The Big Picture | |

- Yet Another Look at FDIC Bank Failures

- Patent Wars?

- Advertising: The Labors of Hercules

- It’s All Connected: An Overview of the Euro Crisis

- Repairing Infrastructure Can Help Economy

- The Myth Of the Chinese Soft Landing

- Meteor, Milky Way and Northern Lights

- There’s Enough Math in Finance Already. What’s Missing is Imagination.

- The Only Way to Save the Economy: Break Up the Giant, Insolvent Banks

| Yet Another Look at FDIC Bank Failures Posted: 23 Oct 2011 03:30 PM PDT Here is yet another in our all-too-regular continuing series, courtesy of Ron Griess of The Chart Store: |

| Posted: 23 Oct 2011 01:30 PM PDT I find it interesting to see the debate framed in terms of huge companies battling over inventions — but to me, the much bigger concern is when giant firms rip off the smaller inventor, who often cannot afford to prosecute their claims. > Hat tip IP Metrics |

| Advertising: The Labors of Hercules Posted: 23 Oct 2011 11:00 AM PDT |

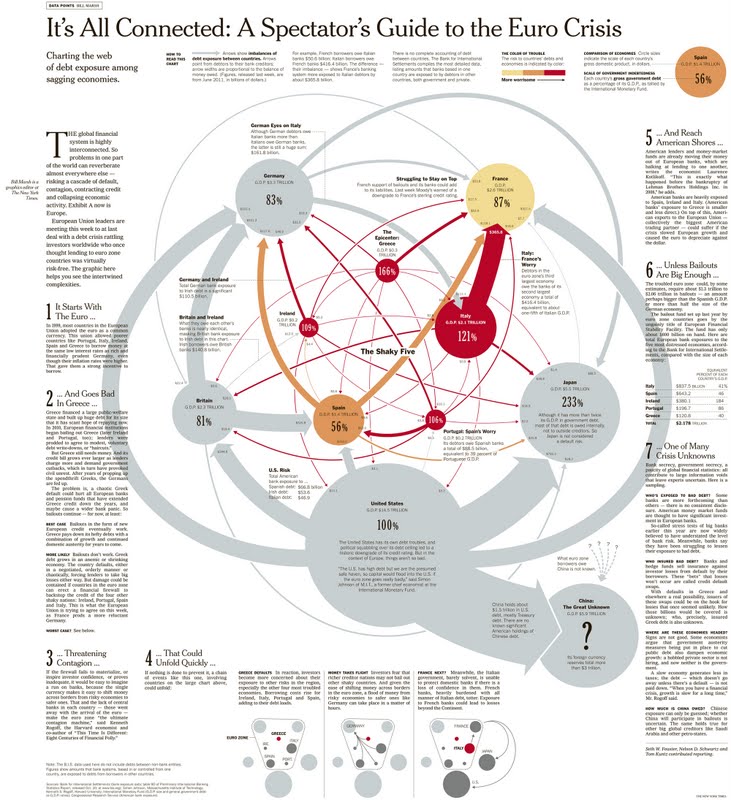

| It’s All Connected: An Overview of the Euro Crisis Posted: 23 Oct 2011 09:00 AM PDT |

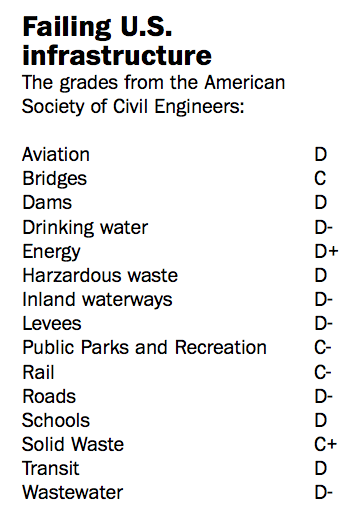

| Repairing Infrastructure Can Help Economy Posted: 23 Oct 2011 06:00 AM PDT >

The print version had the somewhat alarmist (but accurate) headline The public investment we need to make now, for our competitiveness, our jobs and our safety; the online version is the brief but also accurate hedder Repairing infrastructure can help repair economy. Here’s an excerpt from the column:

The Post also included a scorecard of the US infrastructure from American Society of Civil Engineers – seeing it laid out like this is very telling: > If we are going to be deficit spending — and that is the US history of the past 40 years — then let’s leave behind an infrastructure that the private sector can build on. That is far more productive than giving trillions of dollars to reckless bankers, tax cuts for the wealthiest Americans, or a war of choice in Iraq. Instead, we can create a country that equals the best of Germany, Japan and China. The alternative is the sort of Austery that is leading to an entire continental recession in Europe. The choice is ours . . . > Source: Washington Post Sunday, October 23 2011 page G6 (PDF) |

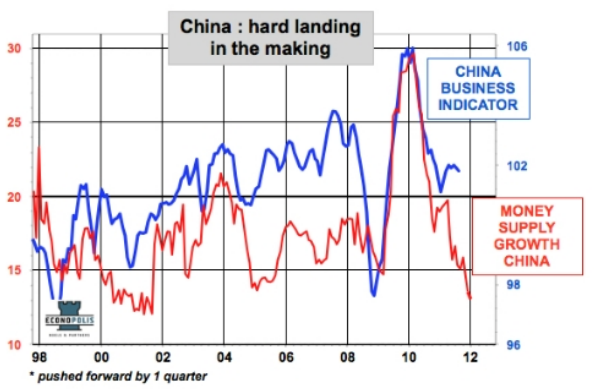

| The Myth Of the Chinese Soft Landing Posted: 23 Oct 2011 05:15 AM PDT > From Econoshock in Belgium, comes this look at a potential Chinese hard landing:

Last year, reliable Chinese statistics topped the list, but there are now at least 2 reliable Chinese statistics and -unfortunately- only 1 AAA country. The two reliable Chinese statistics are : 1. Power output (electricity) 2. Money supply Forget most of the other data in China: GDP numbers for instance are notoriously unreliable. The rumours of an economic slowdown in China have been circulating for a while. Idle buildings and capacity overhang are some of the warning signs of the Chinese economy. But now a new and more alarming warning sign has turned on: money supply has collapsed in recent quarters. The growth of money supply is closely related with credits and hence infrastructural activity and fixed investments in general. The Chinese banks have put the brake on new loans, and as a result, activity will start to slow more markedly in coming months. Analysts have so far stated that China will experience a soft landing. But the chart is a serious indication that there is no such thing as a soft Chinese landing. > Source: |

| Meteor, Milky Way and Northern Lights Posted: 23 Oct 2011 04:30 AM PDT Here is another view of that meteor tearing through an aurora (shown previously here) An Amateur photographer, Tommy Eliassen, composed the image in Ifjord, Finnmark, Norway. Eliassen made the photo on Sept. 25 using a Nikon D700 with a wide angle lens and long exposures between 25-30 seconds: Source: MSNBC |

| There’s Enough Math in Finance Already. What’s Missing is Imagination. Posted: 23 Oct 2011 03:00 AM PDT Emanuel Derman | Big Think Author, Professor of Financial Engineering, Columbia University October 21, 2011 Emanuel Derman: In some sense, all of finance is about imagination because finance is about saying, what should something be worth today based on what I think is going to happen in the future? Nobody knows what's going to happen in the future. And so all financial models are specifying in some way an imagined future and then saying, if that future is true, what should I pay for something today? And so for example, if you're building an option model, you're saying, what will volatility be in the future? And given my estimate of volatility in the future, I can value an option today. If you're looking at CDO's, which sort of came in a cropper in the big financial crisis, essentially human beings are saying, what will housing prices do in the future? What will defaults on loans be and defaults on mortgages be? And given my imagined scenario for the future, what should The big failures, I think, are failures of imagination, not of mathematics. The big mistakes are when you don't' think of something that does come to fruition eventually. When I was in graduate school, I went to see a movie the night before my qualifying exams called, "Bedazzled" with Peter Cook and Dudley Moore. It's about 40 years old, but I think it was remade a few years ago. Dudley Moore – I think they're both dead now, Dudley Moore and Peter Cook – he was a short-order cook at a Wimpy's in London and he's in love with the waitress that serves him. Peter Cook plays the devil and offers him seven chances to seduce the waitress in exchange for his soul. And so he agrees. And then he tries to specify the circumstances under which he will be with the waitress. And so the first time, he says something like, he'd like to be in a fancy castle in Oxfordshire and with her and both of them in love with each other and both of them wealthy. And the devil snaps his fingers, and there they are in this castle and they're around the billiard table and they're in love with each other, but she's married to the owner of the castle and he's just a guest. And she has scruples, so she's not willing to get involved with him. And in every scenario he tries of these seven scenarios he gets it wrong. In the last one he asks if they can both just be somewhere quiet with nobody to interfere with them and nobody talking, and they make them both nuns in a sort of Trappist monastery. And so his imagination can never specify precisely enough the future that he'd like to have. And I think that's sort of what goes wrong with a lot of financial models. You can't really write down one short description of all the things that markets may do in the future. |

| The Only Way to Save the Economy: Break Up the Giant, Insolvent Banks Posted: 22 Oct 2011 09:48 PM PDT Painting by Anthony Freda: www.AnthonyFreda.com The Government Created the Giant BanksAs MIT economics professor and former IMF chief economist Simon Johnson points out, the official White House position is that:

This is false … giant banks are incredibly destructive for the economy. We Do NOT Need the Big Banks to Help the Economy RecoverDo we need the Too Big to Fails to help the economy recover? The following top economists and financial experts believe that the economy cannot recover unless the big, insolvent banks are broken up in an orderly fashion:

In addition, many top economists and financial experts, including Bank of Israel Governor Stanley Fischer – who was Ben Bernanke's thesis adviser at MIT – say that – at the very least – the size of the financial giants should be limited.

Even the Bank of International Settlements – the "Central Banks' Central Bank" – has slammed too big to fail. As summarized by the Financial Times:

And as I noted in December 2008, the big banks are the major reason why sovereign debt has become a crisis:

Similarly, a study of 124 banking crises by the International Monetary Fund found that propping banks which are only pretending to be solvent hurts the economy:

The big banks have been bailed out to the tune of many trillions, dragging the economy down a bottomless pit from which we can't escape. See this, this, this and this. Unless we break them up, we will never escape. If We Break Up the Giants, Smaller Banks Will Thrive … And Loan More to Main StreetDo we need to keep the TBTFs to make sure that loans are made? Nope. USA Today points out:

Dennis Santiago – CEO and Managing Director of Institutional Risk Analytics (Chris Whalen's company) – notes:

Fortune reports that smaller banks are stepping in to fill the lending void left by the giant banks' current hesitancy to make loans. Indeed, the article points out that the only reason that smaller banks haven't been able to expand and thrive is that the too-big-to-fails have decreased competition:

BusinessWeek notes:

Fed Governor Daniel K. Tarullo said:

Thomas M. Hoenig pointed out in a speech at a U.S. Chamber of Commerce summit in Washington:

On the other hand, Hoenig pointed out:

45% is about 45% morethan the amount of increased lending by the too big to fails. Indeed, some very smart people say that the big banks aren't really focusing as much on the lending business as smaller banks. Specifically since Glass-Steagall was repealed in 1999, the giant banks have made much of their money in trading assets, securities, derivatives and other speculative bets, the banks' own paper and securities, and in other money-making activities which have nothing to do with traditional depository functions. Now that the economy has crashed, the big banks are making very few loans to consumers or small businesses because they still have trillions in bad derivatives gambling debts to pay off, and so they are only loaning to the biggest players and those who don't really need credit in the first place. See this and this. So we don't really need these giant gamblers. We don't really need JP Morgan, Citi, Bank of America, Goldman Sachs or Morgan Stanley. What we need are dedicated lenders. The Fortune article discussed above points out that the banking giants are not necessarily more efficient than smaller banks:

And Governor Tarullo points out some of the benefits of small community banks over the giant banks:

It is simply not true that we need the mega-banks. In fact, as many top economists and financial analysts have said, the "too big to fails" are actually stifling competition from smaller lenders and credit unions, and dragging the entire economy down into a black hole. The Failure to Break Up the Big Banks Is Causing Rampant FraudPainting by Anthony Freda: www.AnthonyFreda.com Top economists and experts on fraud say that fraud is not only widespread, it is actually the business model adopted by the giant banks. See this, this, this, this, this and this. In addition, Richard Alford – former New York Fed economist, trading floor economist and strategist – showed that banks that get too big benefit from "information asymmetry" which disrupts the free market. Nobel prize winning economist Joseph Stiglitz noted in September that giants like Goldman are using their size to manipulate the market:

The giants (especially Goldman Sachs) have also used high-frequency program trading which not only distorted the markets – making up more than 70% of stock trades – but which also let the program trading giants take a sneak peak at what the real (aka "human") traders are buying and selling, and then trade on the insider information. See this, this, this, this and this. (This is frontrunning, which is illegal; but it is a lot bigger than garden variety frontrunning, because the program traders are not only trading based on inside knowledge of what their own clients are doing, they are also trading based on knowledge of what all other traders are doing). Goldman also admitted that its proprietary trading program can "manipulate the markets in unfair ways". The giant banks have also allegedly used their Counterparty Risk Management Policy Group (CRMPG) to exchange secret information and formulate coordinated mutually beneficial actions, all with the government's blessings. In other words, a handful of giants doing it, it can manipulate the entire economy in ways which are not good for the American citizen. And the political system. No wonder Nobel prize-winning economist Paul Krugman thinks that we have to break up the big banks to stop their domination of the political process. The Failure to Break Up the Big Banks Is Dooming Us to a Derivatives DepressionAll independent experts agree that unless we rein in derivatives, will have another – bigger – financial crisis. But the big banks are preventing derivatives from being tamed. We have also pointed out that derivatives are still very dangerous for the economy, that the derivatives "reform" legislation previously passed has probably actually weakened existing regulations, and the legislation was "probably written by JP Morgan and Goldman Sachs". As I noted last year:

That's bad enough. But Bob Litan of the Brookings Institute wrote a paper (here's a summary) showing that – even if real derivatives legislation is ever passed – the 5 big derivatives players will still prevent any real change. James Kwak notes that Litan is no radical, but has previously written in defense in financial "innovation". Here's a good summary from Rortybomb, showing that this is yet another reason to break up the too big to fails:

And the extreme concentration of power and control over the entire global economy of a handful of large banks means that the entire system is extremely vulnerable. Why Aren't They Be Broken Up?So what is the real reason that the TBTFs aren't being broken up? Certainly, there is regulatory capture, cowardice and corruption:

But there is an even more interesting reason . . . The number one reason the TBTF's aren't being broken up is [drumroll] . . . the 'ole 80′s playbook is being used. As the New York Times wrote in February:

In other words, the nine biggest banks were all insolvent in the 1980s. Indeed, Richard C. Koo – former economist at the Federal Reserve Bank of New York and doctoral fellow with the Fed's Board of Governors, and now chief economist for Nomura – confirmed this fact last year in a speech to the Center for Strategic & International Studies. Specifically, Koo said that -after the Latin American crisis hit in 1982 – the New York Fed concluded that 7 out of 8 money center banks were actually "underwater" and "bankrupt", but that the Fed hid that fact from the American people. So the government's failure to break up the insolvent giants – even though virtually all independent experts say that is the only way to save the economy, and even though there is no good reason not to break them up – is nothing new. William K. Black's statement that the government's entire strategy now – as in the S&L crisis – is to cover up how bad things are ("the entire strategy is to keep people from getting the facts") makes a lot more sense. |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |