The Big Picture | |

- Big Lie: Still Most Popular Column on WaPo

- Niall Ferguson: China Masters the ‘Killer Apps’

- Succinct summation of week’s events (11/11/11)

- Government Blameless in Bubble/Bust/Bailouts?

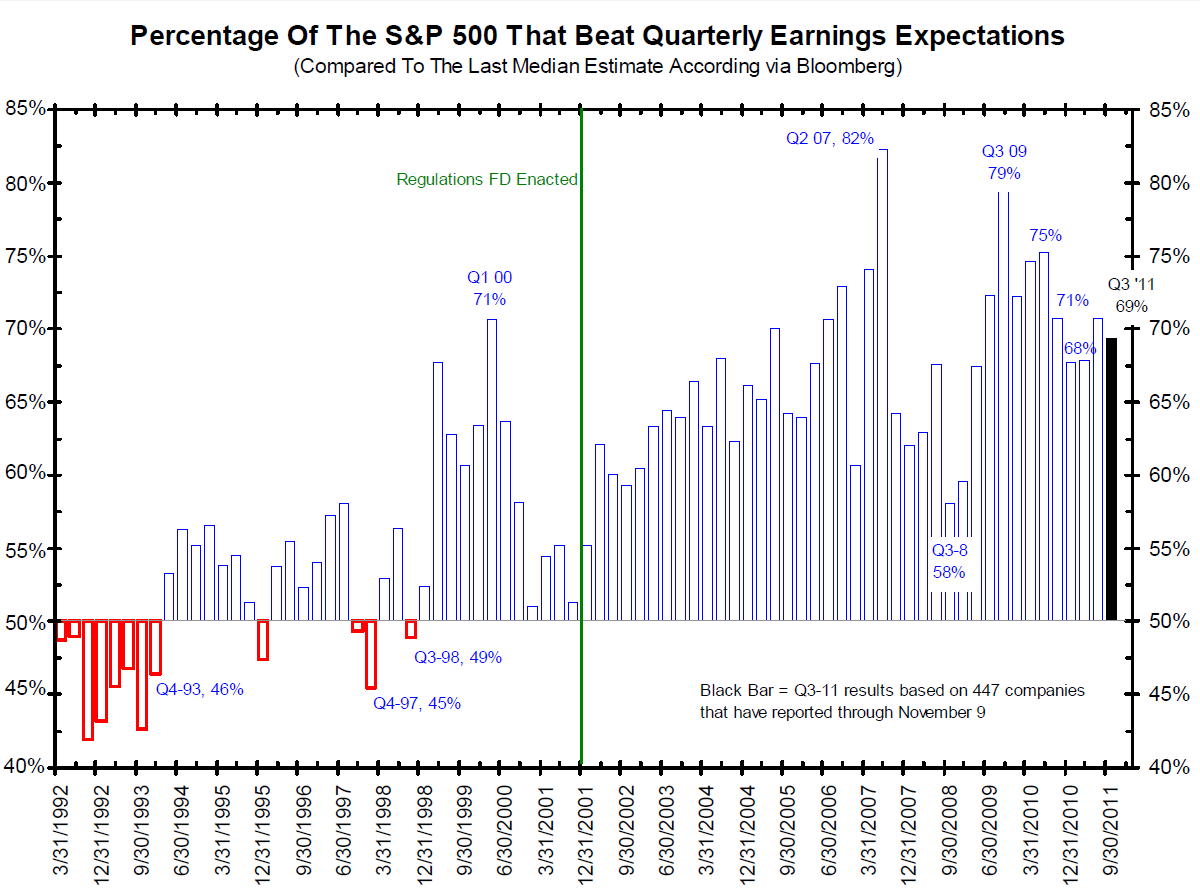

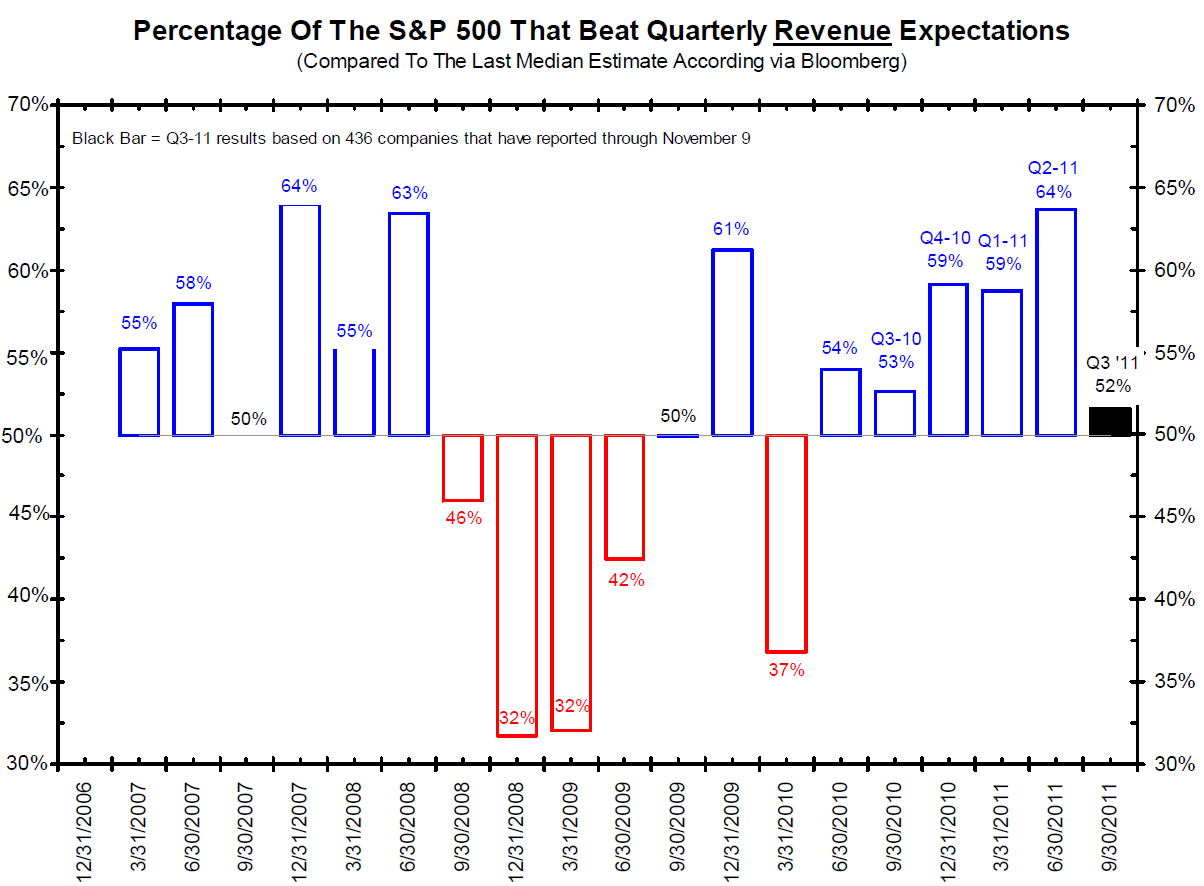

- Earnings Season Update

- 11/11/11 11:11:11

- And Now, A Short Break From EuroZone Dominated News

- UoM confidence better than expected ahead of BF

- TDS: Indecision 2012 – Mercy Rule Edition

- Review: Black Box Casino: How Wall Street’s Risky Shadow Banking Crashed Global Finance

| Big Lie: Still Most Popular Column on WaPo Posted: 11 Nov 2011 02:19 PM PST This is freakin madness: My column from Sunday, The Big Lie, is still the most popular piece still in the Washington Post, and the most popular in the Business section. Its garnered 1,700 comments. > Source: Washington Post |

| Niall Ferguson: China Masters the ‘Killer Apps’ Posted: 11 Nov 2011 02:00 PM PST |

| Succinct summation of week’s events (11/11/11) Posted: 11 Nov 2011 12:30 PM PST Succinct summation of week’s events: Positives:

Negatives:

|

| Government Blameless in Bubble/Bust/Bailouts? Posted: 11 Nov 2011 10:00 AM PST Reason has a critique of The Big Lie column. It was so disingenuous, I did something I rarely do: I sent an email to the author and editors at Reason. It went something like this:

As William James noted, “a great many people think they are thinking when they are merely rearranging their prejudices.” UPDATE: November 11, 2011, 11: 45 Tim prints my response, and adds to the discussion here. |

| Posted: 11 Nov 2011 08:30 AM PST |

| Posted: 11 Nov 2011 08:11 AM PST Today has been called a one-derful day. At eleven seconds past 11:11 am, on this, the 11th day of the 11th month of the 11th year, we have an unusual date and time:

This is not going to happen again for a while. And 1000 900 years ago, in the year 1111, we had two extra digits in the run. Meanwhile, enjoy your one-derful day. |

| And Now, A Short Break From EuroZone Dominated News Posted: 11 Nov 2011 08:00 AM PST Kiron Sarkar is an investor and advisorin London. Formerly in the M&A dept of N M Rothschild in London, he was head of M&A of Rothschild (Hong Kong) and worked on their international privatisation team. He worked as privatisation adviser to the UK Governments Know How Fund. Most recently, he was European Head of Media, Tech and Telecoms at CIBC World markets. Kiron has acted as a lead adviser in respect of over US$150bn of deals and has worked globally in both developed and emerging markets. What an amazing few weeks. Volatility remains extreme, with relatively low volumes in markets – basically, the same old, same old. In Europe, the pesky Greeks have FINALLY been told to get their act together and I suspect now understand that their normal antics (particularly their propensity to LIE) will no longer be tolerated. A Technocrat Unity Government, under the former ECB Deputy, Mr Papademos has been formed, with a mandate to push through much needed structural and austerity measures, which were totally ignored previously. In Italy, Berlusconi continues to try and remain in power, but his days are numbered. Will Italy follow Greece and appoint a Technocrat Government, lead by Mario Monti – still not a shoe in, but remains the most likely scenario. However, never underestimate Berlusconi’s attempts to screw this up/interfere – after all, if he loses power, he will have far less influence to impact the 4 (if I recall) criminal charges that he faces. Good news however, Italy’s Senate has today passed debt reduction measures – more will be needed and, indeed, a number of measures will need to be brought forward. That should mean that Berlusconi exits imminently, making 2 out of the 3 PM’s to go – the next one to exit (not before time) will be Zapatero – the Spanish PM – this month. Mr Berlusconi’s description of Mrs Merkel was truly The market certainly targeted Italy, with 10 year bond yields rising to 7.4%. However, it is obvious that the ECB has been intervening heavily and 10 year BTP yields are down to 6.60% (down 29bps today and well below the 7.40%+ recently). Phew, it was a hairy ride, but my long Italian bond position (which I bought on expectations of ECB

