The Big Picture | |

- 10 Year iPod Anniversary: Music in the Digital Age

- 30 yr auction poor

- 10 Thursday PM Reads

- Social by Design: Design Thinking & Business

- 29% of Mortgages Are Underwater

- S&P on France

- Is Italy Too Big To Bailout?

- Supercommittee Impact On Your Stock Investments

- QOTD: Chasing Performance

- Our Supercycle Oscillator Updated

| 10 Year iPod Anniversary: Music in the Digital Age Posted: 10 Nov 2011 04:00 PM PST Pretty cool piece of work from Bloomberg, taking the broad look at Selling Music in the Digital Age, not coincidentally, on the 10th anniversary of the iPod: > Video after the jump:

|

| Posted: 10 Nov 2011 02:19 PM PST The 30 yr bond auction was poor. The yield was almost 5 bps above the when issued and the bid to cover of 2.40 was below the 12 month avg of 2.65 and the 2nd weakest since Nov ’10. Also, dealers got stuck with the 3rd biggest % amount of the year with less going to direct and indirect bidders. Today’s auction follows the weak 10 yr yesterday and is a sign of some market pushback to these historically low interest rates. Bernanke said today that “inflation likely to stay close to 2% or less.” Maybe the bond market disagrees with this forecast as the last CPI reading was closer to 4%. Also, the other dynamic that 10 yr and 30 yr maturities will capture is the fiscal health of the US government with the Super Duper Deep Undercover Secret Committee in DC just weeks away from unveiling their compromise or lack thereof in the midst of our entitlement state reaching a breaking point over the next decade plus. |

| Posted: 10 Nov 2011 01:45 PM PST My afternoon train reading:

What are you doing? > • How the 99% and the Tea Party can Occupy WhiteHouse.gov (Anil Dash) |

| Social by Design: Design Thinking & Business Posted: 10 Nov 2011 01:00 PM PST |

| 29% of Mortgages Are Underwater Posted: 10 Nov 2011 12:00 PM PST MSNBC – Nearly 29% of mortgaged homes underwater

USA Today – Foreclosure backlogs could take decades to clear out Foreclosure sales are moving so slowly in half the states that at the current pace, it will take more than eight years on average to clear the 2.1 million homes in foreclosure or with seriously delinquent mortgages, new research shows. That's about twice as long as a year ago in the states where foreclosures go through courts — before the mortgage industry was upended by last fall's disclosures that court papers in many foreclosure cases were improperly prepared. Since then, new checks have slowed the process. The backlogs suggest that the fallout from the nation's worst housing-market collapse is likely to weigh on real estate prices in many markets for years to come, and on some markets for longer than on others. Comment: According to Census data, a total of 76.428 million owner occupied units existed in the U.S. as of 2009. Of those, 50.3 million currently had a mortgage on their property. Recently, Core Logic estimated that 22.5% of all homes in the U.S. were underwater and another 5% had near negative equity. Additionally, JP Morgan has estimated that 27% of all foreclosures are walkaways. Zillow's estimates offer another data point on mortgages, suggesting nearly a third of all homes are now underwater. |

| Posted: 10 Nov 2011 09:31 AM PST From S&P on France correcting that they've changed their rating on France. "As a result of a technical error, a message was automatically disseminated today to some subscribers of S&P's Global Credit Portal suggesting that France's credit rating had been changed. This is not the case: the ratings of France remain AAA with a stable outlook, and this incident is not related to any ratings surveillance activity. We are investigating the cause of the error." |

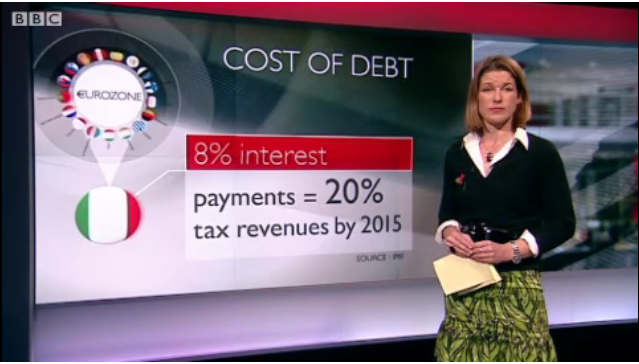

| Posted: 10 Nov 2011 09:15 AM PST As the crisis unfolds in Rome, bankers and investors all over the world are weighing up whether to continue lending to Italy. If they stop – Italy could quite simply run out of money. But many fear that Italy’s economy – the third largest in the eurozone – is simply too big to bail out. > Source: |

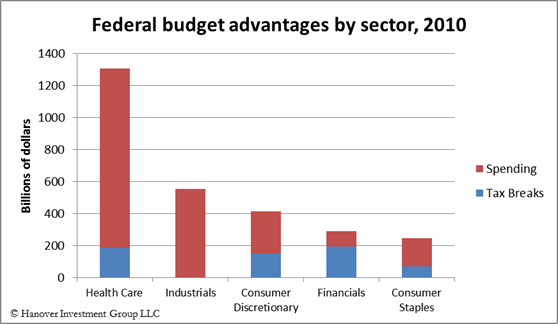

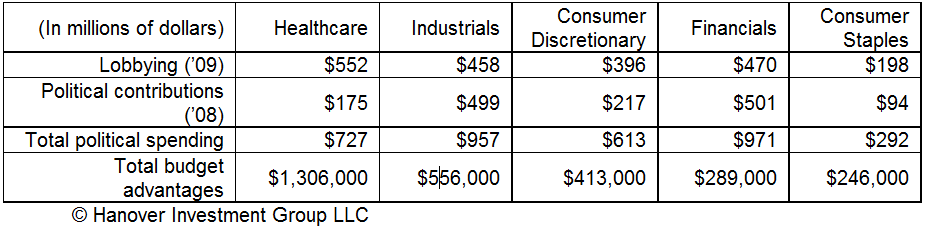

| Supercommittee Impact On Your Stock Investments Posted: 10 Nov 2011 09:00 AM PST Very interesting observations from Robert Dugger of Hanover Investment Group: They looked at the Federal budget, sector by sector, to see if they could determine the stock market winners and losers, or at least advantages, as well as lobbying and political contributions. >

> The full commentary is on their blog. |

| Posted: 10 Nov 2011 07:30 AM PST Jeremy DeGroot discusses a very common malady to which all too many investors succumb: Performance Chasing:

That is a very astute observation, something that I have discussed previously; See When Do You Fire a Manager? for more info. |

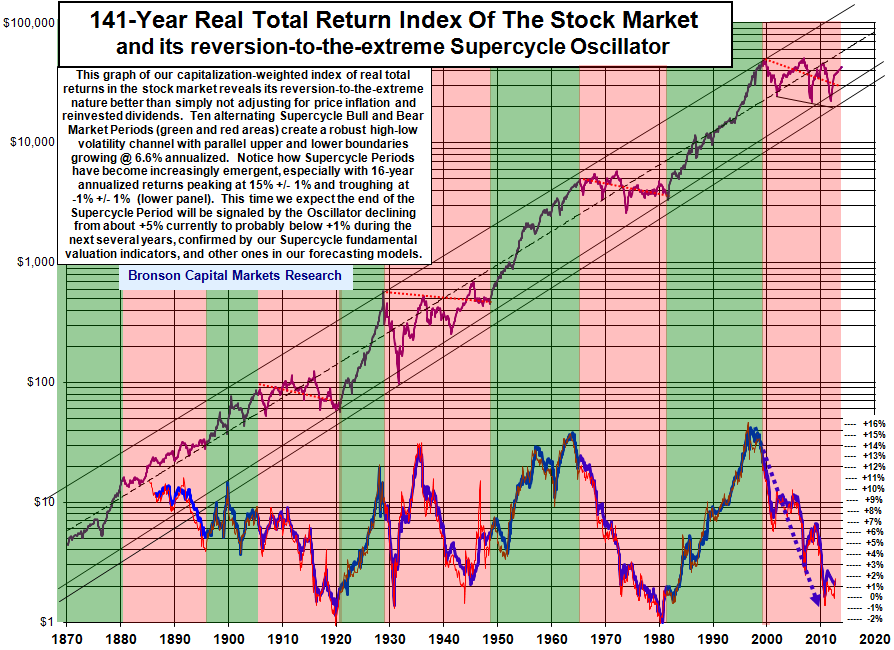

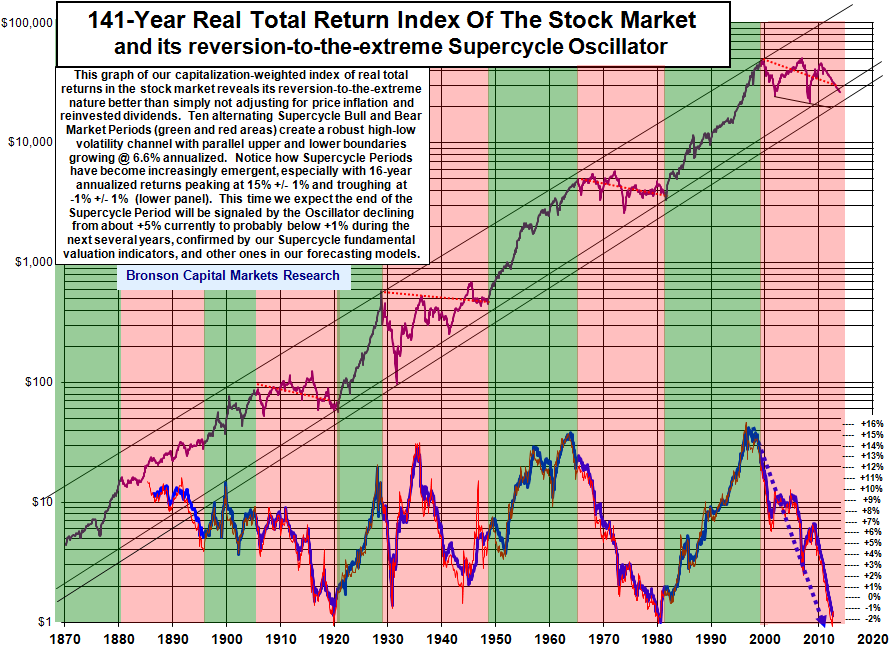

| Our Supercycle Oscillator Updated Posted: 10 Nov 2011 07:22 AM PST The following charts show that as long as a third and final Supercycle Bear Market is developing, as we've repeatedly forewarned, regardless of its actual path, or its price-time geometry, our Supercycle Oscillator (defined in the legends of the charts) will reach the mean-reversion target area that we've previously reported, which is sufficient to end the Supercycle Period Winter in about three years. Furthermore, the same mean-reversion extreme is also true for all of our Supercycle Valuation Indicators. This includes these financial statement ratios from the aggregate income statement and balance sheet of all publicly traded U.S. corporations ): Price to Earnings, Price to Book Value, Tobin's Q (price to enterprise value) and Price to GDP (supposedly Warren Buffet's favorite macro valuation metric). Upon request we will present updates of our charts for each of these. Down-Up-Down Path (this one is what we broadly expect) If the SPX declines during the next 11 months to 600, and is followed by a six-month 50% retracement rally, which is in turn followed by a 18-month flat period, along with inflation declining to 0%, then our 16-year Supercycle Oscillator will to continue to decline a mean-reversion low of -0.2% in Oct '12, as illustrated in the chart below. If the SPX low is 500 in Oct '12 instead of 600 then the Oscillator low at that time will be -1.3%. If the SPX low is 700, then low will be 0.7%. If inflation does not decline, the Oscillator low will still be in Oct '12, But it will lower at -0.7%. Down-All-The-Way Path If the SPX declines during the next 35 months to 600, without any meaningful interim retracement rally during the, along with inflation declining to 0%, then our 16-year Supercycle Oscillator will to continue to decline a mean-reversion low of -2.1% in Jul '14, as illustrated in the chart below. If the SPX low is 500 in Jul '14 instead of 600 then the Oscillator low at that time will be -3.1%. If the SPX low is 700, then low will be -1.3% Source: Bronson Capital Markets Research |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment