The Big Picture | |

- 7 Billion: How Did We Get So Big So Fast?

- Mid-Week PM Reads

- Should You Invest in Groupon IPO?

- The UN Predicts The World’s Population Explosion

- More on FOMC

- NASA: Working on Tractor Beams

- FOMC speaks, Evans says do more

- Mike Mayo’s Exile on Wall Street

- Where The Jobs Are

- Stocks Drift Higher Ahead of FOMC News

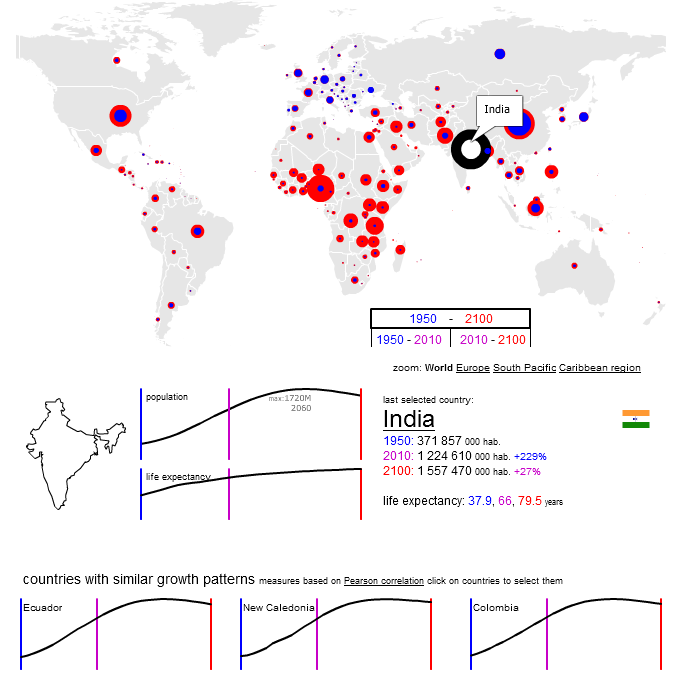

| 7 Billion: How Did We Get So Big So Fast? Posted: 02 Nov 2011 02:30 PM PDT It was just over two centuries ago that the global population was 1 billion — in 1804. But better medicine and improved agriculture resulted in higher life expectancy for children, dramatically increasing the world population, especially in the West. As higher standards of living and better health care are reaching more parts of the world, the rates of fertility — and population growth — have started to slow down, though the population will continue to grow for the foreseeable future. U.N. forecasts suggest the world population could hit a peak of 10.1 billion by 2100 before beginning to decline. But exact numbers are hard to come by — just small variations in fertility rates could mean a population of 15 billion by the end of the century.

|

| Posted: 02 Nov 2011 02:30 PM PDT My afternoon train reading:

What are you reading? |

| Should You Invest in Groupon IPO? Posted: 02 Nov 2011 01:00 PM PDT |

| The UN Predicts The World’s Population Explosion Posted: 02 Nov 2011 11:30 AM PDT Source: |

| Posted: 02 Nov 2011 11:00 AM PDT Two more things on the FOMC. With all the tough talk from Fed Pres Fisher on current Fed policy and his stated distaste for QE2, timeline on a near zero fed funds rate and OT, he decided not to dissent today. Neither did Plosser and Kocherlakota. Thus, any hawkishness and reservations that they have expressed with their previous dissents doesn’t square with their vote for current policy. Also, with Bernanke’s press conference, the Fed will reveal new economic forecasts on growth and inflation for the next few years but if there is one thing everyone should know by now, never pay attention to them because they are rarely correct. |

| NASA: Working on Tractor Beams Posted: 02 Nov 2011 10:29 AM PDT ‘Tractor beams — the ability to trap and move objects using laser light — are the stuff of science fiction, but a team of NASA scientists has won funding to study the concept for remotely capturing planetary or atmospheric particles and delivering them to a robotic rover or orbiting spacecraft for analysis. This animation shows how a hypothetical future mission might eventually employ tractor beam technology.’

Hat tip boingboing |

| FOMC speaks, Evans says do more Posted: 02 Nov 2011 09:21 AM PDT After saying that economic growth remains slow in Sept, the FOMC today said “growth strengthened somewhat in Q3, reflecting in part a reversal of the temporary factors that had weighed on growth earlier in the year.” They also cited household spending that “increased at a somewhat faster pace in recent months.” Other comments on the economy are similar to the Sept statement. On inflation, they still have no worries and said again “inflation appears to have moderated since earlier in the year as prices of energy and some commodities have declined from their peaks.” Thus, the Fed is on record saying that $93 crude oil is not inflationary because its below its 2011 high of $115. They should explain that to main street. On OT and MBS purchases, they remain on track with what as announced in Sept. Evans, wildly dovish, wanted more accommodation and that reveals nothing new about him as he hinted at it in a talk a few weeks ago. What he thinks more accommodation will do is worth asking but Turullo, Dudley and Yellen are close to QE3 too and be sure Bernanke is also. QE3 is thus a matter of time, not if with this Fed. Two more things on the FOMC. With all the tough talk from Fed Pres Fisher on current Fed policy and his stated distaste for QE2, timeline on a near zero fed funds rate and OT, he decided not to dissent today. Neither did Plosser and Kocherlakota. Thus, any hawkishness and reservations that they have expressed with their previous dissents doesn’t square with their vote for current policy. Also, with Bernanke’s press conference, the Fed will reveal new economic forecasts on growth and inflation for the next few years but if there is one thing everyone should know by now, never pay attention to them because they are rarely correct. |

| Mike Mayo’s Exile on Wall Street Posted: 02 Nov 2011 09:00 AM PDT |

| Posted: 02 Nov 2011 08:30 AM PDT ~~~ Given the NFP release coming up on Friday, I thought it might be interesting to look at an obscure employment data point, via Jim Bianco:

Source: Bianco Research, LLC |

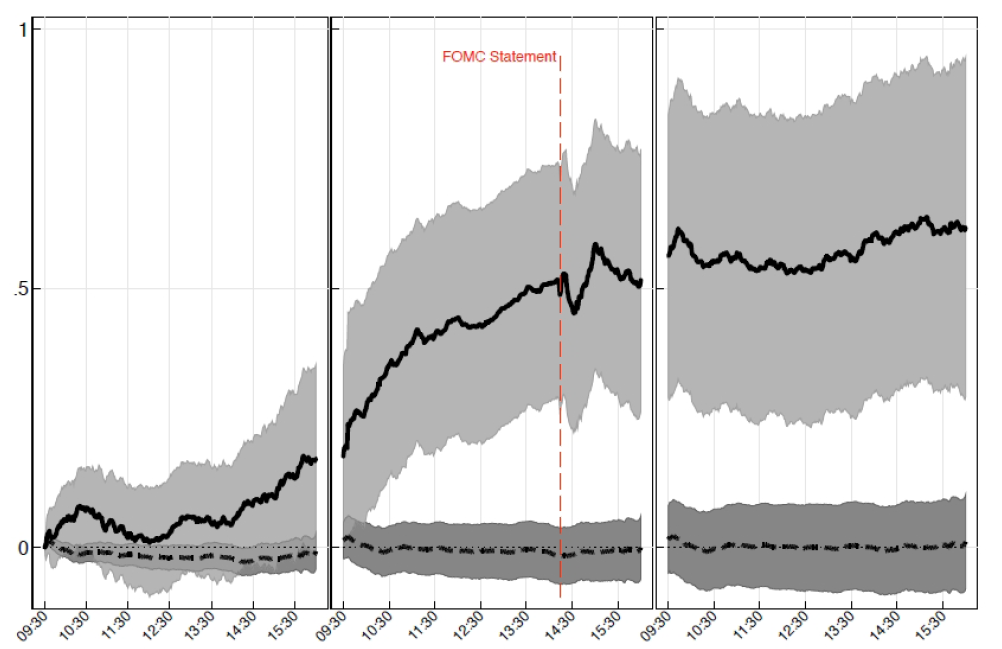

| Stocks Drift Higher Ahead of FOMC News Posted: 02 Nov 2011 07:30 AM PDT Click to enlarge: ~~~ Why are equity returns so strong on FOMC announcement days? The answer is not clear: factors such as risk, volatility, and liquidity cannot explain the market’s reaction. Similar patterns do not emerge around other scheduled macroeconomic announcements or across other asset classes such as fixed income and currencies. Regardless of the source, however, these findings suggest that equity investors should be circling FOMC announcement dates in their calendars. A recent paper entitled "The Pre-FOMC Announcement Drift," David Lucca and Emanuel Moench of the Federal Reserve Bank of New York find that U.S. stock prices rise significantly in the 24 hours prior to FOMC announcements but do not rise or fall significantly after FOMC decisions are released to the public. In fact, the authors find that 80% of the equity premium of the S&P 500 index over treasuries from 1994 to 2011 was earned solely on FOMC announcement days, meaning that all other trading days combined accounted for only 20% of the equity premium during this period. The authors also found similar patterns in numerous international equity markets such as France, Germany, Spain, and the United Kingdom. Source: |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |