The Big Picture | |

- Succinct summation of week’s events (09/23/11)

- Gold Off $100; Trades Down to $1630

- BN reporting that more Greek bondholders can play

- The Myth Of Cash On The Sidelines

- QOTD: When This Cycle Ends…

- Capturing the Beauty Of The Milky Way at Midnight

- 10 Friday AM Reads

- Fed, Mortgages, Housing

- What next?

- Groping for Some Stability

| Succinct summation of week’s events (09/23/11) Posted: 23 Sep 2011 01:00 PM PDT Succinct summation of week’s events: Positives:

Negatives:

|

| Gold Off $100; Trades Down to $1630 Posted: 23 Sep 2011 12:00 PM PDT click charts for updated prices ~~~ > What is up with Spot Gold prices lately? After trading up to $1900 (double top?), its been a painful ride down. Today, it broke through $1700 to the downside, which may flip a few technicians negative. Over the past few months, we have discussed Gold as a trade repeatedly. In the presentation I made at the Agoroa conference in Vancouver, I titled one section “Gold is a Trade, Not a Religion.” We also noted that Diverging ETFs: What Are GLD & SPY Telling Us ? (August 23rd, 2011). The Gold trade may not be over — especially if we eventually see a QE3 — but for now, it looks like it is going to be a painful backing and filling process, as the shiny yellow metal consolidates all of 2011′s gains. In 4 days, Gold has retraced 6 weeks of gains, taking us back to prices last seen in early August. I have heard rumors of Gold being sold to cover margin calls in equities. Serious support exists at 1600, then at the 200 day moving average, around 1525 . . . ~~~ NOTE: Here is what I discussed at Agora: When the long term trend channel has an upside parabolic breakout, you have to peel off 10 or 20%. You can always buy it back cheaper, when the parabola collapses. |

| BN reporting that more Greek bondholders can play Posted: 23 Sep 2011 10:47 AM PDT Bloomberg news is reporting that Greece wants to expand the size of Greek bondholders that can sell back their bonds back to Greece as originally agreed upon with the July 21st Bailout 2. As part of that agreement, Greece can buy back debt with money issued to it from the EFSF but only certain bondholders were allowed to sell back to them, specifically those taking part in the debt swap. The EU may now allow Greece to accept bonds from a broader group of Greek bondholders at the same time Greece proceeds with the debt exchange plan. The bottom line goal is too further put a dent in their debt load and this should help. While this sounds like there can be more debt reduction than initially thought, which is good, a haircut of 50%+ rather than the 21% in the debt exchange would do so much more dramatically. |

| The Myth Of Cash On The Sidelines Posted: 23 Sep 2011 08:30 AM PDT On Friday the Federal Reserve released its quarterly Flow of Funds data, current through June 2011. One of the more popular headlines from this data concerns the record amount of "cash on the sidelines". Through Q2 2011, nonfarm nonfinancial corporate businesses held $2.05 trillion in liquid assets on their balance sheets. As the argument goes, this must be a sign of pent-up demand just waiting to be unleashed on the market. The second chart below illustrates why this may not necessarily be the case. Liquid assets held on companies' balance sheets is a nominal number, much like the nominal level of GDP, that rarely decreases. Of course cash on the sidelines is at a record nominal level, it usually is. This series must be compared to other balance sheet items for relevance. The chart below shows liquid assets as a percentage of total nonfarm nonfinancial corporate business assets since 1952. By this measure, the "cash on the sidelines" argument is far less compelling. Even when examined over a shorter time frame, as shown below, the percentage of cash on the sidelines is still within its range of the past 30 years. While liquid assets have certainly increased relative to the rest of corporations' assets since the end of 2008, the idea of record levels of cash just waiting to invest in the markets is not evident when viewed in this manner. Source: |

| Posted: 23 Sep 2011 07:30 AM PDT You are so CORRECT with this observation, IMHO: Before this full cycle ends, will the March 2009 lows hold? Ron Griess of The Chart Store fame makes the following observation:

Great stuff, Ron. |

| Capturing the Beauty Of The Milky Way at Midnight Posted: 23 Sep 2011 07:00 AM PDT |

| Posted: 23 Sep 2011 06:30 AM PDT Ahhh, not quite so busy today. Here are what I hope to read when I get 3 minutes today:

What are you reading? > |

| Posted: 23 Sep 2011 05:30 AM PDT Fed, Mortgages, Housing

We shall paraphrase. The Fed giveth and the Congress taketh away. First the Fed. By now, everyone between here and Mars knows about "Operation Twist." Simply put: the Fed is selling short-term securities and buying longer-term securities. The overall size of its portfolio remains the same. Markets reacted with a lowering of longer-term interest rates. The 10-year benchmark US Treasury note traded to a record low yield; it is currently 1.78%. The 30-year bond broke below a 3% yield and is currently at 2.89%. Shorter-term rates are unchanged. Worldwide dollar flows coupled with huge excess dollar liquidity balances combine to keep these rates near zero. The 2-year Treasury note yields 0.19% this morning. The Fed is committed to maintaining its very low short-term rate strategy for two more years. BTW, Bernanke's term as Fed Chairman ends in 2013. Every Republican candidate has indicated he/she would replace him if elected president. Bernanke has the votes (seven affirmative) to continue his policy; he is now accustomed to three dissenting voting presidents. The market is used to them, too. The Fed also committed to rolling its mortgage portfolio by reinvesting cash flows into more qualified mortgage paper. This policy action was a surprise to many observers. The mortgage paper originates with the federal agencies (GSEs). It is riskless because of the US government backstop of Fannie Mae, Freddie Mac and FHA. Residential mortgage rates reacted by falling. We are about to see the 15-year conforming mortgage interest rate below 3% and the 30-year below 4%. This policy is designed to help the real estate market stabilize. Thus, the Fed giveth. Now to the Congress, where the lunatics we elect to represent us taketh away. Congress has been in a fight over funding FEMA, which needs money. It is dealing with hurricane and flood damage from South Carolina to Vermont. It also needs to be prepared for the next event. The post-Katrina FEMA cannot exist as a "pay as you go" and/or "wait until we need you" agency. It has to be forward-looking so it can react to crisis in a timely way. But Congress is stymied by those who will not fund emergency appropriations without cutting something else. So FEMA sits in limbo while Washington fiddles, Texas burns, and Vermont tries to dry out. What has that got to do with housing and the Fed? Answer: a lot. Here is an excerpt from a research note penned yesterday by Charles Gabriel of Capital Alpha Partners, LLC. We thank Charles for giving us permission to share this note with readers, and for providing the links to see the details. Readers: please take a few minutes and examine the information in the links below. This is huge. In New Jersey, as an example, every county is negatively impacted by the Congress' inability to reach common ground decisions. "Last Chance Hopes for a Loan Limit Reprieve Are Now Dead – What Does ItMean? Many thanks again to Charles Gabriel, his partner Jim Lucier, and their colleagues for superb research. As for our elected Washington lunatics, we fear that Congress may undo all the Fed is trying to do. It seems to me that the finger-pointing by Congress at the Fed is aimed in the wrong direction. House Members and Senators of both parties need to look in the mirror. We are headed to Helsinki and Stockholm next week. Helsinki for brief meetings (one day) and then to Stockholm for the Swedbank annual global economic outlook meeting. It will be followed by the Global Interdependence Center conference (www.interdependence.org). European sovereign debt issues and resolution options will be the subject of both the public portion and the private discussion. Some thoughts on stocks before we leave for Stockholm. It looks like markets are going to test the 1100 level of the S&P 500 index. That was the intraday low reached on August 8 and retested twice in the futures market. Was it an interim selling climax or was it "the" selling climax? History suggests it was the final climax, if we are not going into another recession. If we are heading into recession again, history suggests that the bear market will be longer and the bottom deeper. We are on the "no recession" side. Slowdown yes, but steep recession, no. We admit that uncertainty is very high, and all expectations have wide confidence intervals. We look at the S&P 500 Index dividend yield and see it higher than the riskless 10-year Treasury note yield. We look at conservatively estimated earnings yields and compute an equity risk premium of 600 to 700 basis points. That is an extraordinarily high reward for anyone willing to invest in stocks. History shows it is a bargain. We will seize it. Our longer-term target for the S&P is above 2000 by the end of this decade, if not before. Skoal. David Kotok, Chairman and Chief Investment Officer |

| Posted: 23 Sep 2011 05:06 AM PDT The G20 late yesterday said they are “committed to a strong and coordinated international response to address the renewed challenges facing the global economy.” Whatever this means we’ll have to see but anything short of another round of debt reduction for Greece, among other things, and we’ll again be wasting everyone’s time. Greece, Germany and some EU officials still are putting on the public face that just by satisfying the conditions of the bailout they can get thru this. Hopefully behind the scenes the discussions are more realistic. Moody’s, in downgrading Greek banks “believes that private creditors may incur substantial economic losses on their Greek government bond holdings beyond the terms of the current debt exchange.” With respect to the ECB and calls for them to lower interest rates, do some really think that a benchmark rate of say 1% is a game changer relative to 1.5%? Did that work for the Fed? An ECB official did say “if the data in early Oct shows that things are worse than we anticipated, we will look at the kind of decisions we have to take for that.” The bottom line issue for the ECB is whether to print or not to print in buying sovereign debt, not whether to cut rates 25 or 50 bps. On the story yesterday that 16 European mid tier banks on the cusp of falling below certain capital ratios need to raise capital sooner rather than later, an EU official said they still have until Apr ’12. S&P futures are off their lows after ECB member Nowotny is explicitly laying out one of the steps they can take to ease the ever growing funding stress in the European banking system. While he says still “there is no immediate liquidity problem for banks” he does see issues with banks refinancing themselves longer term, thus “the ECB will probably discuss reintroducing a 12 month tender,” aka 12 month loans. |

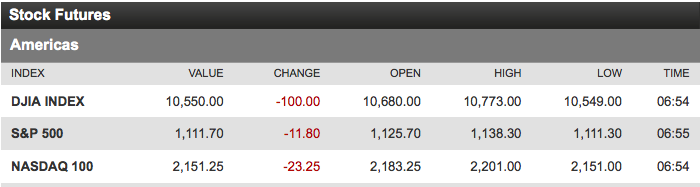

| Posted: 23 Sep 2011 04:24 AM PDT click for updated equity futures > Futures are swinging back and forth as markets blindly grope to find some stability. The 1100 level is worth watching, as is the August lows. I suspect a minor bounce is somewhere in the offing, but its for fast traders only — not investors. Advisors who have fresh capital lying around, I would put it to work, but only to match your existing defensive allocations. (i.e., if your portfolios are 30-50% equities, than you could start to scale in here). Remember, the goal is not to bottom tick markets, but rather to own equities at advantageous valuations, using market volatility to build slowly (rather than “guess”). We have not gotten to the point where we can discuss capitulation, but since I mentioned the August lows, lets go a step further with this thought experiment: Before this full cycle ends, will the March 2009 lows hold? |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

![Live New York Gold Chart [Kitco Inc.]](http://www.kitco.com/images/live/nygoldw.gif)

No comments:

Post a Comment