Furthermore, the Spanish Government is not paying its bills to help Euro Zone 2012 GDP continues to be DOWNGRADED – even Germany’s numbers Next we have France. Well consumption, defence and auto’s are the Belgium, well another problem country, though apart from being the HQ OK, so whats the future. It’s clear to me that the new ECB President Another inevitability will be the issue of EURO BONDS, irrespective of German control of the Euro Zone (at present they are including France However, in the short term, the EFSF is a nonsense – I simply cannot Whilst US commentators continue to criticise the Euro Zone (as I do, Reports continue to circulate that Germany will push for changes to If I am right, I believe that investors, in due course, will allocate The UK is, off course, having its problems. However, we do have our I have no doubt that the BoE will increase the size of its current QE As an aside, having lost my 2 bete noir’s, Brown and Trichet, I I had a great trip to the US. It is clear that US economic data (by A digression for the moment. A gentleman called Sean Egan alleged that As Mr Egan’s Jefferies call came shortly after the problems associated An American friend of mine Barry Ritholtz (he produces a great daily Another misguided view (in my humble opinion) is of the FED. In my I spent some time in Washington and, as usual, spoke to a number of Focus could well shift to the US and, in particularly, to the Super I remain (short term) BULLISH – have not changed. My biggest fear is I met Mr Robert Hardy in the States. He writes an excellent I am virtually certain of this and I am also certain it will be the Finally, China. Interestingly, China is better known by US based The FT had an interesting article the other day – it reported that The deleveraging by European banks (especially as they know that they A further problem is that with European banks reducing their Sovereign In any event, I’ve droned on for far too long. Markets look health |

| UoM confidence better than expected ahead of BF Posted: 11 Nov 2011 07:21 AM PST The 1st look at Nov UoM confidence at 64.2 was well above estimates of 61.5, up from 60.9 in Oct and the best since June when it was 71.5. The 11 month average ytd is now 67.2. The main catalyst of improvement was in the Outlook component which rose 4.4 pts while Current Conditions were up 1.5 pts. One year inflation expectations were unchanged at 3.2% which compares to the 20 year average of 3.0%. Five year inflation expectations fell to 2.6% from 2.7% which matches the lowest since Mar ’09. Helping to keep inflation expectations relatively muted are gasoline prices which continue to lag 14% below the highs reached in May, although remain elevated at $3.44 per gallon on avg according to AAA. With crude though approaching $100 again, gasoline prices will likely start heading higher again. Bottom line, while still at sluggish levels, confidence has stabilized for now and we’ll soon see what that means for holiday sales as we’re just weeks away from Black Friday. |

| TDS: Indecision 2012 – Mercy Rule Edition Posted: 11 Nov 2011 07:15 AM PST A comedian can spend his whole life digging through the comedy mines for sound bites to sustain his family, and then Rick Perry gives him 53 seconds that can change his life. |

| Review: Black Box Casino: How Wall Street’s Risky Shadow Banking Crashed Global Finance Posted: 11 Nov 2011 07:00 AM PST Today I am pleased to announce a new series at TBP, book reviews by Chris Whalen. Longtime readers of TBP are quite familiar with Chris Whalen. From his perch at Institutional Risk Analyst to his appearances on Bloomberg and CNBC, the former NY Fed and bear Stearns analyst is an astute observer of banking foibles. Chris and I partly disagree about how the fault for the collapse. But unlike Mayor Bloomberg or Mitt Romney, he is not a mere politico rationalizing an unsupportable position. We can have an intelligent discussion as to the factors that contributed to the collapse — and collegially disagree. Here is Chris’ first review: ~~~

One of the many reasons that I am grateful to my friend Alex Pollock at American Enterprise Institute is his reminders regarding the nature of reality when it comes to finance and analysis. Accounting, he inveighs, is just one perspective on the elephant. Where you stand determines your view of the pachyderm. Instead of treating Washington & Wall Street as separate factors, England instead describes the interaction of Fannie Mae, Freddie Mac and the large Wall Street banks as part of a single market. By focusing on the new bank capital standards put in place in 2001, the subsequent increase in subprime lending by Fannie Mae and Freddie Mac after 2004 and the amazing explosion of cash and derivative private label RMBS, Black Box Casino describes the affordable housing partnership as a true collaboration between the Wall Street banks, national realtors, home builders, politicians and community activists. In Chapter 3, for example, appropriately entitled "Seeds of the Disaster," England describes how the culture of affordable housing in Washington was enforced by federal bank regulators such as Boston Fed President Richard Syron. Under his leadership, the Boston Fed published a series of scathing research reports detailing the "racist motives" behind bank lending patterns in New England – a message that was also being delivered by Fed examiners working in that region. The point here is that a series of positive and negative incentives emanating from Washington and driven by politics did alter bank lending behavior during the past decade and more. Badly underwritten loans were then sold to investors. You know the rest of the story. When it comes to credit availability, were we are today is closer to normal. The role of the GSEs going back to Fannie Mae Chairman David Maxwell is likewise treated in detail, especially the symbiotic relationship between Maxwell and the Lehman Brothers rain maker Jim Johnson, who eventually came to run Fannie Mae. The author also reminds us how deep and far back in time go the roots of the subprime mess. "What is forgotten today is that the purpose of the GSE legislation in 1992 was not to inaugurate an era of credit allocation and affordable lending," England writes, "but to provide Fannie and Freddie from suffering the fate of the failed savings and loan industry." England rightly identifies the GSEs as the funding fall back to the S&Ls of the 1980s for the housing industrial complex in the 1990s and thereafter. England goes on to explain that the capital standards set by Congress for the GSEs were so small that the effective leverage was over 200:1: "This Congress basically created the framework for what would become the world's two largest hedge funds." And England describes very nicely how the politicians of that era, from Henry Cisneros to Bill Clinton and George W. Bush, all focused on access to affordable housing as a political cash cow. When Barry said on Bloomberg Radio this past Thursday that Fannie and Freddie were just two more messed up banks, he really does them a great service. In fact, the GSEs were the highly leverage guarantors of Wall Street's total mortgage production, subprime and conforming. The largest lenders of the time, from Countrywide to WaMu to Wells Fargo and Bank America, controlled the entire secondary mortgage market, as they do today. Bank America, Wells Fargo, Citigroup and JPM are today a cartel operating in the secondary market for home loans in concert with the GSEs and the private mortgage insurers, which are effectively appendages of the banks and GSEs. The fact that most of the insurance exposure taken by the GSEs was conforming, as Barry and many others rightly argue, misses the point. Wall Street banks were using the underpriced GSE insurance to move supposedly "prime" loan production that would otherwise have never been done. The supposedly high quality conforming, 80% debt, 20% cash down loans now are starting to go bad in growing proportions due to the fact that one third of all mortgages are now under water. The gaming of the GSE guarantees for collateral in RMBS trusts created by Countrywide, WaMu and other lenders is well documented. This short-changing on RMBS investors in conforming deals was a direct factor in the decision to force a merger with Bank America, which was Angelo Mozilo's conduit lender. The GSEs and private MIs, whose pricing was forced down by the GSE's artificially low risk pricing, were equally enablers in the sense that the pricing of their guarantees was an order of magnitude too low to cover the true economic risk. The fact of Washington's subsidy of the prime mortgage market and the political protection offered to Fannie and Freddie by politicos like former CT Senator Christopher Dodd is described nicely in Black Box Casino, particularly the refusal of Dodd, Rep Barney Frank (D-MA) and other key Democrats to move on GSE reform. England recalls Frank telling the Washington Post that the reason for the collapse of the GSEs was market psychology, not "fundamentals." But the fundamental fact is that the government sponsorship for the US housing market going back to WWII has run its course, tracking demographic and social trends perfectly. We should recall that it was only after WWII that Wall Street began creating structured securities following the financial boom of the Roaring Twenties. The landmark Supreme Court decision by Luis Brandeis in Benedict v. Ratner in 1925, which created the standard for collateralized borrowing, also shut down the Wall Street sausage machine and arguably caused the Great Crash of 1929. With the subprime crisis we now have come full circle. Barney Frank, Chris Dodd and many other politicians of both parties leveraged the housing market with the full faith and credit of the US Treasury. The tab for Fannie, Freddie and FHA is north of $170 billion and climbing. After the 2012 election, we'll get the bad news on embedded losses inside the GSEs from defaults on those supposedly "prime" conforming loans that were guaranteed by the US taxpayer for scant consideration. Black Box Casino tells this story in a well written and sourced perspective on our shared misery. |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |