The Big Picture | |

- 10 Labor Day Afternoon Reads

- Precipitous Reduction in Bank Reserve Requirements

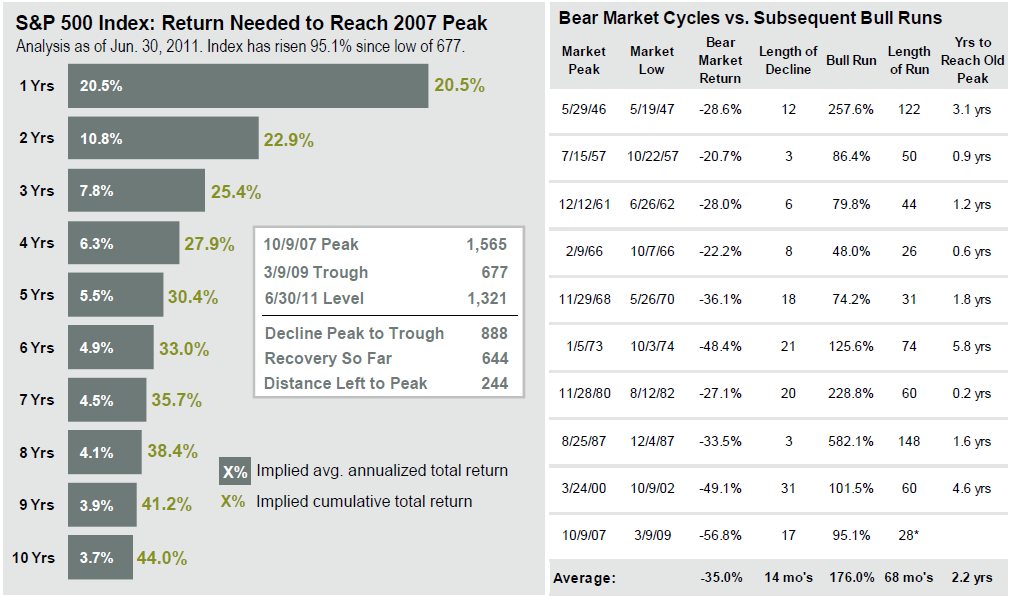

- Equity Scenarios: Returns Required to Regain Peak

- Labor Day, Leen’s Lodge, Employment Report

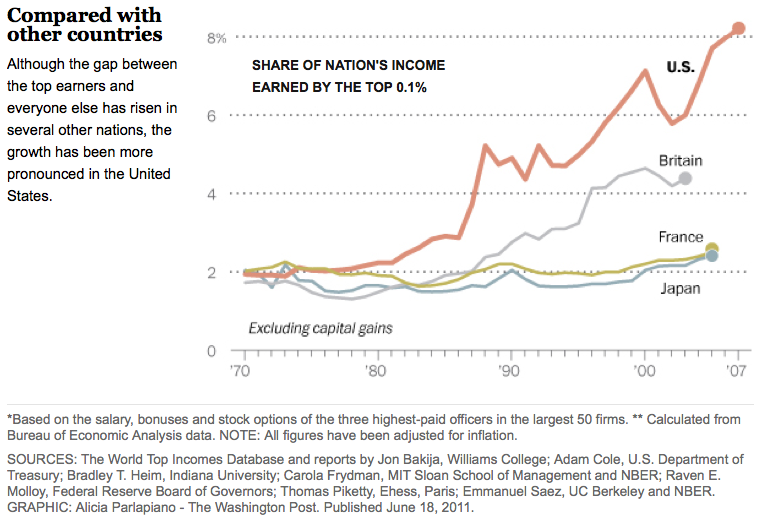

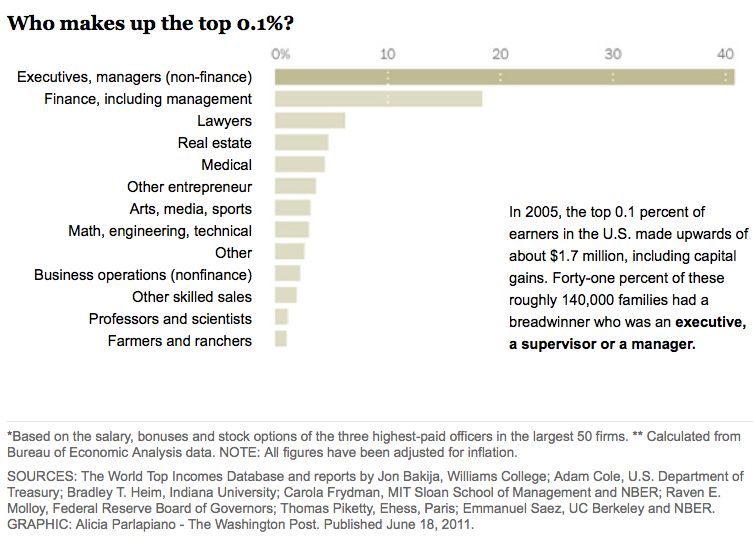

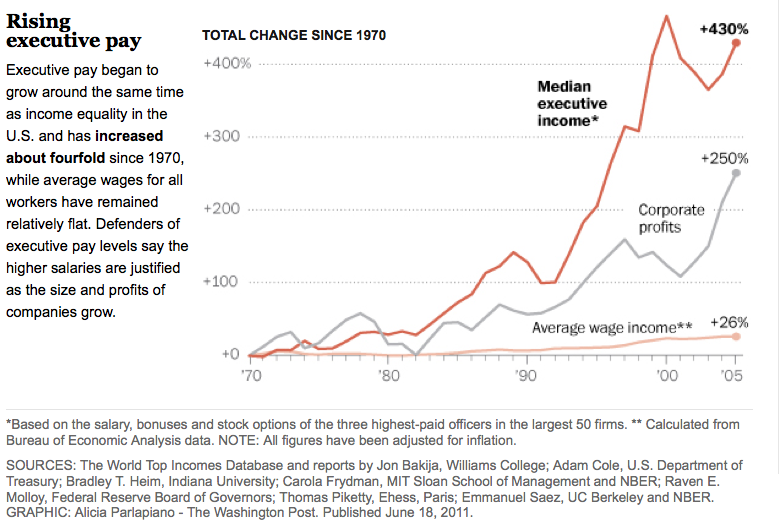

- WP: Special Report on “Breakaway Wealth”

- Kurt Vonnegut: Stories Have Shapes

- Germans who play with fire . . .

- FDIC Bank Failures

- A House with a Slalom Course View

- Roubini Warns of Global Recession Risk

| Posted: 05 Sep 2011 02:00 PM PDT Its been a hazy, lazy Labor Day, capping off a full week of outdoor activities. I am now back in my climate controlled lair, ready for a nap. I know exactly what I will read before dropping off for an afternoon siesta:

What did you read this weekend? >

|

| Precipitous Reduction in Bank Reserve Requirements Posted: 05 Sep 2011 11:30 AM PDT In Barron’s this week, Alan Abelson discusses the gradual changes in Bank reserve requirements over the years, and the impact that has had on banking, via Crosscurrents Alan Newman. Note that this is not the 2005 SEC change in leverage rules fro investment shops, but parallels the same radical deregulation and regulatory capture. Excerpt:

Interesting stuff . . . > Source: |

| Equity Scenarios: Returns Required to Regain Peak Posted: 05 Sep 2011 09:00 AM PDT Many investors ignore this sort of data, but its too important not to occasionally remind people about. The table below looks at the nature of asymmetrical gains and losses, especially, the returns necessary to recover from losses. A 25% loss requires 33% gains to get back to break even, a 50% loss requires a 100% gain, etc. Consider the following Bull, Bear and In-between scenarios for return to break even: > Source: BLS, FactSet, J.P. Morgan Asset Management. Source: JP Morgan funds |

| Labor Day, Leen’s Lodge, Employment Report Posted: 05 Sep 2011 07:30 AM PDT Labor Day, Leen's Lodge, Employment Report My long-time friend and fishing guide Ray Sockabasin put the onion rings in a special beer batter concoction that he characterizes as an "old Passamaquoddy Indian recipe." With the frying pan on the fire, in went the onion rings… sizzle, sizzle, sizzle, and out they came – fabulous. They were so light you could think of them as almost floating – why, you might use one as a 'bobber' if you were bait fishing in Big Lake in Grand Lake Stream, Maine. Labor Day weekend is a quieter time in Maine. This is a place where you can read, study research reports, take some time to go fishing, have conversations, and at the same time consider some very serious issues. On Friday morning via Leen's Lodge satellite connection, the eyes were fixed on the employment report. We channel-flipped between CNBC and Bloomberg. We happened to catch the release on CNBC when another good friend and skilled economist, Bob Brusca, was guest hosting for the hour. We listened to the dialogue among Brusca, Diane Swonk, Mark Zandi, Steve Liesman, and others. Setting aside some commentary, which I would consider rather innocuous, let me focus specifically on the skilled comments that came from Liesman and the three guest economists. No matter what one does with this employment report, one has to come away with an ominous feeling. It simply was not good. Interpretation of details could suggest that it was break-even, or "not any worse than I thought," or subject to reinterpretation because of the revisions. There was nothing in it that was robust or optimistic. There is much speculation about why this is so. Some of us, myself included, expected the second and third quarters of 2011 to be particularly weak. We attributed the loss of at least a half point in GDP to the supply-chain interruptions in the manufacturing sector due to the tragedy in Japan. We cannot blame the earthquake and the hurricane for August employment data. The effects of those natural events will be seen when we get the report in early October for September. We can attribute some major employment composition changes to the changes in government policy, the debate over layoffs in Minnesota, or to the labor interruption that took place with Verizon. In addition, August is notoriously a difficult month for employment data. It is impacted by all sorts of cross currents, from vacations to auto cycles to other causes. With certainty, the employment report guarantees that interest rates will remain low and stay low for a protracted period. On the heels of the employment report, the Treasury market rallied enormously. Ten-year Treasury yields dropped by a quarter of a point, and thirty-year Treasury yields did the same. The Federal Reserve did not act in the hour preceding or following the employment report. So, when you look at this extraordinary volatility in which Treasury securities moved by more than two full points, you cannot attribute that to the Fed. You can attribute such violent moves to the high volatility applicable to Treasury securities in a climate of enormous uncertainty. Our view remains the same. We expect the fourth quarter of 2011 to be better than the second and third quarters of 2011. We expect the supply-chain interruptions to have run their course. We expect the rebuilding and recovery in states from South Carolina to Maine and Vermont to be underway in the fourth quarter. We also expect the commitments that will be made to continue that rebuilding and recovery to take place in the early part of 2012. It is a shame that the failed policies in Washington from our political leaders, both Democrat and Republican, House, Senate, and White House – that is right – failed, failed, failed – miserable policies coming from Congressmen, Senators, Democrats, Republicans, and the President – all of them carry the unemployment burden of the United States on their shoulders and in their hands. On the left, they would spend without reservation and without constraint. On the right, they would continue to subsidize very wealthy, specialized investment managers with carried interest tax at fifteen percent and subsidize ethanol production at the cost of billions of dollars a year, while failing to pay those who need help or threatening payments to those who serve in the Armed Forces of the United States. Our political system in Washington is broken. Democrats, Republicans, Congressmen, Senators, and the President have failed to lead. They all put their re-election possibilities and their personal political careers ahead of the nation's interests. The employment report should be the time that the President speaks to a joint session of Congress. That should be convened at 9:00 am on the first Friday of the month, when the unemployment statistics from the previous month are released to the public. Labor Day, Leen's Lodge, employment report. Satellite television brings the unemployment report onto the lake, into the blue sky, and into the sunshine. It interferes with the ambience of a wonderful location in Maine. We will take a little time off, but must confess, the ruminations and discussions here are on national policy issues, markets, and economics. The good news is, the fishing is terrific, and the geography of pristine waters and wonderful green surroundings survives in spite of the monsters that lurk in our government in Washington. ~~~~ David R. Kotok, Chairman and Chief Investment Officer |

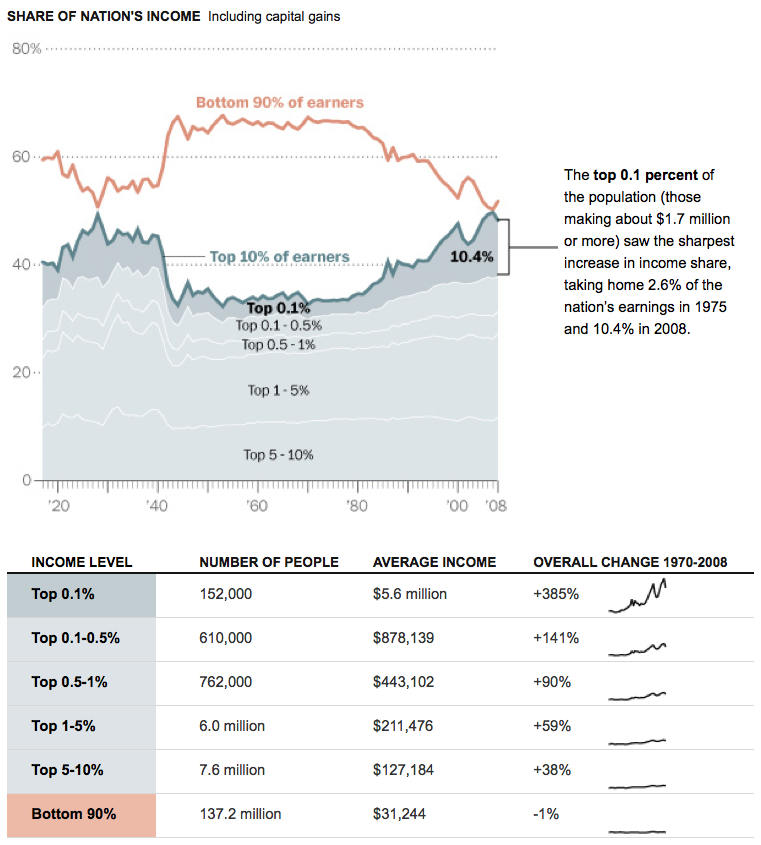

| WP: Special Report on “Breakaway Wealth” Posted: 05 Sep 2011 06:00 AM PDT There is a huge Washington Post special report on Breakaway Wealth in the US. More than most other industrialized nations, the US has seen the top 0.1% compensated in vastly disproportionate numbers versus the rest of the populace. There are at least several reasons to be concerned about this, beyond basic fairness: 1) Nations that have extremes wealth disparities tend towards social unrest. Usually, its banana republics and dictatorships, but it could happen in a corporate-owned quasi democracy as well. 2) CEOs and other company insiders have been engaging in a massive grab of shareholders wealth for decades. Its gotten appreciably worse in the 2000s. 3) Management is now trying to hide their compensation from the business owners — the firm’s shareholders Making matters even more outrageous, these CEOs are trying to pass legislation that would legally allow them to not to disclose executive compensation at public companies:

Legalized theft of shareholder assets, approved by a corrupt Congress. What little respect I had left for the GOP is now completely gone. This is not “business friendly” — its utterly corrupt theft of shareholders. The charts below (click for larger graphics) show exactly how absurd this has become. The rumors you may have heard about class warfare have been greatly exaggerated . . . > US Compared with other countriesWho makes up the top 0.1%?Rising executive payGrowing share of income for the rich

> Sources: Business group: Public companies shouldn't have to compare CEO and worker pay |

| Kurt Vonnegut: Stories Have Shapes Posted: 05 Sep 2011 05:00 AM PDT |

| Germans who play with fire . . . Posted: 05 Sep 2011 04:30 AM PDT People who play with fire > Exit polls in respect of the vote in Mrs Merkel’s home State of Mecklenburg-Vorpommern (hope I got the spelling right), suggest that she has been trounced, as have her coalition partners (Free Democrats), who have been so badly beaten that they could have lost all their representatives in the regional assembly. This is the 6th regional election loss this year for Mrs Merkel and her coalition – a bit careless I would have thought. Now it gets serious. The key election issue was Mrs Merkel’s handling of the Euro Zone crisis – she had tried to get tough on the Euro Zone – too little, too late. However, I suspect she will be far less tolerant from now on. As I keep banging on, Mrs Merkel is not a natural leader – she is a back room operator, cautious of taking a position unless she has achieved prior consensus. Furthermore, she does not understand markets – a common problem with most European politicians, bureaucrats and officials. The next German regional elections are in Berlin later this month. The Greeks have been ignoring all calls to get serious. They have run out of time. On Wednesday, the German Constitutional Court rules. Most believe that they will not block the bail out of the peripheral Euro Zone countries. Quite possibly, but giving a blank cheque to the executive, is also unlikely, in my humble opinion. They may, for example, insist on additional oversight by the German Parliament, which will make the EFSF and the future ESM unworkable, as decisions (which need Parliamentary approval) will take far too long to deal with market issues – basically means that it is over to you ECB/Monsieur Trichet to sort things out – and they are totally reluctant, though what choice do they have. Recently the German President accused the ECB of violating its mandate and Article 123 of the Lisbon Treaty. The head of the German Central Bank (the Bundesbank), Mr Jens Weidmann has, equally, been highly critical of the ECB – he stated that EU law was being “gutted” by the ECB bond purchases of Italian and Spanish and other PIIGS debt. No Essentially, the EU/ECB have overreached themselves and imposed their wishes (through unelected Commissioners in the case of the EU and appointed Board members in the case of the ECB) upon Europe. I seem to remember “no taxation without representation” and we all know what happened next. The French have generally exercised more political control (until the French revolt) over their people, than other Recent polls suggest that the German’s don’t necessarily want to ditch the Euro. Yes, a number want the DM back, but the majority (quite sensibly) will live with the Euro, but don’t want to bail out the entire Euro Zone, especially if they don’t meet their commitments (Greece….). I totally understand that sentiment. Indeed, I believe the Germans have been uber generous to date, but that generosity has a limit. This, off course, leads me back to the Greeks. They have totally ignored all their commitments/promises etc. Their fiscal position is unsustainable and worsening. The proposed austerity measures are unworkable and the Government has given up trying. This cannot continue. However, the Greeks will have to be allowed to default – and The Italians better reconsider their recent attempts to backslide from their commitments – they have a large debt maturity this week – some E14.6bn and E62bn by the end of September (the highest ever in a single month). In total, Italy must roll over E170bn by end December – Whoops. Italian 10 year bond spreads crept up to near 5.30% on Friday, We are coming to an end game – waffle, bluff and bluster wont work mes amis. Neither will the recent Merkel comments (and the views of the senior German politician I met last week) who told me that the markets were just getting hysterical and that they (the I still have the email address of the particular German politician. I don’t believe I’m generous enough to avoid sending him a short note in due course, though I suspect that my invitation to visit the Bundestag will be forgotten about. Oh well, still worth it – indeed, it’s irresistible. Will await the market reaction and the German Constitutional Court ruling on Wednesday, just to be sure though. ~~~ A qualified UK accountant, Kiron joined the M&A dept of N M Rothschild in London. He was then appointed head of M&A of Rothschild (Hong Kong). On his return to the UK, he was a founding member of the Rothschild international privatisation team. Subsequently headed up the Central and Eastern European ("CEE") team – rated No 1 in 4 out of 5 years (Privatisation International). On leaving Rothschild, he worked as privatisation adviser to the UK Governments Know How Fund, which was established to advise Governments in CEE on policy, privatisation, economic, financial, regulatory and other issues. Subsequently European Head of Media, Tech and Telecoms at CIBC World markets. Following CIBC, Kiron advised on telecoms and energy deals in CEE. Kiron has acted as a lead adviser in respect of over US$150bn of deals and has worked globally in both developed and emerging markets. |

| Posted: 05 Sep 2011 03:45 AM PDT Just cause its a holiday weekend does not mean that the FDIC isn’t busy closing insolvent banks! Via Ron Griess of the Chart Store: > |

| A House with a Slalom Course View Posted: 05 Sep 2011 03:45 AM PDT |

| Roubini Warns of Global Recession Risk Posted: 05 Sep 2011 03:00 AM PDT Economist Nouriel Roubini says the risk of a global recession is greater than 50 percent, and the next two to three months will reveal the economy’s direction. In an interview with WSJ’s Simon Constable, Roubini also says he’s putting his money in cash. “This is not the time to be in risky assets,” he says.

|

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment