The Big Picture | |

- TBP’s 30 Most Influential Finance Sources

- Read It Here First: MS Earnings Concerns

- Michael Spence: Political Ideology Blocking Good Policy

- Counties (Finally) Suing MERS Over Recording Fees

- New Home Sales fall as Aug proves tough month

- A Weak Week But Not Unique

- 10 Monday AM Reads

- Macro Tides: How Much Longer?

- Europe now focusing on how, not if?

- Watch the Bounce

| TBP’s 30 Most Influential Finance Sources Posted: 26 Sep 2011 02:00 PM PDT

Following that (Meh!) complaint, I asked readers who was their most influential managers, thinkers, traders and strategists — who impacted their trading, thinking and investment process more than the rest of the chattering classes. For obvious reasons, I excluded myself & TBP (the sample group of TBP is biased). Well, you responded in force. Almost 500 votes were submitted for 90+ people. The list ranged far and wide, with many nominees. I thought it was more intriguing than the Business Week piece, with far less sell side names and far more interesting, thoughtful suggestions. Kudos to TBP readers for your intriguing perspectives. This is the list you, the home viewer, came up with:

| ||||||||||||||||||||||||||||||||||||||||||||

| Read It Here First: MS Earnings Concerns Posted: 26 Sep 2011 12:30 PM PDT Morgan Stanley Research channels our prior discussion on earnings during recessions:

What should SPX prices be? Depends upon how much earnings fall during the coming slow down/recession. If we get a pre-2000 recession drop of 15%, then we are priced fairly. A 2001-recession like drop of 25% means more downside. Of course, the 2008 outlier — earnings plummeted 44% during the credit crisis — well, that means a whole lot more downside work in equities . . . > Hat tip Sam Ro Previously: Is the S&P500 Cheap? (August 29th, 2011) McKinsey: Equity Analysts Are Still Too Bullish (June 2nd, 2010) | ||||||||||||||||||||||||||||||||||||||||||||

| Michael Spence: Political Ideology Blocking Good Policy Posted: 26 Sep 2011 11:15 AM PDT ~~~ Source: | ||||||||||||||||||||||||||||||||||||||||||||

| Counties (Finally) Suing MERS Over Recording Fees Posted: 26 Sep 2011 09:30 AM PDT

> In all of the market mayhem of last week, this article may have slipped by unnoticed: Merscorp, Bank of America Sued by Dallas District Attorney. We’ve discussed Mortgage Electronic Registration Systems (aka MERS) repeatedly over the years, including its quasi-legal standing and how it illegally failed to pay lawful recording fees to states and counties. (Back in March ’11, we discussed that County & State Litigation vs MERS was coming soon). The Dallas DA action may be the largest major City/County litigation versus MERS. This may break open the flood gates for other such suits by counties and states around the country. The politics of this are quite fascinating: The bankers may own the corrupt US Congress, and they may have intimidated or bought off many of the more cowardly State Attorneys General, but there simply are too many counties and District Attorneys representing local interests throughout the country to all be bought off. Buying/intimidating/controlling all of the local country District Attorneys may be like herding cats — nearly impossible. I am going to stand by my original prediction: The early litigants may get something, but the latter lawsuits will likely result in bankrupting MERS. An interesting legal question is whether the banks that created MERS — Bank of America, Countrywide, Fannie Mae, Freddie Mac, et. al. — can be reached beyond the corporate shield. Unless someone can demonstrate intentional fraud by design, I tend to doubt it. Stay tuned . . . > Source: BofA Case May Be Followed by More Mortgage Suits by Counties Margaret Cronin Fisk and James Sterngold See also: Dallas County DA Sues MERS, Says Shadow Recording System Confused Title and Cost Money Homeowners' Rebellion: Could 62 Million Homes Be Foreclosure-Proof? ~~~ On a related note, this embarrassing WSJ article — Niche Lawyers Spawned Housing Fracas — was not their finest moment . . . | ||||||||||||||||||||||||||||||||||||||||||||

| New Home Sales fall as Aug proves tough month Posted: 26 Sep 2011 09:15 AM PDT The August turbulence in global markets saw New Home Sales, a measure of contract signings of new homes, fall by 7k to 295k annualized, the lowest since Feb and down from 302k in July. The figure was 2k above estimates and July was revised up by a modest 4k. The lowest since at least 1963 was seen in Aug at 278k. Sales did rise in the Midwest but fell in the Northeast and the South and West where the biggest foreclosure competition is occurring. Months supply rose to 6.6 from 6.5 as the absolute number of homes for sale fell by just 2k. The median home price fell by 7.7% y/o/y. Bottom line, this is more of the same at least in the new home market where competition from existing homes remain fierce at the same time more want to rent and those that want to buy have to deal with tougher lending decisions and inconsistent appraisals. | ||||||||||||||||||||||||||||||||||||||||||||

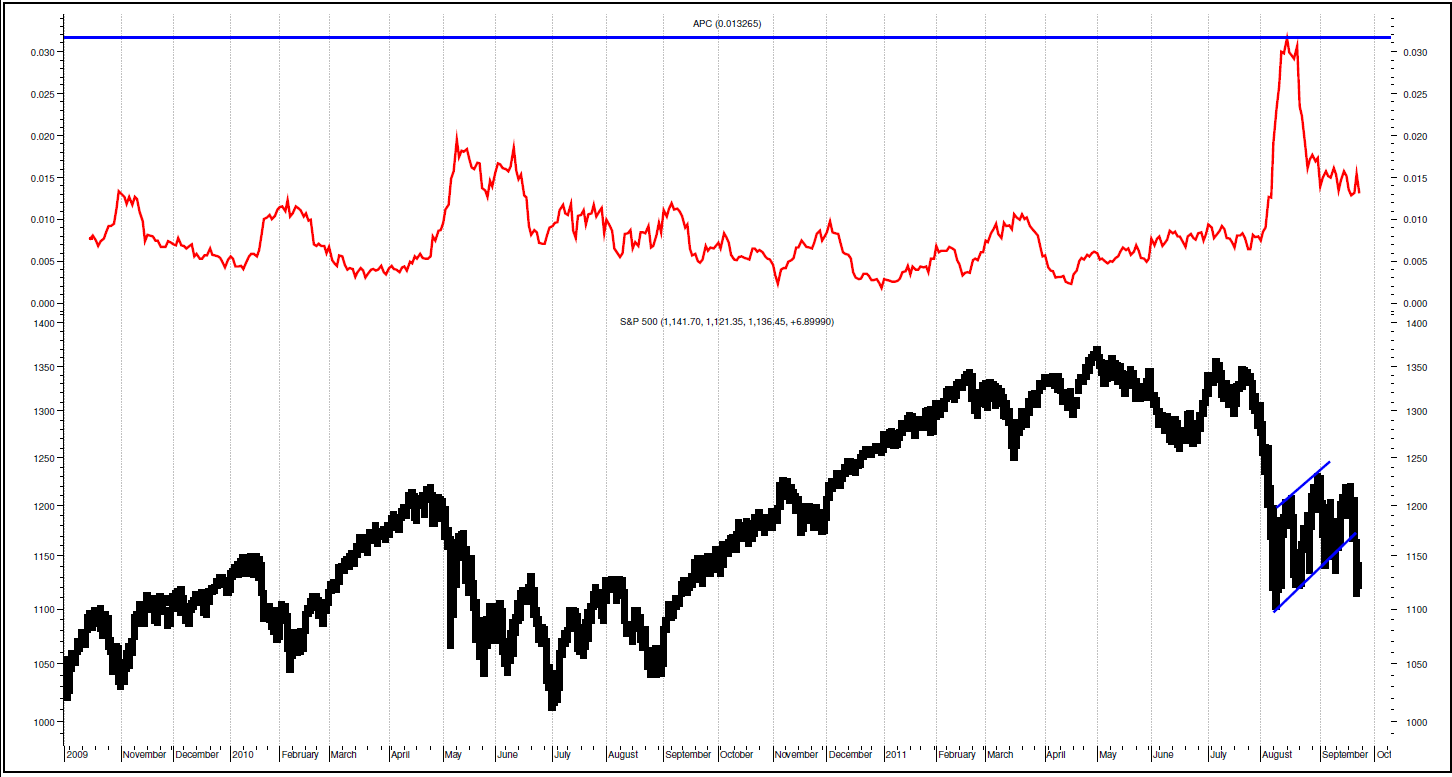

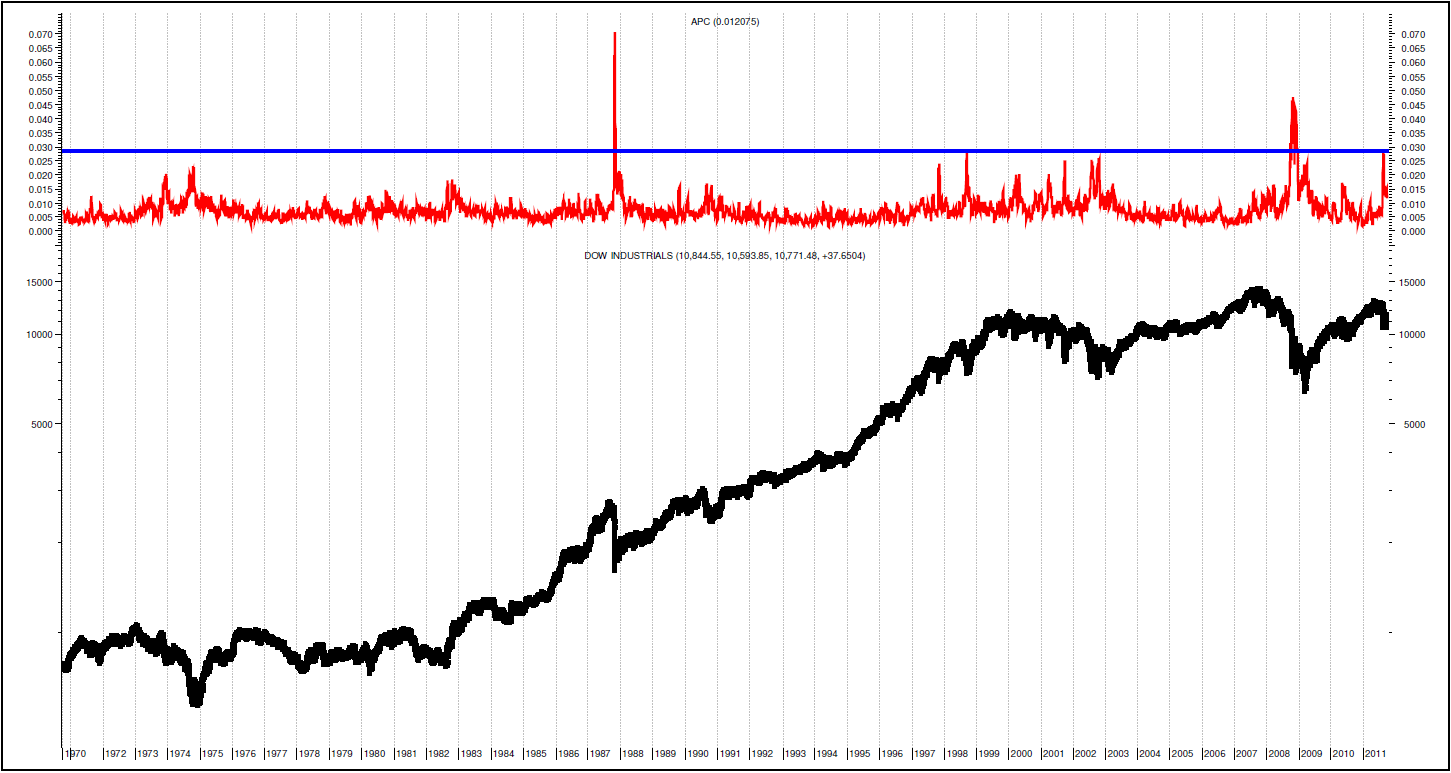

| Posted: 26 Sep 2011 08:05 AM PDT Dick Arms has spent nearly half a century following, trading and writing about Stock Markets. Best known for his Arms Index, or TRIN, his other major contributions to Wall Street methodology include Equivolume Charting, Ease of Movement, Volume Adjusted moving averages, Volume Cyclicality, and a number of volume based indicators. Reproduced here with permission of author. ~~~ Certainly it was a very sharp decline, the second worst week of the year, but it comes after the second best week of the year, and is indicative of the extremely nervous market we are in. The swings in the markets ever since the big slide began in early August have recently become almost commonplace. In fact, I am bothered by the fact that the politicians and media seem to be on a crusade to inform us of just how volatile the markets have been. The implication is that it is unprecedented, and somehow improvised by the villains that occupy the financial centers of America. One gets the impression that the next move will be an attempt to have further government intrusion in the markets. Yet it would seem that the observation about the unique volatility that is being blamed on the bad boys and girls of Wall Street is being generated by the very people who are doing the crusading; the politicians and the press. But it is not unique! Big volatility is a valid market tool and a valid observation, but it has always been with us. Volatility represents, for the astute, an opportunity not a detriment. Big volatility comes into markets when the emotions are running high. When traders and investors are particularly afraid they tend to produce a volatile market. But fear is a valid and common emotion. The gazelle that smells the presence of a lion feels fear and flees. But he is not doing something unusual nor is he necessarily acting stupidly. The flight instinct is built into all of us. But long after the lion is left far behind, the gazelles that got the message without sensing the lion continue to run. The less fearful stop and graze. Carrying the analogy to the stock market, there are times to stop and graze when the majority of the gazelles are still running for the hills. On the chart below we see the volatility, the upper red line, as measured using the APC, the Absolute Percent Change. Key here is the word Percent. The calculation is merely the ten-day moving average of the daily change in the Dow Industrials, regardless of the direction of change. But it is then divided by the level of the Dow, so that it does not matter whether we are looking at a Dow at 1200 or 12000, the change is observable within that context. Here we see that the volatility was, early in August, at a very high level compared to the prior two years. There was a big spike in volatility on the market low in mid-2010, but not as big as what happened recently. But please be sure to observe that the volatility invariably was higher on market lows than on market highs. In other words, fear is a much more disturbing emotion than is greed. Just looking at this one would find validity to the recent complaints. But that is not the whole story. Lets, on the next chart, look at a really long-term picture: > Here, again the red line is the APC, but now we are going all the way back to 1970, more than forty years. I have inserted a blue horizontal line to show where we were a few weeks ago, at the top of the spike. Hey! There have been times in history when the current volatility was child's-play by comparison. As recently as the market lows in 2008 we saw much more volatility. Perhaps the critics could blame that too on manipulation, but what about 1998 or 1987? Going back further we do not see quite such extreme readings, but remember that the period from the early eighties to the late nineties was a huge secular bull market, punctuated by only one period of extreme fear, and that was the aforementioned 1987. > My point is that the volatility in early August, and the still high volatility we are seeing now, are not unique. They are, in fact, normal and informative. The spike in early August told us the fear was overdone. The gazelles were panicking. It was a time to go against the crowd. Some grazing should have been quite nourishing. And it did not justify the government coming in and building a huge lion-proof fence around the gazelles. They would soon starve and so would the lions. Source: ~~~ Dick has received many of the highest awards in Technical Analysis, including the Market Technicians Association award for lifetime achievement. He has been inducted into the Traders Hall of Fame. Located in Albuquerque, New Mexico, Dick advises a select group of institutions with his weekly letter and personal consultation package, priced at $8000 per year. | ||||||||||||||||||||||||||||||||||||||||||||

| Posted: 26 Sep 2011 06:30 AM PDT Some interesting reading to start off your week:

What are you reading? >

| ||||||||||||||||||||||||||||||||||||||||||||

| Posted: 26 Sep 2011 05:30 AM PDT

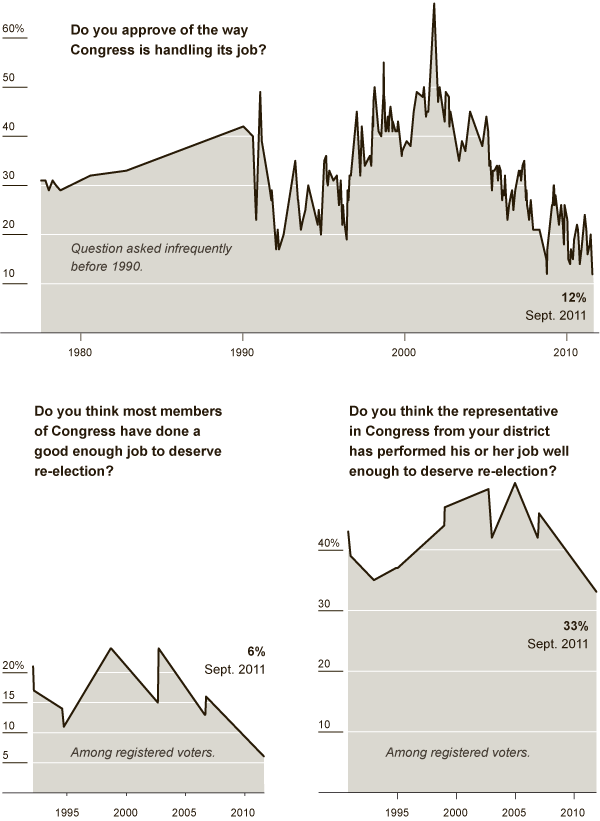

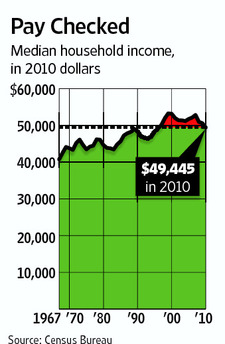

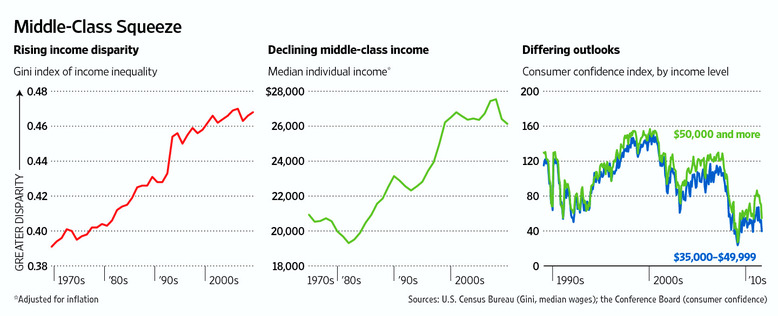

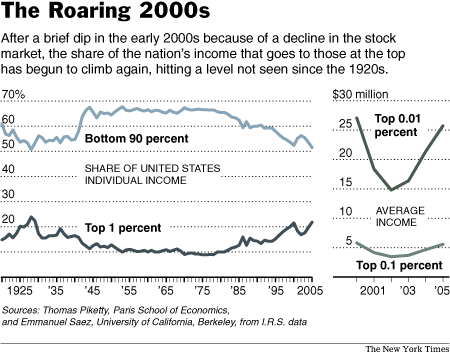

; One of the standard family car trip experiences was children asking "How much longer?" Sometimes even before the car had left the driveway! If they waited for more than 30 minutes, it was a real sign they were growing up. Invariably, even a saint's patience wears thin, and long before the destination was in sight, the question would be asked repeatedly, How much longer? A good parent would answer "Not much longer, sweetie", no matter how many hours remained on the drive. It's been three years since Lehman Brothers failed, and to say the recovery has been a disappointment would be generous. The rebound since the recession that was officially proclaimed over in June 2009 has been weak, with a number of statistics suggesting the recession never truly ended. It's been a difficult three years for the majority of Americans and most want one question answered, "How much longer?" Most politicians (especially if they fear their own job is at risk) would look into the camera and say "Not much longer." Those politicians seeking office, would boldly proclaim, "Not much longer, if I am elected!" Unfortunately for the current crop of politicians, their message is not being delivered to kids in the car's backseat, but into family rooms throughout our country to millions of adults, who are simply disgusted with the leadership vacuum that promises more tough times. In the latest New York Times/CBS News Poll only 12% of respondents approved the way Congress is handling its job. The remarkable point is not that 88% of registered voters were unhappy with Congress, but that there were still 12% who approved! Only 33% felt their Congressperson deserved to be reelected. We have stressed since mid 2009 that the myriad of structural imbalances we are facing took decades to build up, and, therefore, would not be unwound quickly. The interconnectedness between all the headwinds holding growth down suggests this trip is going to last years. (weak job and income growth, lower home values, soft consumer spending, inadequate tax revenues at all levels of government, underfunded private and public pensions, historically low interest rates which punishes savers and pension actuaries, an aging population bulge, trillions in unfunded liabilities in the Medicare and Social Security programs, unsustainable safety net expenditures that prevented a deeper contraction, and the need to cut government spending in the not too distant future) We probably missed something, but this list is long enough to discourage even the most stalwart optimist. Job and income growth are the two most important drivers of the economy, since they fund consumer spending and government spending through personal income taxes and sales taxes. More than 84% of those wanting a full time job have one, but their incomes are not growing. According to the Census Bureau, median household income is 7.1% below its peak in 1999. After falling for three consecutive years, it was $49,445 in 2010, and roughly equal to its 1996 level when adjusted for inflation. Even as middle class Americans have been squeezed for more than a decade by a lack of income growth, they have also been hurt by an imbalance of income disparity that has been gradually worsening since the late 1960's. The Gini index measures the extent to which the distribution of income among individuals or a household within an economy deviates from a perfectly equal distribution. A Gini index of zero represents perfect equality and 1.00 equals perfect inequality. According to the Census Bureau, the Gini coefficient totaled .468 in 2009, the most recent calculation available. This suggests income disparity has risen by 20% over the last 40 years. The Gini index measures the fairness of income distribution, and not the absolute income of a country. Despite all our troubles, the average American worker still earns more each year than other workers throughout the world. However, in terms of income distribution, the United States sports a Gini index that is comparable to Mexico and the Philippines.

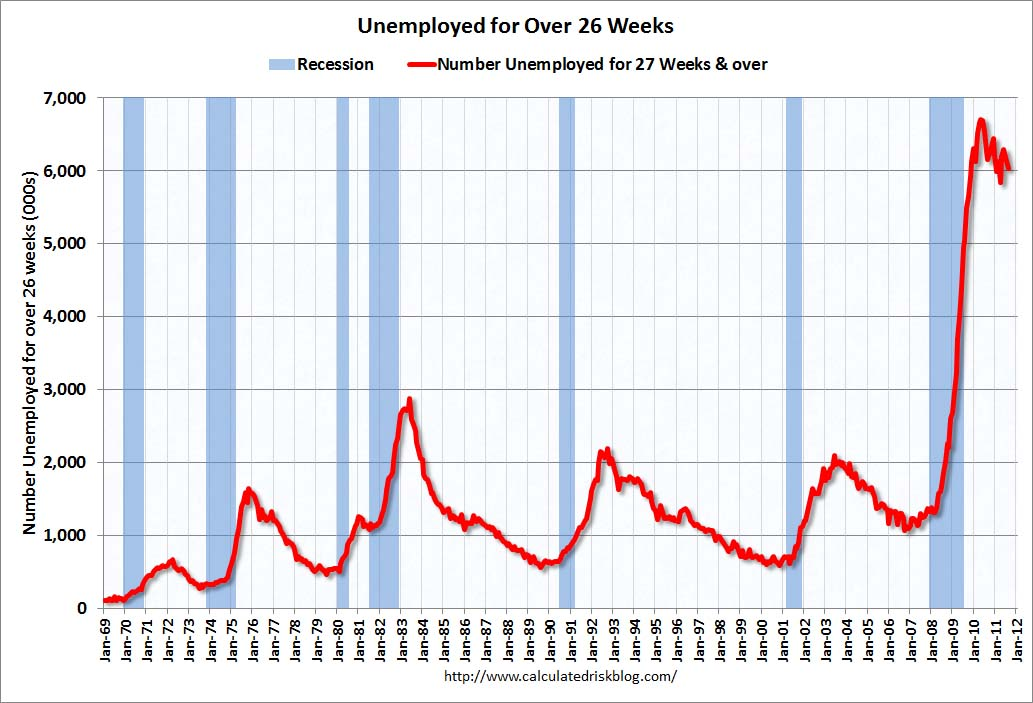

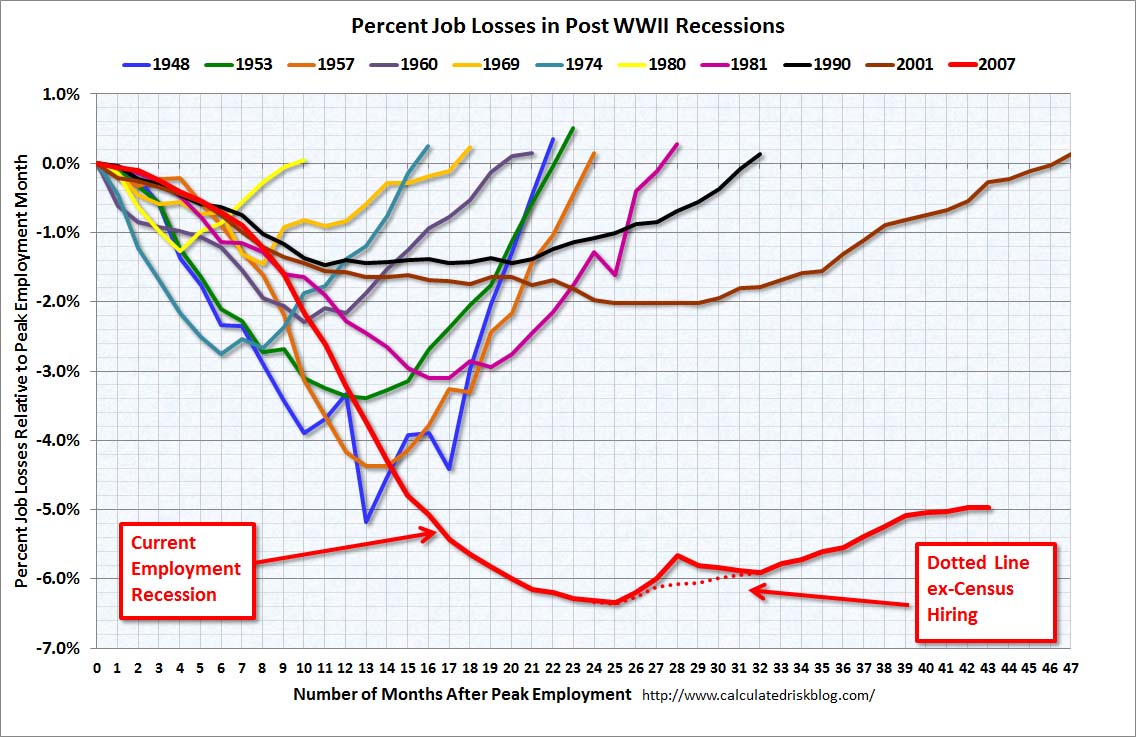

In August, no jobs were created, and the unemployment rate remained unchanged at 9.1%. Another 8.8 million workers, or 6.7% of the labor force, are working part time, but would prefer a full time job. The number of hours worked fell as did hourly pay. Over the last year, the average worker's pay increased 1.9%, well below the increase in the cost of living. Six million workers have been unemployed for more than 27 weeks. The US has not experienced anything like this since the 1930"s. The longer someone is unemployed, the more their skills erode and they fall further behind the curve.

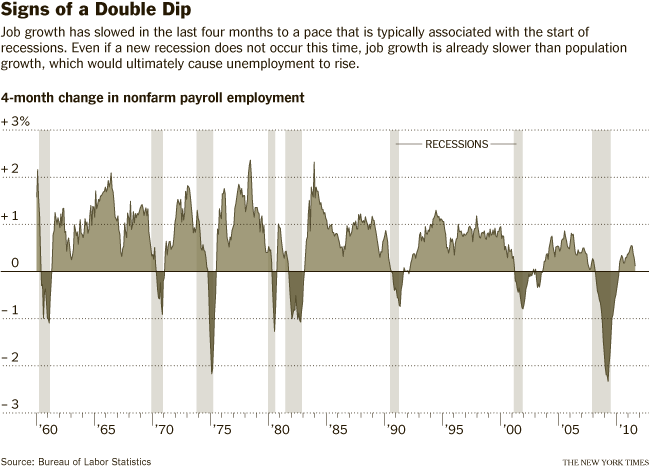

Another way of measuring the depth of job losses and the quality of the recovery is to look at a 4 month change in non-farm payroll employment. Since 1960, the only recession that equates to the magnitude of job losses experienced in 2008-2009 occurred in the 1973-74 recession. In the wake of that recession, employment growth virtually exploded with the 4 month change exceeding 2.2%. The deep recession in 1981-81 was also followed by a significant snap back in employment 2.2%. Based on this metric, the rebound in jobs to .5% is less than 25% as strong as the 1975 and 1983 recoveries.

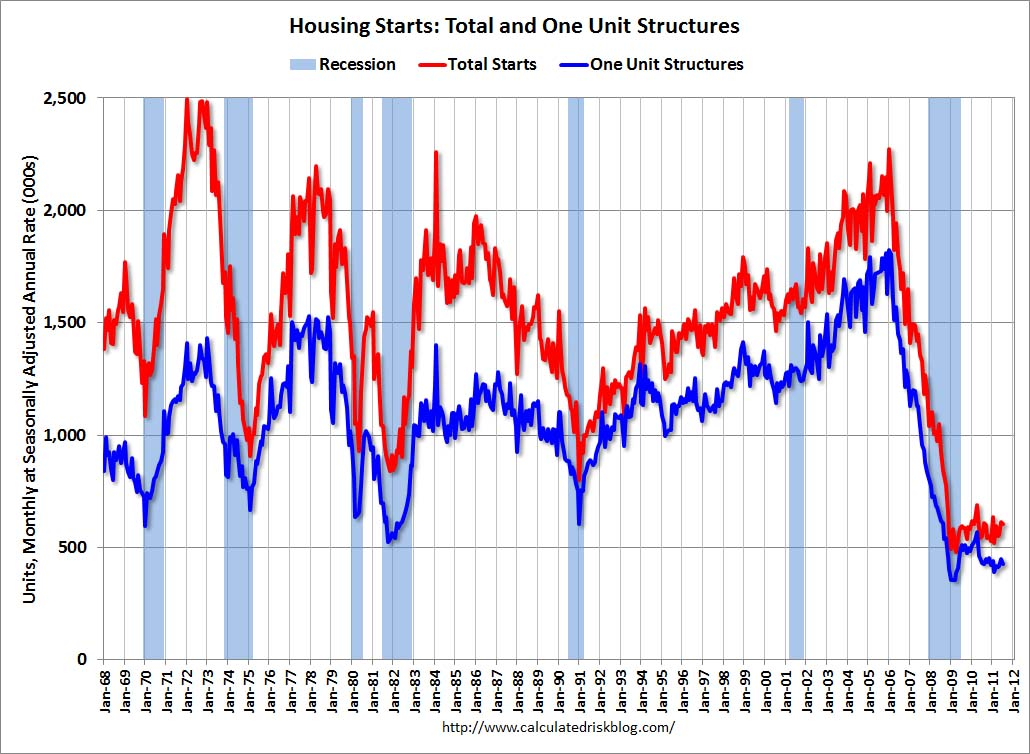

In the last 40 years, the growth in home construction contributed significantly to the economic rebound that followed each recession. Despite record low mortgage rates and record affordability, housing starts hover at the lowest levels since 1963. There are a number of reasons why there is no pent up demand as in prior cyclical recoveries. The lack of job growth has certainly played a role. However, the 30% decline in home prices may have improved affordability, but it has eroded current and future demand as never before. More than 25% of homeowners are underwater according to CoreLogic, which precludes them from refinancing and benefitting from the lowest mortgage rates in history. Even if they can afford their current mortgage, few can afford to sell since they would lose all their equity and most don't have the savings for a new down payment. As long as home prices languish, more than 25% of future demand is gone. Higher lending standards have also shrunk the demand pool by another 5% to 10%, for at least another two years. This suggests that demand will be 35% lower or more for several years.

This weak recovery is happening despite a record level of fiscal stimulus. According to the Congressional Budget Office, the federal government will spend $2.0 trillion in government social benefits in the fiscal year that ends on September 30. Income transfers will total 17% of total income, a record. Somewhat alarming, total personal income and social insurance taxes will total $1.9 trillion. This deficit of $100 billion contrasts with the $500 billion surplus in 2007 between social benefits and taxes. As we have noted previously, disposable income would be down 4% from 2007, rather than up 4% as a result of government safety programs, i.e. unemployment benefits, food stamps for 46 million Americans, and the unearned income and child tax credits. Clearly, the recession would have been deeper and the recovery even more feeble had these programs not been in place to support aggregate demand. However, this level of spending is unsustainable, and no replacement for healthy income and job growth.

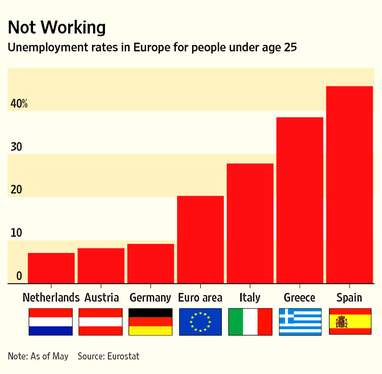

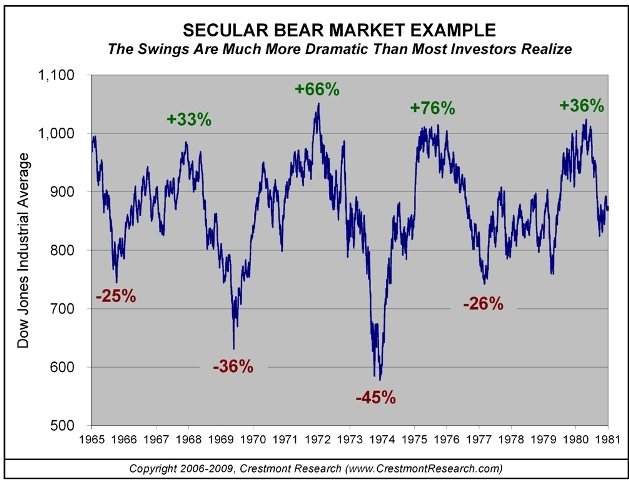

Over the last year, consumer inflation has climbed to 3.8%, while producer prices are up more than 6%, according to the Labor Department. Even core inflation has pushed up to 2% from 1%. The uptick in inflation complicates the Federal Reserve's flexibility to provide more monetary accommodation, should the recent slowing in the economy persist or accelerate. When the Fed announced it was defining 'extended period' to mean it would keep rates low for two years, three members of the FOMC voted against the change. Their primary concern was that inflation might intensify in coming months, and risk the Fed's inflation credibility. Most FOMC votes are unanimous. Occasionally, one member might dissent. For three to dissent is truly rare. Given the recent inflation news, the doves on the FOMC will announce more accommodation at the September 20-21 meeting. The Fed's statement will likely emphasize that the Fed has many tools it can use, if and when they are needed. That will spark speculation that the Fed will move at the November meeting. Europe Last month we asked a simple question, "What happens when monetary and fiscal policy hit the wall?" This question is not only pertinent for the United States, but also for almost every developed country, since most of the G7 nations are confronting many of the same problems and the same monetary and fiscal limitations. Last week, the Federal Reserve, Bank of Japan, Bank of England and the Swiss National Bank, said they would provide the European Central Bank with unlimited dollar funding for the remainder of this year. After receiving dollar funding from the other central banks, the ECB will lend to banks throughout Europe who are having difficulty accessing short term funding. The underlying problem is that European banks are loaded with holdings of sovereign debt from Greece, Portugal, Spain and Italy. Not long ago, the sovereign debt of these countries was rated AAA, and holding sovereign debt was considered a sign of balance sheet strength. Not anymore. The recent European bank stress test used a 21% discount for Greek sovereign bonds, which are now selling at a 60% discount to face value. Many large banks would be insolvent if they had to mark to market their holdings of Greek bonds. And, to a far lesser extent, their holdings of Spain and Italy, which have also lost value. The only viable solution is a large recapitalization of many European banks. The central banks' arrangement to provide dollar funding to alleviate a severe short term funding problem does not address the real elephant in the room. There is too much debt sitting on bank balance sheets, and too little economic growth in too many EU countries to support the mountain of debt they are carrying. At the end of June, annual GDP growth was up .8% in Italy, up .7% in Spain, and down by .9% in Portugal and 7.3% in Greece. According to ECB data, bank lending over the past year was down 9% in Ireland, 3% in Greece and Italy, and 1% in Portugal and Spain. Given the recent turmoil, it's a safe bet lending has contracted further. This will lead to even slower growth in coming months in these countries, and in Germany too. The European debt crisis is going to get worse, and it will have a negative effect on global growth. China, India, and Brazil The Peoples Bank of China has been tightening monetary policy since last October, through a series of interest rate increases totaling .75% in 2011, and nine increases in the bank reserves ratio from 15% to 21.5%. For every $1 of lending, Chinese banks must hold $.215 in reserve, which has resulted in higher borrowing costs. The average yield on top-rated, one-year corporate notes have risen 101 basis points since June 30 to 5.9 percent, and is poised for the biggest quarterly increase going back to 2007. Chinese inflation slowed to 6.2 percent in August, from a three-year high of 6.5 percent in July, but is still far above the official target. Monetary tightening has slowed growth, with the economy expanding 9.5 percent last quarter, the slowest since 2009. The Reserve Bank of India raised interest rates for the 12th time in 18 months on September 15 to 8.25%. India's benchmark wholesale price index hit a 13-month-peak of 9.78% in August, well above the bank's comfort zone of 5.0%. India's inflation is the highest of any large global economy. After raising interest five times this year to combat inflation, Brazil's central bank cut rates on September 1 from 12.5% to 12%. The central bank said high debt and weaker growth in developed economies could slow Brazil's economy, which is still expected to grow by 5% over the next year. Inflation is 6.9%, which made the cut a bit of a surprise. However, the Brazilian Real has appreciated 50% since early 2009, which has made Brazilian exports expensive. Lower rates may bring the Real down, and help export growth offset some of the global slowing. The tightening of monetary policy over the last year by China, India, and Brazil will cause their domestic economies to slow. Coupled with the slowdown in developed countries, global growth is set to slow for the rest of 2011 and early 2012. Stocks We believe the U.S. stock market is in a secular bear market that could last until 2014-2016, and could prove similar to the secular bear market that held the DJIA in a broad trading range during 1966-1982. This secular bear market could extend until 2020 or longer, since it is associated with the largest financial crisis in history. As discussed last month, the structural imbalances that need to be corrected are unprecedented, and may require more time to work through than the 16 years of the 1966-1982 experience. Monetary policy was effective during the 1966-1982 bear market, since it was focused on curbing inflation. The Federal Reserve raised rates to lower inflation in 1969-1970, 1973-1974, and 1981-1982, which caused the stock market to fall and the economy to eventually slip into recession. A pool of pent up demand for housing and autos was created every time the Fed raised rates, since they are interest rate sensitive. It is our hope that the low in March 2009 will mark the nadir of this secular bear market, just as the December 1974 low marked the low point of the 1966-1982 trading range. After the DJIA bottomed in 1974, it spent more than 7 years trading between 1,000 and 700, even though in terms of the stock market, the worst was over. A similar window of time would target late 2015 or early 2016 for the next secular market bottom. The rally from March 2009 was a cyclical bull market within the context of the longer term bear market. We believe the cyclical bull market rally ended in early July, and a new bear market has begun. If this macro analysis is correct, at least one more decline of 25% to 35% will occur during the next five years, before the current secular bear market ends. Given the European banking crisis and the fragility of the recovery in the U.S., it is not hard to see the S&P 500 falling to 1040 or 950 in coming months. In the Special Update on September 7, we noted that the Major Trend Indicator had provided a bear market rally buy signal, with the S&P at 1198.62. Based on a number of measurements we thought the S&P could reach 1259 to 1265. We also noted that the rally might even be over. "After dropping from 1230 to 1140, the S&P recovered .618% of the 90 point decline it suffered between Thursday and yesterday morning, near today's high. (1230-1140 = 90 *.618 = 56 + 1140 = 1196.) Although not likely, it's possible the rally is over! Yikes!" After pushing up to 1204 on September 8, the S&P quickly reversed, and by September 9 the buy signal was reversed. Whip saws are never fun, but they do happen, no matter how good a momentum indicator may be, and the Major Trend Indicator is pretty good. We ended the Special Update with the following comment. "The most important point we can make is that the odds favor the S&P falling below 1101 sooner or later, since a new bear market likely began in early August." Although a rally up to 1250 is still possible, we're not going to play, given the potential of a quick decline that could erupt almost any day if Europe deteriorates further. If the S&P does fall below 1101, we will send out a Special Update. Dollar In our May letter we recommended going long the Dollar via its ETF (UUP) at $21.56, and in our July 31 Special Update, we suggested adding to the UUP position below $20.91. The troubles in Europe have hurt the Euro, boosting the Dollar as we expected. We think UUP will trade above $23.00 in coming months. Bonds As long as the 10-year Treasury yield is below 2.45%, we view it as a warning sign of further banking problems in Europe, and economic weakness in the U.S. Gold As long as gold holds above $1700, the trend is still up. Paradoxically, gold stocks and gold could be vulnerable if the European banking crisis intensifies, and causes institutional investors to sell their winners to raise cash. | ||||||||||||||||||||||||||||||||||||||||||||

| Europe now focusing on how, not if? Posted: 26 Sep 2011 04:45 AM PDT Now that the key to success for maneuvering thru the markets is being able to successfully parse the words of politicians and central bankers instead of analyzing the economy and a company’s fundamental prospects lets look at what was said over the past few days in Europe. Merkel seems to be finally coming around to the reality of a Greek default and is now focusing her mind to how to deal with the fallout. She said “I don’t rule out at all that at some point we will have the question whether one can do an insolvency of states just like with banks,” an expanded EFSF puts them “in a position to react,” “we have to put up a barrier,” “so we can in fact let a state go insolvent.” On the possibility of leveraging the EFSF to a greater size, another German official sees no need for it beyond its soon to be new size. European officials seem to be finally coalescing around a Greek default but with so many cooks in the kitchen, the pace of decision making is unfortunately glacial. From the ECB, Nowotny said “the ECB never pre-commits, and rate cuts cannot be excluded.” Another ECB official said a rate cut will be discussed next week but is not on the agenda. What is will be possibly restarting their purchases of covered bonds and reintroducing a 12 month loan facility. Germany’s Sept IFO business confidence figure fell to the lowest since June ’10 but was 1 pt better than expected. Italian consumer confidence was in line with estimates but at the weakest since July ’08. | ||||||||||||||||||||||||||||||||||||||||||||

| Posted: 26 Sep 2011 04:30 AM PDT Last week saw markets around the world hit turbulence, as concerns over European nations, and indeed, even the survival of the Euro, escalated. One of our long term themes is that during an economic crisis, we find out who the Faux Capitalists are and who truly believes in Free markets. Like atheists in foxholes, the Faux Caps beg the government for assistance when under duress. Last week saw strong rallies in Bonds and Dollars, and weakness in Stocks, Commodities and the Euro. That could set up a counter-move the next few days. The quality of the initial bounce today — breadth and volume especially — will help determine the subsequent intensity and duration of these moves. Lets take a quick look at what might be in store for various asset classes:

The bottom line is that some sort of a counter-trend move is coming, with a bounce in equities and commodities quite probable. But we have not yet seen a capitulation to mark the end of this downward move, and I put us only in the 4th inning. If the bounce fails, look out below . . . >

See also: http://www.bloomberg.com/news/2011-09-26/commodities-drop-as-silver-slumps-on-europe-debt.html |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment