, and the United Kingdom, central banks introduced similar facilities or expanded existing facilities to boost the provision of liquidity in their local currencies. The types of facilities have varied across countries commensurate with differences in financial systems. In the euro area, where the banking sector plays a relatively large role in financial intermediation, the ECB focused on increasing liquidity to banks. Similarly, the Bank of England sought to improve banks’ liquidity positions by allowing them to exchange illiquid mortgage-backed securities for U.K. treasury bills for up to three years. One of the lessons of the crisis was that financial markets have become so globalized that it may no longer be sufficient for central banks to offer liquidity in their own currency; financial institutions may face liquidity shortages in other currencies as well. For that reason, the Federal Reserve established bilateral currency swap agreements with 14 foreign central banks during the financial crisis. The swap facilities have allowed these central banks to borrow dollars from the Federal Reserve to lend to banks in their jurisdictions, which has served to ease conditions in dollar funding markets globally. Similarly, the ECB established bilateral swap lines with several other central banks in Europe to exchange euros for their respective currencies. As lender of last resort, a central bank works to contain episodes of financial instability; but recent events have shown the importance of anticipating and defusing threats to financial stability before they can inflict damage on the financial system and the economy. In particular, the crisis illustrated some important benefits of involving central banks in financial supervision. Among these benefits are the facilitation of close and effective information sharing between supervisors and the providers of backstop liquidity, especially during crises; the ability to exploit the substantial overlap of expertise in the making of monetary policy and financial stability policy; and the usefulness of the information supervisors gather about economic and financial conditions for monetary policy. Appreciation of these benefits is leading to larger roles for central banks in financial supervision. For example, the Bank of England received expanded powers and responsibilities for financial stability with the establishment of a prudential regulator as a subsidiary of the bank and the creation of a separate Financial Policy Committee within the bank that will identify, monitor, and take action to reduce systemic risks. In the euro area, the newly created European Systemic Risk Board, which is chaired by the president of the ECB and includes the governors of all European Union central banks, draws heavily on central bank expertise, including analytical, statistical, and administrative support from the ECB. In the United States, the Federal Reserve has reoriented its existing supervisory activities to incorporate a broader systemic focus; it also has been assigned new responsibilities for financial stability, including supervisory authority over nonbank financial institutions that are designated as systemically important by the Financial Stability Oversight Council and new backup authorities for systemically critical financial market utilities. The Integration of Monetary Policy and Financial Stability Policies As I noted earlier, in the decades prior to the crisis, monetary policy had come to be viewed as the principal function of central banks; their role in preserving financial stability was not ignored, but it was downplayed to some extent. The financial crisis has changed all that. Policies to enhance financial stability and monetary policy are now seen as co-equal responsibilities of central banks. How should these two critical functions fit together? At an institutional level, as I have already suggested, the two functions are highly complementary. Monetary policy, financial supervision, and lender-of-last-resort policies all benefit from the sharing of information and expertise. At the Federal Reserve, for example, macroeconomists help design stress-test scenarios used by bank supervisors, while supervisors provide information about credit conditions to macroeconomic forecasters. Threats to financial stability, and their potential implications for the economy, are thoroughly discussed at meetings of the FOMC. An important debate for the future concerns the extent to which it is useful for central banks to try to make a clear distinction between their monetary and financial stability responsibilities, including designating a separate set of policy tools for each objective. For example, throughout the crisis the ECB has maintained its “separation principle” under which it orients changes in its policy interest rate toward achieving price stability and focuses its unconventional liquidity and balance sheet measures toward addressing dysfunctional markets. The idea that policy is more effective when separate tools are dedicated to separate objectives is consistent with the principle known to economists as the Tinbergen rule.7 In practice, the distinction between macroeconomic and financial stability objectives will always be blurred to some extent, given the powerful interactions between financial and economic conditions. For example, monetary policy actions that improve the economic outlook also tend to improve the conditions of financial firms; likewise, actions to support the normal functioning of financial institutions and markets can help achieve the central bank’s monetary policy objectives by improving credit flows and enhancing monetary policy transmission. Still, the debate about whether it is possible to dedicate specific policy tools to the macroeconomic and financial stability objectives is a useful one that raises some important practical questions. A leading example is the question of whether monetary policy should “lean against” movements in asset prices or credit aggregates in an effort to promote financial stability. In my view, the issue is not whether central bankers should ignore possible financial imbalances–they should not–but, rather, what “the right tool for the job” is to respond to such imbalances.8 The evolving consensus, which is by no means settled, is that monetary policy is too blunt a tool to be routinely used to address possible financial imbalances; instead, monetary policy should remain focused on macroeconomic objectives, while more-targeted microprudential and macroprudential tools should be used to address developing risks to financial stability, such as excessive credit growth. Prudential tools can be structural or cyclical in nature. Examples of structural prudential tools are measures to ensure adequate levels of capital and liquidity in the banking sector or to increase the resiliency of the financial infrastructure. Examples of cyclical prudential tools include varying caps on loan-to-value ratios on mortgages, as Korea and Hong Kong have done; dynamic provisioning for losses by banks, as employed in Spain; time-varying margin and haircut rules; and countercyclical capital requirements, as have been set out in BaselIII. In principle, structural and cyclical prudential tools could both damp the buildup of imbalances and bolster the resilience of the financial sector to a decline in asset prices by increasing its capacity to absorb losses. The diverse tools of financial regulation and supervision, together with appropriate monitoring of the financial system, should be, I believe, the first line of defense against the threat of financial instability. However, the effectiveness of such targeted policies in practice is not yet proven, so the possibility that monetary policy could be used directly to support financial stability goals, at least on the margin, should not be ruled out. Conclusion The financial crisis of 2008 and 2009 will leave a lasting imprint on the theory and practice of central banking. With respect to monetary policy, the basic principles of flexible inflation targeting–the commitment to a medium-term inflation objective, the flexibility to address deviations from full employment, and an emphasis on communication and transparency–seem destined to survive. However, following a much older tradition of central banking, the crisis has forcefully reminded us that the responsibility of central banks to protect financial stability is at least as important as the responsibility to use monetary policy effectively in the pursuit of macroeconomic objectives. An evolving consensus holds that central banks can dedicate separate toolkits to achieving their financial stability and macroeconomic objectives, but this consensus must be viewed as provisional. Certainly, those toolkits appear to be much better stocked today than before the crisis: monetary policy tools that can be brought to bear if necessary include the management of the central bank’s balance sheet and, to a greater extent than in the past, communication about future policies. Financial stability policy encompasses, as the first line of defense at least, a range of microprudential and macroprudential tools, both structural and varying over the cycle, supported by enhanced monitoring and analysis of potential risks to systemic stability. Clearly, understanding and applying the lessons of the crisis will take some time yet; both theorists and practitioners of central banking have their work cut out for them. 1. In a similar vein, since 2006 the Bank of Japan has provided the range of individual policy board members’ understanding of the inflation rate consistent with price stability. That understanding is reviewed annually. 2. For example, Charles Bean of the Bank of England has suggested that “taking on board the possible risks posed by cumulating financial imbalances may require a shift in the rhetoric of inflation targeters towards the longer term.” See page 70 of Charles Bean (2003), “Asset Prices, Financial Imbalances and Monetary Policy: Are Inflation Targets Enough? 3. See Bank of Canada (2009), “Bank of Canada lowers overnight rate target by 1/4 percentage point to 1/4 per cent and, conditional on the inflation outlook, commits to hold current policy rate until the end of the second quarter of 2010 4. See Bank of Japan (2010), “Comprehensive Monetary Easing 5. See Board of Governors of the Federal Reserve System (2009), “FOMC Statement,” press release, March 18; and Board of Governors of the Federal Reserve System (2011), “FOMC Statement,” press release, August 9. 6. See European Central Bank (2010), “ECB Decides on Measures to Address Severe Tensions in Financial Markets 7. The Tinbergen rule states that if the number of policy targets surpasses the number of instruments, then some targets may not be met. See Jan Tinbergen (1952), On the Theory of Economic Policy (Amsterdam: North-Holland). 8. See Ben S. Bernanke (2002), “Asset-Price 'Bubbles’ and Monetary Policy,” speech delivered at the New York Chapter of the National Association for Business Economics, New York, N.Y., October 15. Source: |

| Posted: 19 Oct 2011 01:30 PM PDT Doh! Left the iPad at home today — so here is your (but not my) train reading:

What are you reading? |

| Posted: 19 Oct 2011 12:19 PM PDT Some headlines coming across DJ tape quoting sources, “EU Bank regulator seeks to use EFSF for bank debt guarantees,” This seems to be in addition to sovereign debt. “Guarantees would provide 1-3 year term funding.” The US Gov’t did the same thing in ’08-’09. “Debt guarantee idea faces opposition from national governments.” Not a surprise with so many cooks in this kitchen. |

| Occupy George Turns Dollars Into Infographics Posted: 19 Oct 2011 11:17 AM PDT Occupy George is looking to inform the public of America’s daunting economic disparity, one bill at a time. By circulating dollar bills stamped with fact-based infographics, they hope to focus attention on wealth disparity in America. As the prints below show, its a fun idea with one small problem: The Bureau of Engraving and Printing prints about 16,650,000 one dollar bills each day. So get crackin’, Occupy George! In the 90 seconds it took to read this, you have fallen another 17,344 dollar bills behind! |

| Posted: 19 Oct 2011 10:51 AM PDT |

| Michael Winslow: Whole Lotta Love Posted: 19 Oct 2011 10:42 AM PDT Rockin: Here is “Officer Sound Effects” from Police Academy (be sure to wait until the 1.26 mark): Hat tip kottke |

| Not with a Bang, but a Whimper: BofA’s Death Rattle Posted: 19 Oct 2011 09:00 AM PDT Not with a Bang, but a Whimper: Bank of America's Death Rattle ~~~ Bob Ivry, Hugh Son and Christine Harper have written an article that needs to be read by everyone interested in the financial crisis. The article (available here) is entitled: BofA Said to Split Regulators Over Moving Merrill Derivatives to Bank Unit. The thrust of their story is that Bank of America's holding company, BAC, has directed the transfer of a large number of troubled financial derivatives from its Merrill Lynch subsidiary to the federally insured bank Bank of America (BofA). The story reports that the Federal Reserve supported the transfer and the Federal Deposit Insurance Corporation (FDIC) opposed it. Yves Smith of Naked Capitalism has written an appropriately blistering attack on this outrageous action, which puts the public at substantially increased risk of loss. I write to add some context, point out additional areas of inappropriate actions, and add a regulatory perspective gained from dealing with analogous efforts by holding companies to foist dangerous affiliate transactions on insured depositories. I'll begin by adding some historical context to explain how B of A got into this maze of affiliate conflicts. Ken Lewis' "Scorched Earth" Campaign against B of A's Shareholders Acquiring thousands of Countrywide employees whose primary mission was to make fraudulent and toxic loans was an inelegant form of financial suicide. It also revealed the negligible value Lewis placed on ethics and reputation. But Lewis did not wait to acquire Countrywide with FDIC assistance. He feared that a rival would acquire it first and win the CEO bragging contest about who had the biggest, baddest bank. His acquisition of Countrywide destroyed hundreds of billions of dollars of shareholder value and led to massive foreclosure fraud by what were now B of A employees. But there are two truly scary parts of the story of B of A's acquisition of Countrywide that have received far too little attention. B of A claims that it conducted extensive due diligence before acquiring Countrywide and discovered only minor problems. If that claim is true, then B of A has been doomed for years regardless of whether it acquired Countrywide. The proposed acquisition of Countrywide was huge and exceptionally controversial even within B of A. Countrywide was notorious for its fraudulent loans. There were numerous lawsuits and former employees explaining how these frauds worked. B of A is really "Nations Bank" (formerly named NCNB). When Nations Bank acquired B of A (the San Francisco based bank), the North Carolina management took complete control. The North Carolina management decided that "Bank of America" was the better brand name, so it adopted that name. The key point to understand is that Nations/NCNB was created through a large series of aggressive mergers, so the bank had exceptional experience in conducting due diligence of targets for acquisition and it would have sent its top team to investigate Countrywide given its size and notoriety. The acquisition of Countrywide did not have to be consummated exceptionally quickly. Indeed, the deal had an "out" that allowed B of A to back out of the deal if conditions changed in an adverse manner (which they obviously did). If B of A employees conducted extensive due diligence of Countrywide and could not discover its obvious, endemic frauds, abuses, and subverted systems then they are incompetent. Indeed, that word is too bloodless a term to describe how worthless the due diligence team would have had to have been. Given the many acquisitions the due diligence team vetted, B of A would have been doomed because it would have routinely been taken to the cleaners in those earlier deals. That scenario, the one B of A presents, is not credible. It is far more likely that B of A's senior management made it clear to the head of the due diligence review that the deal was going to be done and that his or her report should support that conclusion. This alternative explanation fits well with B of A's actual decision-making. Countrywide's (and B of A's) reported financial condition fell sharply after the deal was signed. Lewis certainly knew that B of A's actual financial condition was much worse than its reported financial condition and had every reason to believe that this difference would be even worse at Countrywide given its reputation for making fraudulent loans. B of A could have exercised its option to withdraw from the deal and saved vast amounts of money. Lewis, however, refused to do so. CEOs do not care only about money. Ego is a powerful driver of conduct, and CEOs can be obsessed with status, hierarchy, and power. Of course, Lewis knew he could walk away wealthy after becoming a engine of mass destruction of B of A shareholder value, so he could indulge his ego in a manner common to adolescent males. Acquiring Merrill Lynch: the Lure of Liar's Loans

Investment banks that followed this recipe (and most large U.S. investment banks did), were guaranteed to report record (albeit fictional) short-term income. That income was certain to produce extreme compensation for the controlling officers. The strategy was also certain to produce extensive losses in the longer term – unless the investment bank could sell its losing position to another entity that would then bear the loss. The optimal means of committing this form of accounting control fraud was with the AAA-rated top tranche of CDOs. Investment banks frequently purport to base compensation on risk-adjusted return. If they really did so investment bankers would receive far less compensation. The art, of course, is to vastly understate the risk one is taking and attribute short-term reported gains to the officer's brilliance in achieving supra-normal returns that are not attributable to increased risk ("alpha"). Some of the authors of Guaranteed to Fail call this process manufacturing "fake alpha." The authors are largely correct about "fake alpha." The phrase and phenomenon are correct, but the mechanism they hypothesize for manufacturing fake alpha has no basis in reality. They posit honest gambles on "extreme tail" events likely to occur only in rare circumstances. They provide no real world examples. If risk that the top tranche of a CDO would suffer a material loss of market values was, in reality, extremely rare then it would be impossible to achieve a substantial premium yield. The strategy would diminish alpha rather than maximizing false alpha. The risk that the top tranche of a CDO would suffer a material loss in market value was highly probable. It was not a tail event, much less an "extreme tail" event. CDOs were commonly backed by liar's loans and the incidence of fraud in liar's loans was in the 90% range. The top tranches of CDOs were virtually certain to suffer severe losses as soon as the bubble stalled and refinancing was no longer readily available to delay the wave of defaults. Because liar's loans were primarily made to borrowers who were not creditworthy and financially unsophisticated, the lenders had the negotiating leverage to charge premium yields. The officers controlling the rating agencies and the investment banks were complicit in creating a corrupt system for rating CDOs that maximized their financial interests by routinely providing AAA ratings to the top tranche of CDOs "backed" largely by fraudulent loans. The combination of the fake AAA rating and premium yield on the top tranche of fraudulently constructed (and sold) CDOs maximized "fake alpha" and made it the "sure thing" that is one of the characteristics of accounting control fraud (see Akerlof & Romer 1993; Black 2005). This is why many of the investment banks (and, eventually, Fannie and Freddie) held substantial amounts of the top tranches of CDOs. (A similar dynamic existed for lower tranches, but investment banks also found it much more difficult to sell the lowest tranches.) Merrill Lynch was known for the particularly large CDO positions it retained in portfolio. These CDO positions doomed Merrill Lynch. B of A knew that Merrill Lynch had tremendous losses in its derivatives positions when it chose to acquire Merrill Lynch. Given this context, only the Fed, and BAC, could favor the derivatives deal Banking regulators have known for well over a century about the acute dangers of conflicts of interest. Two related conflicts have generated special rules designed to protect the bank and the insurance fund. One restricts transactions with senior insiders and the other restricts transactions with affiliates. The scam is always the same when it comes to abusive deals with affiliates – they transfer bad (or overpriced) assets or liabilities to the insured institution. As S&L regulators, we recurrently faced this problem. For example, Ford Motor Company attempted to structure an affiliate transaction that was harmful to the insured S&L (First Nationwide). The bank, because of federal deposit insurance, typically has a higher credit rating than its affiliate corporations. BAC's request to transfer the problem derivatives to B of A was a no brainer – unfortunately, it was apparently addressed to officials at the Fed who meet that description. Any competent regulator would have said: "No, Hell NO!" Indeed, any competent regulator would have developed two related, acute concerns immediately upon receiving the request. First, the holding company's controlling managers are a severe problem because they are seeking to exploit the insured institution. Second, the senior managers of B of A acceded to the transfer, apparently without protest, even though the transfer poses a severe threat to B of A's survival. Their failure to act to prevent the transfer contravenes both their fiduciary duties of loyalty and care and should lead to their resignations. Now here's the really bad news. First, this transfer is a superb "natural experiment" that tests one of the most important questions central to the health of our financial system. Does the Fed represent and vigorously protect the interests of the people or the systemically dangerous institutions (SDIs) – the largest 20 banks? We have run a real world test. The sad fact is that very few Americans will be surprised that the Fed represented the interests of the SDIs even though they were directly contrary to the interests of the nation. The Fed's constant demands for (and celebration of) "independence" from democratic government, combined with slavish dependence on and service to the CEOs of the SDIs has gone beyond scandal to the point of farce. I suggest organized "laugh ins" whenever Fed spokespersons prate about their "independence." Second, I would bet large amounts of money that I do not have that neither B of A's CEO nor the Fed even thought about whether the transfer was consistent with the CEO's fiduciary duties to B of A (v. BAC). We took depositions during the S&L debacle in which senior officials of Lincoln Savings and its affiliates were shocked when we asked "whose interests were you representing – the S&L or the affiliate?" They had obviously never even considered their fiduciary duties or identified their actual client. We blocked a transaction that would have caused grave injury to the insured S&L by taking the holding company (Pinnnacle West) off the hook for its obligations to the S&L. That transaction would have passed routinely, but we flew to the board of directors meeting of the S&L and reminded them that their fiduciary duty was to the S&L, that the transaction was clearly detrimental to the S&L and to the benefit of the holding company, and that we would sue them and take the most vigorous possible enforcement actions against them personally if they violated their fiduciary duties. That caused them to refuse to approve the transaction – which resulted in a $450 million payment from the holding company to the S&L. (I know, $450 million sounds quaint now in light of the scale of the ongoing crisis, but back then it paid for our salaries in perpetuity.) Third, reread the Bloomberg column and wrap your mind around the size of Merrill Lynch's derivatives positions. Next, consider that Merrill is only one, shrinking player in derivatives. Finally, reread Yves' column in Naked Capitalism where she explains (correctly) that many derivatives cannot be used safely. Add to that my point about how they can be used to create a "sure thing" of record fictional profits, record compensation, and catastrophic losses. This is particularly true about credit default swaps (CDS) because of the grotesque accounting treatment that typically involves no allowances for future losses. (FASB: you must fix this urgently or you will allow a "perfect crime."). It is insane that we did not pass a one sentence law repealing the Commodities Futures Modernization Act of 2000. Between the SDIs, the massive, sometimes inherently unsafe and largely opaque financial derivatives, the appointment, retention, and promotion of failed anti-regulators, and the continuing ability of elite control frauds to loot with impunity we are inviting recurrent, intensifying crises. I'll close with a suggestion and request to reporters. Please find out who within the Fed approved this deal and the exact composition of the assets and liabilities that were transferred. |

| What Cities’ Homeowners Are the Most Underwater? Posted: 19 Oct 2011 08:30 AM PDT As the housing market collapsed and home prices plummeted, Americans lost vast amounts of wealth. Homeowners in some cities were hit particularly hard — Las Vegas and Orlando, Fla., are now effectively "underwater," with more mortgage debt than property value over all. > Source: |

| Posted: 19 Oct 2011 06:53 AM PDT My morning reads:

What are you reading? > |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |