The Big Picture | |

- 10 Monday PM Reads

- Think Like A Rockstar

- Deficit Polls: Tax Increases vs Spending

- Infrastructure Plan: A Third Option

- How Rare: S&P Dividend Yields vs Treasuries

- Skylar Tibbits: Can we make things that make themselves?

- 10 Monday AM Reads

- The Greek hour glass

- Fork in the Road

- Surfing Bulldog Tillman

| Posted: 19 Sep 2011 03:00 PM PDT My afternoon train reading material:

What are you reading? > Source: TRB | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 Sep 2011 02:42 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deficit Polls: Tax Increases vs Spending Posted: 19 Sep 2011 01:15 PM PDT More people support tax increases then the doctrinaire right-wing position favoring spending cuts during a weak economy. Here’s Bruce Bartlett: >

Bookmark/Search this post with | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

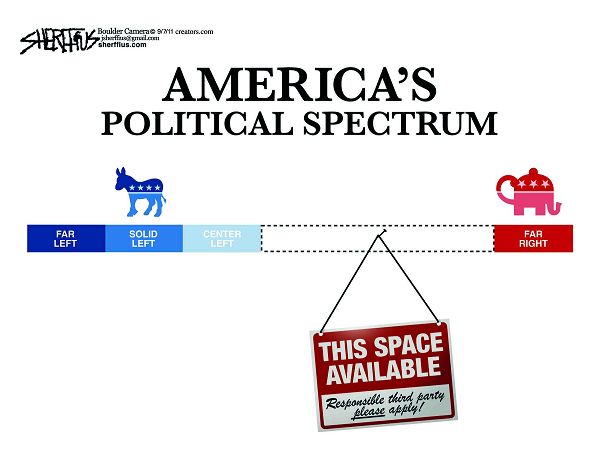

| Infrastructure Plan: A Third Option Posted: 19 Sep 2011 09:15 AM PDT Infrastructure Plan: A Third Option >

President Obama proposed $447 billion in a package designed to stimulate infrastructure spending and project-oriented job creation in the United States. House Speaker Boehner and House Republicans will offer an alternative plan. These plans then go through super-committee negotiations that are attempting to design a budget-deficit, spending, tax-management proposition in a much divided Congress. The outlook for any of the elements offered to lead to a successful compromise is considered bleak by many Washington observers. However, we want to place another option on the table, along with a concise way to pay for it without expanding the Federal deficit. Rather than a mixed package of $447 billion, we propose $535 billion in a five-year program to be allocated to infrastructure spending. The mechanics of this program are via Build America Bonds, a proven and tested method of infrastructure finance. You may be asking yourself: why the number 535? That is the exact number of Senators and Representatives that comprise our Congress. If they vote no, they will each be taking responsibility for voting against one billion dollars of infrastructure spending. We further propose that the monies be distributed among the fifty states in proportion to the number of Senators and Congressmen in each state. Therefore, a small state with one Congressman and two Senators would receive an allocation of $3 billion of Build America Bonds. A larger state with ten Congressmen and two Senators would receive an allocation of $12 billion in Build America Bonds. For what would the money be used? We propose that it must be spent on infrastructure, construction, and municipal development projects. Think of it as a way of funding schools, airports, sewer and water plants, toll roads, and bridges – all that is in the purview of government. Who would determine what projects would be undertaken? Existing local and state-level agencies would decide their needs and how to structure their own projects. If a town needed a water company, they could use a Build America Bond to finance it. If a district needed a new school, they could do the same. Fortunately, the structure would be the same as the Build America Bonds we already know. The Federal government would pay 35% of the interest in the form of a rebate to the issuer of the bonds. We already have close to $200 billion of Build America Bonds issued. The disclosures and techniques in order to finance them are established, so there is no need to form a new federal agency, allocating to other agencies. A federal presence is not required, other than to define the use for which Build America Bond proceeds may be applied. Would this create more federal deficits? Yes, if it was standalone, but we propose an alternative to pay for it. The interest subsidy on a Build America Bond at current market prices is somewhere around 1.5% per year. It works like this: a tax-free bond could be sold in conventional terms, and the buyers of such bonds would be limited to high-tax-bracket, wealthy Americans. Build America Bonds, on the other hand, are taxable instruments to the bond buyer. They are not tax-free municipal bonds, but the Federal government rebates a portion of the interest to the issuer of the bond. So, the issuer of the bond makes a decision as to which method is less costly when it issues bonds. Does it use tax-free bonds? Does it use taxable bonds? Whichever one results in the least expensive finance is the one that is preferred. So, how would the interest-rebate portion be paid out of the Federal budget? The answer here is simple: repeal the ethanol subsidy, which is approximately the same amount of money as it would take to have a half-trillion-dollar Build America Bonds program. The Congressional Budget Office (CBO) would score ethanol subsidy and Build America Bonds at about the same amount of money per year for the next, say, thirty years. What would happen if you stopped the ethanol subsidy? You would use that money instead to rebuild the infrastructure of the United States. You would stop driving up corn prices. You would free up almost half the corn crop, which is currently going into ethanol, and instead let it be applied for food. If ethanol remains economically viable because of the mandate that requires it to be part of the fuel system, so be it. If not, then there will be changes in different types of ethanol-like products. Even the most intense supporters of the ethanol subsidy admit that when the oil price is approximately $100 a barrel, the need for a subsidy for ethanol is really not justified. Why five years instead of two, like the original BABs program? It takes time to plan infrastructure projects. If the project were approved tomorrow, for example, the school board would need to hire architects, contractors, and workers. It would have to go through the process of determining what type of school to build, how it would be built, and enter the process of bidding and construction and permit applications. The same would be true for the sewer plant upgrade or the reconstruction of a bridge. Infrastructure is a long-lead-time activity. Would this create jobs right away? The answer is yes! Most projects create jobs immediately, because engineering firms, designer firms, architectural firms – those who do the preliminary work on a project – get employed quickly. The evolution of a project takes place over several years. Would it create the million jobs that the Obama administration says are needed to rebuild the infrastructure of the United States? We do not know, but we do know what we have seen with Build America Bond-financed projects. We have acted as a financial advisor on a number of them, and we have determined from our experience that many construction, project, and infrastructure-related jobs result from them. Would state and local governments have to use the Build America Bonds money? Absolutely not. This is not a wasteful program; it is an optional program. The money is available; the rerouting of ethanol subsidy money to Build America Bonds is there. The allocation goes to the states, and the states determine their level of participation. Will these bonds stand on their own credit, since the Federal government is not guaranteeing the bond principal? The answer here is yes. Market-based credit analysis and revenues have to be allocated to amortize the bonds – all that goes into the mix of each specific bond project. Each project must stand on its own merit. It must have the revenue, support, and economic research. This gets packaged into an official statement that can be presented to bond investors, who will determine on their own if they want to take the risk and buy this bond. Who will buy these bonds? Build America Bonds are taxable securities. Therefore, they become desirable for pension plans, IRAs, institutions, charitable foundations, banks, and others who are seeking investments at yields that can justify those investments and who at the moment are thirsting to find them. In addition, foreigners will buy Build America Bonds. We saw that in the last round of BABs, when foreign buyers came into the market and started to participate in this form of finance. In summary, here is our proposition. No Federal deficit impact. Repeal ethanol subsidy. Reallocate ethanol subsidy to an interest subsidy in the Build America Bonds program. Launch the Build America Bonds program with a five-year time horizon. With the size of $535 billion, we can easily convince Washington that the math is simple. In Washington, if it is not simple it does not have a chance. That would enable each Congressman to stare down a vote of a $1 billion allocation for his or her state. A concise program that creates infrastructure spending, puts the incentives to do it where they belong, and allows for independent credit analysis, could be implemented immediately and does not interfere with the super-committee's work or any other committee's work. This is our option to rebuild the infrastructure of the United States. ~~~ David R. Kotok, Chairman and Chief Investment Officer | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Rare: S&P Dividend Yields vs Treasuries Posted: 19 Sep 2011 08:30 AM PDT Last week, Ron Griess of the Chart Store brought to my attention a common misunderstanding about dividend yields. The charts below show some of the thinking behind our discussions. To begin with, the common usage of Treasuries — think 10 Year or 30 year for that matter — may not be an ideal comparison. The US sovereign debt has as little default risk as an instrument — certainly much less than any equity has in terms of risk. Towards that end, a better measure might be comparable corporates — either Moody’s Aaa or Bbb rated corporate bonds. Note that the charts, which run from 1920 to present, may belie some current assumptions about dividends and Treasuries: > 10 year U.S. Treasury Yields compared to S&P Comp Yield~~~ Moody’s Aaa Yields vs S&P Comp YieldMore charts (30 Year Treasury and Moody’s BBB), after the jump

~~~ Long-term U.S. Treasury Yields vs S&P Comp Yield~~~ Moody’s Baa Yields vs S&P Comp Yield | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Skylar Tibbits: Can we make things that make themselves? Posted: 19 Sep 2011 07:45 AM PDT MIT researcher Skylar Tibbits works on self-assembly — the idea that instead of building something (a chair, a skyscraper), we can create materials that build themselves, much the way a strand of DNA zips itself together. It’s a big concept at early stages; Tibbits shows us three in-the-lab projects that hint at what a self-assembling future might look like. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 Sep 2011 06:30 AM PDT Here is what I am starting off my week reading:

What are you reading? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 Sep 2011 04:44 AM PDT “We can’t move along without real implementation of fiscal reforms and we are late,” said Greece’s Finance Minister over the weekend, publicly acknowledging that they have not fully followed thru with the conditions demanded by the EU and IMF in order to release more money to Greece as part of Bailout 1. The Finance Minister will have a call with the EU and IMF at 12pm est time to discuss the current situation. I still assume Greece gets the next allotment of money in 2 weeks, followed by full passage of the EFSF by all 17 Parliaments and then an orderly restructuring of Greek debt where bondholders suffer at least a 50% cut in the value of their holdings off par value, more than twice the 21% reduction assumed with the current debt exchange. There are 3 ways to cut debt, pay it off, write it off or inflate out of it. Option 1 is a sign of health, option 2 is always painful but it cleanses while door #3 is the most dangerous. Greece needs to cleanse. In Asia, the Shanghai index fell to the lowest since July ’10 and the Hang Seng closed at the lowest since July ’09. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 Sep 2011 04:15 AM PDT

> The quote above describes the dilemma that investors find themselves in. They are at a fork in the road, and the noise machine all around them is advising that take it. The amusing issue, alluded to but never answered by Yogi, is which way to go. The credit crisis blew up a mere 3 years ago; the recency effect has investors fearing a replay of that crisis, only centered on European instead of US banks. Bloomberg observes more than $75B in fund withdrawals have been pulled from U.S. equity funds since the end of April (Fund Withdrawals Top Lehman as $75B Pulled). That is more than the five month withdrawal after the collapse of Lehman Brothers. US stocks have lost $2.1 trillion in market cap May 2011. Wall Street is lagging the trading. Street Strategists started the year looking for solid gains, including year end consensus targets of 1365 on the S&P 500 — about 8 12% higher from Friday’s close. They have been tripping over themselves to lower their SPX predictions, but as the WSJ observes, they are still looking relatively bullish (Wall Street’s Optimism Fades). Hence, our Stew of Negativity is fairly well understood: Start with fears of another 2008 bank crisis; add a new cyclical recession as your two base ingredients of investor’s worries. Season that with the ongoing de-leveraging and the long slow recovery process that typically follows credit crises; add the accompanying housing overhang, merely half way through its rush towards 10 million foreclosures. Salt & Pepper to taste. Are there any positives? Sentiment is negative, markets are oversold. As mentioned last week, I wished sentiment and oversold readings were more extreme to pull the trigger to get long. Missing the 5.3% pop [UPDATE: To clarify, I mean for a trade; I still have a 50% long exposure via value/dividend equities] last week was not enough to pull me further (or get me excited) about the long side, but it may have worked off some of the oversold conditions. In the hunt for the contrary indicators, I noticed a few modestly interesting items, most from Mike Santoli’s Barron’s column this week, History Lessons. Amongst the notable data points Mike notes:

Those are the positives, though they are hardly compelling. I am unsure of the history of using outflows over so short a period, and I recall outflows were strong for 2 years. The fund manager survey is broad, and is questionable as a timing tool. Insider stock sales t0 purchases ratio tend to accelerate during a downturn; they can broadly inform but have a greater value when they reach extremes. Cuts in corporate earning forecasts similarly don’t make me bullish; nor should the weakest 5 weeks of cuts (really?) give anyone comfort. The only data point in the list that warrants close attention is the Short interest relative to market capitalization. High short interest can equal a squeeze play. It acts as buying power on any move Think of how QE2 liquidity moved equities higher August 2010, eventually leading to an equity pile in. Investors are now at a fork in the road; Yogi would suggest they take it . . . | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 Sep 2011 03:00 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment