The Big Picture | |

- Mid-Week PM Reads

- Rally! Ugly Fade! Reversal Wednesday!

- Are SuperConnected Finance Networks Inherently Unstable?

- China not buying EFSF bonds out of kindness

- Paulson: China Reform Can Help U.S. in Long Run

- China not buying EFSF bonds out of kindness

- Durable Goods orders surprise to upside but…

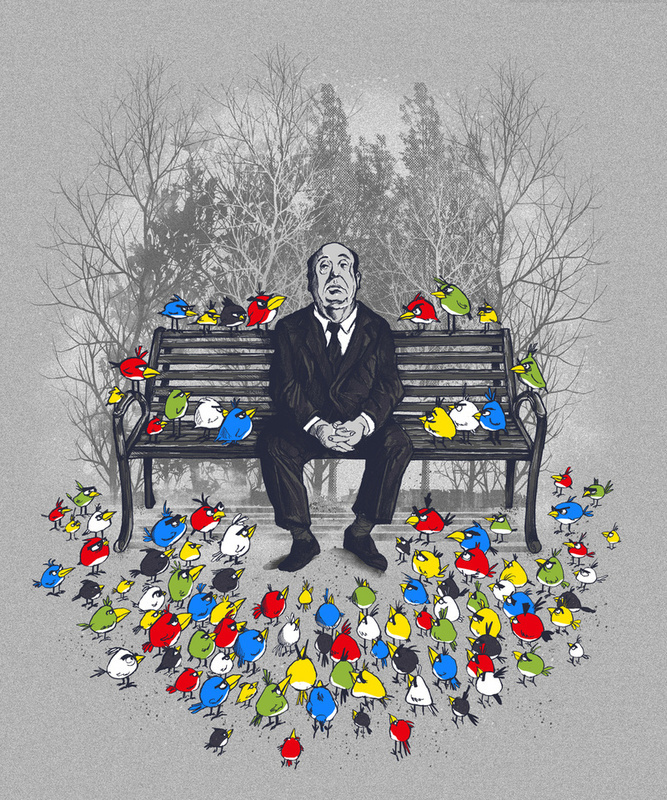

- Revisiting Hitchcock’s Angry Birds

- Is Amazon the Latest Victim of Apple?

- How Well Does Bankruptcy Work When Large Financial Firms Fail? Some Lessons from Lehman Brothers

| Posted: 26 Oct 2011 01:30 PM PDT Afternoon train reading:

What are you reading? |

| Rally! Ugly Fade! Reversal Wednesday! Posted: 26 Oct 2011 12:15 PM PDT I am off to a meeting, but (as of 3:15 pm) I am impressed with this turnaround. I was all set to write how ugly this morning’s fade was, and how problematic it is for the breakout thesis, when this puppy lit up around noon on some nonsensical rumor out of Europe. It seems that the European leaders have come to some sort of an agreement about the near term deliberations. They now apparently have mapped out all of the details about their strategy for their next meeting, where they will make a plan to debate what sort of tactics they want too engage in on their next group summit to kick around an agenda for their next symposium, where they may discuss the bank problems. Over breakfast. Or not. Meanwhile, the S&P trading range has held, and markets are still in breakout mode. Until they fade, in which case they obviously were not in breakout mode, but rather breakdown mode. In which case they will go lower, until they find support (unless that breaks) and then they go lower and find support (that holds) in which case they can reverse. Unless they don’t. If that happens, you might have been caught leaning the wrong way, which helps set the stage for the next turnaround. Unless it doesn’t. Which goes to show you how dangerous crowded trades can be. Unless they continue, cause after all we know the trend is your friend and you can’t fight the tape and its tough to be a contrarian and long and strong is the posture you want. Until it all goes into reverse, and then the trend is not your friend and you should not have gone along to get along with a tape that was a bull trap and it looks like we are heading lower. Unless we don’t. Meanwhile, I gotta go. (Unless I don’t). |

| Are SuperConnected Finance Networks Inherently Unstable? Posted: 26 Oct 2011 11:30 AM PDT

The architecture of global economic power, the concentration of wealth combined with the super connectedness is what is so problematic. I disagree with their list — its less about influence than having massive amounts of capital. As an example, my perspective is that Goldman Sachs (#18) is far more influential than Vanguard (#8). So I am not sure what to make about their top 50. Still, its an interesting concept — that its the inherent nature of these super connected networks that breeds instability and crises. > The top 50 of the 147 super-connected companies1. Barclays plc > Source: http://www.newscientist.com/article/mg21228354.500-revealed–the-capitalist-network-that-runs-the-world.html |

| China not buying EFSF bonds out of kindness Posted: 26 Oct 2011 11:05 AM PDT The market is rallying on the story that China will buy bonds issued by the EFSF. This is not a surprise as they expressed interest back in January, http://www.irishtimes.com/newspaper/finance/2011/0126/1224288325350.html, and China is not doing this out of the goodness of their heart. EFSF is AAA rated paper (assuming France keeps theirs) and the diversification it provides the Chinese away from US Treasuries is much different than China saying they will buy Italian, Spanish or Portuguese debt directly. Thus, this basically is the more conservative way of investing in Europe. Japan has been buying EFSF since they were first issued. |

| Paulson: China Reform Can Help U.S. in Long Run Posted: 26 Oct 2011 10:41 AM PDT Former Treasury Sec. Henry Paulson says the U.S. and China both need long-term, fundamental reform to restore competitiveness and sustain growth that will improve the global economy. America needs a new tax system and we need to think out of the box to fix unemployment, he says in a Big Interview with WSJ’s David Wessel.

|

| China not buying EFSF bonds out of kindness Posted: 26 Oct 2011 10:20 AM PDT The market is rallying on the story that China will buy bonds issued by the EFSF. This is not a surprise as they expressed interest back in January, http://www.irishtimes.com/newspaper/finance/2011/0126/1224288325350.html, and China is not doing this out of the goodness of their heart. EFSF is AAA rated paper (assuming France keeps theirs) and the diversification it provides the Chinese away from US Treasuries is much different than China saying they will buy Italian, Spanish or Portuguese debt directly. Thus, this basically is the more conservative way of investing in Europe. Japan has been buying EFSF since they were first issued. |

| Durable Goods orders surprise to upside but… Posted: 26 Oct 2011 09:49 AM PDT Orders for Durable Goods in Sept were better than expected. Orders ex transports rose 1.7%, above forecasts of up .4% and orders for Non defense goods ex aircraft were up 2.4% vs the estimate of up .5%. Aug was revised lower but not enough to offset the upside surprise in Sept. Shipments, which get directly plugged into GDP, fell by .7% after a scant .1% gain in Aug and 2.1% rise in July. Because inventories rose .1% in Sept, the inventory to shipments ratio did rise to 1.83, the highest since June ’09. Bottom line, cap ex spending was better than expected but a very important factor over the next few months is in play here and that is the expiration of the 100% accelerated depreciation opportunity for the purchase of new equipment that expires on Dec 31, 2011 (it will be 50% in 2012). We of course can’t quantify the extent that cap ex will be pulled forward into 2011 but have to assume there will be some |

| Revisiting Hitchcock’s Angry Birds Posted: 26 Oct 2011 09:00 AM PDT We last visited this mashup concept back in April — so its time to take another look at Hitchcock’s Angry Bids: >

> Source: Hitchcock’s Angry Birds |

| Is Amazon the Latest Victim of Apple? Posted: 26 Oct 2011 08:30 AM PDT Back in August, we made a list of companies that were collateral damage of Apple’s Creative Destruction. That eventually morphed into a Washington Post column, And then there were none: Apple's destruction of rivals. The latest victim of the Apple machine? Amazon.com. The numbers were pretty awful. Q3's profit disappointment missed by 42%, and that number was, according to Bloomberg, “the biggest negative surprise of any technology business in the Standard & Poor's 500 Index.” The loss sliced nearly 20% off of its market cap, whacking $20 billion from over a $110 billion cap to under $92 billion. And next quarter isn’t going to be any better. Projected Q4 losses on the Kindle Fire alone are $200 million dollars; (JPMorgan thinks Amazon can sell 5 million Kindle Fires in Q4) Amazon may be subsidizing the Fire anywhere from $10 to $100 — in the Holiday sales season, the losses are going to amount to a lot of red ink. I have been an Amazon fan since my geek college roommate gave me a gift certificate for the holidays around 1997. I am a good consumer, a loyal Amazon customer who spend an awful lot of money there each year. I find its free shipping, huge selection and customer service (got to have the magic phone number!) mostly delightful. But Valuation and Accounting have always been Amazon’s Achilles heel. Now it seems as if both of these factors are going to be a drag on what looks like a pricey stock. Amazon says its building for the future, and to some degree, that has been true. The problem is its been true for 15 years, and the future has pretty much arrived. They must be referring to the next future, the one that is another 15 years off in, um, the future. Question is how much patience investors have these days. > Daily AmazonMonthly Amazon> Sources: |

| How Well Does Bankruptcy Work When Large Financial Firms Fail? Some Lessons from Lehman Brothers Posted: 26 Oct 2011 07:30 AM PDT How Well Does Bankruptcy Work When Large Financial Firms Fail? ~~~ There is disagreement about whether large and complex financial institutions should be allowed to use U.S. bankruptcy law to reorganize when they get into financial difficulty. We look at the Lehman example for lessons about whether bankruptcy law might be a better alternative to bailouts or to resolution under the Dodd-Frank Act's orderly liquidation authority. We find that there is no clear evidence that bankruptcy law is insufficient to handle the resolution of large complex financial firms. One of the most important questions facing policymakers today is whether the bankruptcy process is, or with modifications could be, a suitable method for handling the failure of complex, nonbank financial firms. Although the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2009 established an orderly liquidation authority to unwind selected systemically important financial institutions, it left bankruptcy as the default for the rest. Opinions are sharply divided on the adequacy of U.S. bankruptcy law to resolve complex nonbank financial firms in an orderly fashion. Somewhat ironically, both camps point to the market disruptions that followed the Lehman Brothers bankruptcy filing in 2008 as supporting evidence for their views. The financial crisis of 2007–2009 was a complex event, so it is not surprising that there are different views about what caused the market turmoil following Lehman's bankruptcy filing. Those views involve differing opinions about whether the bankruptcy resolution of Lehman Brothers was orderly. For example, implicit in the FDIC's analysis of the event is the view that the disorderly resolution of Lehman in bankruptcy was a causal factor in the near collapse of financial markets in the fall of 2008. Holders of this view often argue that U.S. bankruptcy law cannot effectively unwind complex nonbank financial institutions, even if the law is amended. Another view, expressed by many bankruptcy scholars, is that Lehman's reorganization went fairly smoothly and spillover effects were limited. Proponents of this view attribute the market turmoil after Lehman's bankruptcy filing to policy uncertainty: The U.S. government decided to let Lehman fail when the market expected a government-assisted rescue. Still, they acknowledge that the law should be improved to better handle complex financial institutions. We won't be able to sort this debate out here, but we will point to some lessons that can be drawn from the events surrounding the Lehman bankruptcy filing. These lessons concern whether the insolvency of large or complex financial companies can be adequately handled through the judicial process of bankruptcy. We also consider what changes, if any, need to be made to the bankruptcy code to make bankruptcy a desirable alternative to ad hoc bailouts or to resolution under the Dodd-Frank Act's orderly liquidation authority. In the end, the Lehman case is just one event, and though many people have tried to extract deep meaning from it, the conclusions we can draw from it, though useful, are limited. U.S. Bankruptcy Law and Complex Financial InstitutionsThe debate over the ability of U.S. bankruptcy law to resolve complex financial firms largely centers on four questions. Does the bankruptcy of a systemically important firm increase the chances of market turmoil? Will the bankruptcy of such firms cause contagion? Does the law's treatment of qualified financial contracts lead to disorder in bankruptcy resolutions? And finally, do limitations in the scope of bankruptcy law complicate the resolution of complex financial firms? The Lehman bankruptcy grants some insight into each of these questions. Bankruptcy and Market TurmoilLehman Brothers filed for bankruptcy on September 15, 2008. Markets clearly showed signs of increasing stress thereafter and during the fall of 2008. Yields in short-term markets spiked the week following the Lehman filing. Risk spreads in short-term credit markets widened—indicating a "flight to quality" by market participants. For example, the term Libor-OIS spread increased around 350 basis points in the period following the Lehman bankruptcy (figure 1). A similar picture emerges from the credit default swaps (CDS) market (figure 2). Some analysts maintain that it was Lehman's use of the bankruptcy courts that caused the market turmoil. They often point to graphs like figures 1 and 2 as evidence of the insufficiency of bankruptcy law to resolve complex financial firms. Others claim that it was not the use of bankruptcy, but rather policy responses inconsistent with market expectations that caused markets to panic. That is, Lehman was allowed to fail when financial markets, and even the Lehman management team, expected a government-assisted rescue. A closer look at events around that time suggests that neither view is entirely correct.

The Lehman bankruptcy occurred during a time when there were good reasons for market participants to question the solvency of a number of large financial firms. The bankruptcy was accompanied by nearly two dozen significant disruptive events in September 2008 alone, some unrelated to the Lehman filing and some related to its failure. The clustering of multiple events around the time of the bankruptcy makes it difficult to identify the causal effects of the bankruptcy on markets, let alone the use of U.S. bankruptcy law. While Lehman's failure triggered many problems in markets, event clustering makes it impossible to empirically identify the use of bankruptcy courts as the root of those problems. Moreover, it is impossible to separate out the impact of Lehman's bankruptcy filing from the uncertainty created by its filing. Studies have shown that such uncertainty can have significant effects on markets. For example, in 1982 Penn Square Bank was liquidated by the FDIC, which experimented with modified payouts to resolve large bank failures (see Furlong, 1984). These modified payouts created uncertainty in the minds of the large, explicitly uninsured creditors of Continental Illinois as to whether they were exposed to losses in the event Continental was closed. This uncertainty drove the run on the deposits of Continental Illinois before its collapse in 1984 (see Sprague, 1986). The source of market turmoil following Lehman's failure, then, cannot conclusively be attributed to the use of bankruptcy law to resolve the firm's insolvency or to the uncertainty created by policy actions inconsistent with market expectations. Bankruptcy and ContagionWhen a large, complex financial firm fails, the method of resolution should not be conducive to contagion. That is, the resolution process should not endanger the solvency of other firms. This is especially true in systemic crises, when the financial system is already stressed. Bankruptcy critics often argue that bankruptcy law may trigger contagion because it is designed to pay creditors strictly according to the priority of their claims. There is no consideration of their financial condition or potential market instability. Thus, contagion may spread through the use of bankruptcy if the recovery of creditors in need of liquidity is insufficient, or indirectly through credit default swaps (CDS) written on the resolved firm's debt. But the Lehman bankruptcy does not support the view that bankruptcy leads to contagion. The day after Lehman Brothers filed for bankruptcy, the Reserve Primary Money Fund announced that it had "broken the buck": Due to losses on its holdings of Lehman debt, the net asset value of the Fund's shares had fallen to $0.97 a share. It was only the second time in history that a money market fund's share value had fallen below a dollar, and it reflected how large an impact Lehman's collapse was having. Most analysts would concede that the Fund's "breaking the buck" was a direct consequence of the Fund's losses on its holdings of Lehman debt, that the losses led to contagion, and that the contagion effects impacted the money market mutual fund industry and the commercial paper market thereafter. It is harder to argue that the structure of U.S. bankruptcy law, and not the insolvency of Lehman itself, was responsible for the losses on Lehman debt and the subsequent contagion. It may also be the case that the contagion effects were more a consequence of the money market funds' overexposure to Lehman and to a specific feature of the money funds themselves—the pegging of the share price to $1. The share-price peg creates incentives for retail customers to run on a fund when its ability to maintain the peg becomes uncertain. Customers believe it is in their best interest to run to ensure par redemption of their money-fund shares. Lehman's bankruptcy also tested the CDS market, as there was a reported $400 billion of credit protection written against Lehman's debt. At the time of its bankruptcy, Lehman was the largest failure to be handled in the CDS market. For the purpose of settling the CDS contracts, Lehman's debt was determined to be worth 9.75 cents on the dollar at an International Swaps and Derivatives Association auction, lower than the pre-auction estimates of 12 to 15 cents. However, the settlement of credit protection written on Lehman did not have material effects on financial markets. Bankruptcy and Qualified Financial ContractsDerivatives and repos are a special type of contract called qualified financial contracts (QFCs), which are exempt from the trust avoidance powers of the Bankruptcy Code and the automatic stay. The trust avoidance provisions and automatic stay are designed to coordinate creditor payouts and ensure that they occur according to the priority of the claims that were established when the original agreements were made and transacted, rather than in a race to grab firm assets on the eve of failure or after the firm fails. This special treatment of QFCs in bankruptcy may complicate the process of reorganizing financial companies in bankruptcy. Bankruptcy experts disagree about the effect that the QFC exemption will have on the ability of financial firms to reorganize in bankruptcy. Lehman's QFC book was the largest in history to be handled in bankrutpcy. While Lehman's reorganization has provided additional guidance on which financial contracts are exempted from the automatic stay and how QFCs will be handled in bankruptcy, there is still disagreement on how well bankruptcy handles QFCs. Generally, opinions fall into one of two schools of thought. First, there are those who argue that the QFC exemption was an obstacle to an orderly resolution in the Lehman case. In testimony before a House subcommittee in 2009, Harvey Miller, the lead bankruptcy attorney for Lehman, argued that the exemption of some 930,000 derivative counterparties from the automatic stay led to a massive destruction of value through counterparties canceling their contracts. Ayotte and Skeel (2009) and Roe (2010) argue that the safe harbor provisions of bankruptcy for QFCs create perverse incentives for counterparties. Those incentives contribute to the systemic implications of a firm's failure, including creating a stampede for the exits, which inhibit orderly resolution under bankruptcy. Second, there are those who argue that Lehman's derivatives portfolio was handled effectively because of the exemption from the automatic stay. Kimberly Anne Summe, a managing director at Lehman, provided this interpretation of the impact of Lehman's counterparties canceling their contracts on the value of Lehman's estate. Summe noted that only around 3 percent of Lehman's derivative contracts remained in the bankruptcy estate 106 days after the filing, potentially preventing the spread of distress to Lehman's counterparties by allowing them to quickly close out and re-establish their hedges before market conditions changed too dramatically. However, the benefit of allowing quick re-hedging is unclear, as is the cost of losing going-concern value (the value of the company as an ongoing entity rather than a liquidated one) due to the stay exemption. Bankruptcy supporters argue that QFCs should be subject to a limited automatic stay, and there appears to be a case for their position. The FDIC enjoys a one-day stay on QFCs in bank receivership cases, and there is little evidence that this limited stay for FDIC receiverships has been a problem. Moreover, when a nonbank financial firm is resolved under the orderly liquidation authority established in the Dodd-Frank Act, QFCs are subject to a one-day stay. If this stay is priced into QFCs with depository or systemically important financial institutions and U.S. bankruptcy law were changed to parallel the Dodd-Frank provision, markets would not likely be disrupted, and the pricing of QFCs would be identical across counterparties. It would also have the added benefit of giving the bankruptcy estate up to three days to determine what to do with a derivatives book before counterparties could close out and net, provided that the insolvent firm filed on a Friday. The Scope of U.S. Bankruptcy LawThe final material stumbling block to an orderly resolution under bankruptcy of a complex financial firm such as Lehman is the exclusion of certain types of businesses from Chapter 11 (which provides for corporate reorganization). In the case of Lehman, the exclusion of its broker dealer subsidiary (Lehman Brothers, Inc.) from filing for Chapter 11 complicated the resolution of Lehman Brothers Holdings International. Lehman Brothers, Inc., became the subject of a liquidation proceeding under the U.S. Securities Investor Protection Act four days after Lehman Brothers Holdings International filed for bankruptcy, during which time the brokerage was borrowing from the Federal Reserve Bank of New York under the Primary Dealer Credit Facility. The absence of government support likely would have complicated the sale of Lehman's broker-dealer to Barclay's. Because it did not have access to the special financing provisions that firms filing under Chapter 11 are entitled to, the brokerage would have lost going-concern value but for its access to the Primary Dealer Credit Facility. While the sale was quickly approved, without government support the sale may not have been possible under bankruptcy law. Whether this merits a change in U.S. bankruptcy law would have to be addressed separately for each exemption, though some argue the prohibition of broker-dealers reorganizing in bankruptcy no longer makes sense (see Skeel, 2009). Policy ImplicationsLehman Brothers Holdings International is not the first, nor likely the last, systemic financial company to run aground. The case of Lehman is interesting, however, because its failure occurred during the most severe financial crisis in the United States since the Great Depression. The economic and financial market climate in which Lehman failed greatly complicated any resolution method that did not involve taxpayer assistance in the form of capital infusions or blanket guarantees of creditors. Yet Lehman has become the poster child for the orderly liquidation authority provisions of Title II of the 2010 Dodd-Frank Act. Drawing inferences from Lehman about the effectiveness of bankruptcy in dealing with failing financial firms is problematic. It is difficult to use a single data point—the Lehman bankruptcy—to separate out the impact of Lehman's failure, the use of bankruptcy to resolve it, and the policy uncertainty. Still, Lehman's bankruptcy offers guidance on how to approach future failures of large, complex financial firms. It appears that there are provisions of bankruptcy law that merit review and possible revision. In the absence of those changes, it may be the case that systemically important pieces of an insolvent firm may be more effectively resolved in an administrative proceeding such as the orderly liquidation authority established under Dodd-Frank. But based on the experience with Lehman, there is no clear evidence that bankruptcy law is insufficient to handle the resolution of large, complex financial firms. Recommended Readings"Study on the Resolution of Financial Companies under the Bankruptcy Code," Board of Governors of the Federal Reserve System, 2011. “Bankruptcy or Bailouts?" by Kenneth Ayotte and David A. Skeel, Jr., 2009. University of Pennsylvania Law School ILE Research Paper No. 09-11. "The Orderly Liquidation of Lehman Brothers Holdings Inc. under the Dodd-Frank Act," Federal Deposit Insurance Corporation (FDIC), 2011. FDIC Quarterly, vol. 5, no. 2. "Derivatives and the Bankruptcy Code: Why the Special Treatment?" by Franklin Edwards and Edward R. Morrison, 2005, Yale Journal on Regulation (January 1). "FDIC's Modified Payout Plan," by Fredrick T Furlong, 1984. Federal Reserve Bank of San Francisco, Economic Letter, May 18. "Credit Derivatives: An Overview," by David L Mengle, 2007. Federal Reserve Bank of Atlanta, Economic Review, vol. 92, no. 4. "Bankruptcy's Financial Crisis Accelerator: The Derivatives Players' Priorities in Chapter 11," by Mark J. Roe, 2010. <available at ssrn.com/abstract=1567075>. Testimony before the Subcommittee on Commercial and Administrative Law of the House of Representatives Committee on the Judiciary, 111th Congress, 1st Session, for Hearings on "Too Big to Fail: The Role for Bankruptcy and Antitrust Law in Financial Regulation Reform, October 22. Harvey R. Miller, 2009. "Bankruptcy Boundary Games," by David A. Skeel, 2009. University of Pennsylvania Law School ILE Research Paper no. 09-25. The New Financial Deal: Understanding The Dodd-Frank Act and Its (Unintended) Consequences, by David Skeel, 2011. Hoboken, NJ: John Wiley and Sons. Bailout: An Insider's Account of Bank Failures and Rescues, by Irvine H. Sprague, 1986. New York: Basic Books. "Lessons Learned From the Lehman Bankruptcy," by Kimberly Anne Summe, 2009. In Ending Government Bailouts As We Know Them; Kenneth E. Scott, George P. Schultz and John B. Taylor, eds., Chapter 5, Stanford California: Stanford University Press. "What the Libor-OIS Spread Says," by Daniel L Thorton, 2009. Federal Reserve Bank of St. Louis, Economic Synopses, no. 24. |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Interesting look at the network of firms that in the words of

Interesting look at the network of firms that in the words of

No comments:

Post a Comment