The Big Picture | |

- Open Thread: What is Causation?

- The charade of the super (or not so super) committee

- Fed and ECB to do more to ease credit stress?

- Tumblr Numblrs

- Reimagining Album Covers

- Bank Fraud Prosecution Continues to Drop under Obama

- Top Favorite Stock Holdings of Congress

- More pressure to introduce QE in the Euro Zone

- 10 Mid-Week AM Reads

- CPI little changed but oil now at $100

| Open Thread: What is Causation? Posted: 16 Nov 2011 04:00 PM PST Last week, I discussed “The Big Lie goes viral” in terms of the causes of the financial crisis. But that commentary begged the issue: What exactly is “Causation“? This is a precise term of art that has a very specific meaning. Many of the world's greatest thinkers, from Aristotle to Kant to Hume, have examined exactly what causality is. It plays a major role in the fields of Law, Physics, Logic and Economics. To me, Causality is the relationship between one event ("the cause") and a second event ("the effect"). I want to focus on the nature of that relationship. How and when can we say that one event is a consequence of another? To assess how blameworthy any factor is regarding the cause of a subsequent event, I look at the following:

All of these elements are not necessary to demonstrate a cause and effect relationship; however, a lack of these factors is quite damning to claims of causation. ~~~ Discuss . . . |

| The charade of the super (or not so super) committee Posted: 16 Nov 2011 01:10 PM PST The other factor that also has markets on edge is the results to date or lack thereof from the Super (or not so super) committee. But, before we get excited or disappointed on what this committee will deliver, let’s look at what is being discussed. They are trying to get to $1.2-1.5T in budget reductions over 10 years. Thus, $120-$150B per year, only 1% of GDP is being debated here, a joke of a number and also a blip in the context of $15T in national debt that is only growing and $60T of unfunded liabilities related mostly to medicare, medicaid and social security. Bottom line, any deal that does not address these three programs and sustainably reduces the upward trajectory in the spending on them is a giant charade. |

| Fed and ECB to do more to ease credit stress? Posted: 16 Nov 2011 12:10 PM PST While the Fed has set up swap lines to the ECB to help relieve some of the stress in the interbank lending markets, Fed Pres Rosengren is acknowledging that “clear stresses in short term credit markets” still exist. All one has to do is look at the euro basis swap making a new multi year high today to see this. In response to this, Rosengren is saying “crisis might warrant coordinated action by Fed, ECB” according to BN. What this action is he didn’t expand on but would entail likely more liquidity facilities if needed. |

| Posted: 16 Nov 2011 11:30 AM PST |

| Posted: 16 Nov 2011 11:07 AM PST Awesome collection of album covers revisited by the Cargo Collective at thirty three and a third (more here). Here are a few favorites: >

> Hat tip GMSV

|

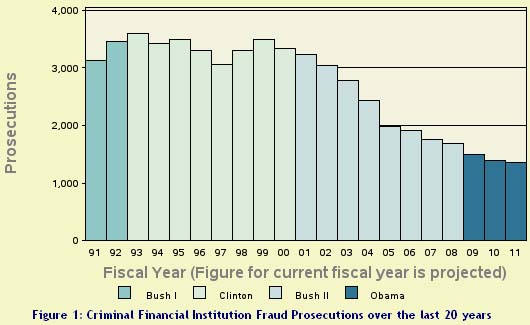

| Bank Fraud Prosecution Continues to Drop under Obama Posted: 16 Nov 2011 08:45 AM PST In such a target rich environment,. how on earth is it possible that Bank Fraud prosecutions are dropping? It is an outrage! > > I bitched about this when George W. Bush was President, and I will continue until we get someone in the White House who understands what the RULE OF LAW actually means . . . > Previously: Failing to Prosecute Wall Street Fraud Is Extending Our Economic Problems (December 15th, 2010) Bush/Obama Fraud Prosecutions Down 39% Since 2003 (May 25th, 2011) Sources: Prosecutions for Bank Fraud Fall Sharply |

| Top Favorite Stock Holdings of Congress Posted: 16 Nov 2011 07:30 AM PST Why isn’t congressional members required to put their holdings into a blind trust? Why can’t we ban insider trading by Congress members be banned? How cant these elected officials do “the people’s business” when they are too busy running around trading on the votes they are about to cast? How one earth can we ever get fair outcomes of issues involving finance, healthcare, or energy when the members so personally have a monetary stake in an outcome they may or may not be in the public interest? Why aren’t these people in jail? ~~~ 1. General Electric (GE) Members invested: 75 Top Congressional Investors 2. Procter & Gamble (PG) Members invested: 62 Top Congressional Investors 3. Bank of America (BAC) Members invested: 57 Top Congressional Investors 4. Microsoft (MSFT) Members invested: 56 Top Congressional Investors 5. Cisco Systems (CSCO) Members invested: 56 Top Congressional Investors 6. Pfizer (PFE) Members invested: 51 Top Congressional Investors 7. Intel (INTC) Members invested: 47 Top Congressional Investors 8. Wells Fargo (WFC) Members invested: 45 Top Congressional Investors 9. AT&T (ATT) Members invested: 44 Top Congressional Investors 10. Exxon Mobil (XOM) Members invested: 42 Top Congressional Investors Sources: Open Secrets, CNBC, |

| More pressure to introduce QE in the Euro Zone Posted: 16 Nov 2011 07:00 AM PST Kiron Sarkar is an investor and advisor in London. Formerly in the M&A dept of N M Rothschild in London, he was head of M&A of Rothschild (Hong Kong) and worked on their international privatisation team. He worked as privatisation adviser to the UK Governments Know How Fund. Most recently, he was European Head of Media, Tech and Telecoms at CIBC World markets. Kiron has acted as a lead adviser in respect of over US$150bn of deals and has worked globally in both developed and emerging markets. Last Monday, the ECB announced that they had bought just E4.5bn of peripheral Euro Zone Sovereign debt, less than half the previous weeks total – likely to have been mainly Italian, with some Spanish and possibly Portuguese bonds. I had believed, somewhat optimistically, that the ECB would have been far more aggressive, particularly given that Draghi had supported the idea of bond purchases, even before he took over at the helm at the ECB – however, it was not to be. Italian 10 year yields had declined by over 100 bps at one stage last week (rose subsequently), suggesting some aggressive buying, though – will have to wait for next Monday’s announcement. They rose above 7.0% today, but I presume the ECB is buying as yields re lower today in spite of a weaker Euro/Market German officials continue to express their opposition to QE, but in reality, the fact that they are talking about QE to such an extent, suggests to me that it is being discussed seriously. The real problem is trying to convince the Germans, given their total paranoia of inflation – they still remember the 20′s/30′s and the resultant rise of the Nazi party, which was blamed/caused by hyper inflation. Whilst this is understandable, it is not a realistic position for the present. Indeed, I believe that Mrs M has finally understood this – the problem is that neither she, nor her colleagues, have persuaded or even discussed the need for it with the German public (read voters). As I keep banging on, QE in the Euro Zone will be introduced, sooner rather than later. The Euro Zone will, I expect suggest that it is a “temporary” measure (as the ECB claims in respect of its unlimited financing of European banks, but if I recall, this unlimited financing has gone on for 3 years), but “temporary” will last quite some time – certainly not months. A German official, with a wonderful name of Mr Bofinger (hope I got the spelling right and need to check him out, particularly to his standing in Germany), stated that it was unrealistic to expect that countries such as Italy could continue with the current level of bond yields – he is clearly correct. Expect more such statements, to get the German public ready for impending QE. To “sell” the idea even more, the Euro Zone will have to introduce measures that force countries to comply with predetermined fiscal targets, particularly given the antics of the Greeks. You will be amazed to hear that the Greek finance Minister suggests that Greece will produce a budget surplus in 2012 – must have been the ouzo, probably mixed with the awful metaxa. In addition, treaty changes have been proposed by Germany and Holland – inevitable. The Dutch, for example, want changes which will allow for the expulsion of countries that do not comply with their pre determined fiscal commitments – a clear reference to Greece. This is also positive, as these countries have to start getting real. Once these measures are in place (and may require a period of time – not too long – to monitor compliance), the Euro Zone can then issue Euro Bonds, which clearly is the final objective. At that stage, you may finally have a workable Euro ie with fiscal and monetary union – political union to follow thereafter A number of you believe that the above is impossible. Well, certainly based on recent comments by Euro Zone (particularly German) politicians, I don’t blame you. However, may I suggest that you don’t listen to what politicians say. As a character from the famous UK TV sitcom “yes Prime Minister” used to say “it’s only true once it has been officially denied”, or words to that effect and, boy oh boy, we have had many, many official denials. Timing – well certainly some next year at the latest – though in the case of another crisis (quite likely), possibly even sooner. I listened to an interview with an EU politician on Bloomberg the other day. He was clear that QE was coming. However, he added, that his Euro Zone colleagues (German) were not quite there YET. He believed that the Euro Zone had to have a deep, deep, deep problem before its introduction – to date you have had a deep, deep problem ie one more nudge necessary. Sensible guy, but not surprisingly, he was a Brit, though importantly he was on an EU Finance Committee. Could Spain provide that last and necessary nudge before QE is introduced. This weekend the Spanish go to the polls. The current administration will be kicked out and the Conservative party will take over – not before time. Wait a bit longer and horror stories will emerge as to the true state of Spain’s financial position. As you know, I believe that Mr Zapatero/Mrs Salgado have LIED constantly – Spain is in deep trouble – in my opinion much more so than Italy. The market (finally) seems to be getting it – Spanish bond yields are rising to levels where LCH Clearnet is likely to impose additional collateral requirements – oops. French bond yields continue to rise inexorably – basically the game is up and there is no alternative to QE. Having said that the Spanish index, the IBEX, may well rally on a change of Government – covered my short yesterday. I’ve just read that the Spanish Finance Minister is reiterating GDP of +1.3% (well at least its not the previous one of +1.7%) for 2011 and, in addition, he adds that the Government is “targeting” a budget deficit of 6.0% of GDP for the current year (interesting word “targeting” don’t you think A number of you advise me that Germany has number of supporters within the Euro Zone and who support their opposition to QE namely, Finland, Austria and Holland. Whilst certainly an interesting country please, do you believe that the Euro Zone will take Finland seriously – remember the deal the Finns negotiated with the Euro Zone re their requirement to receive collateral in order that they participated in the additional Greek bail out – it was a dreadful deal for the country The Austrians – well they have significant exposure to Central and Eastern Europe (also through their banks – look at the recent w/offs by Raifaissen for example) and their economy is under pressure – bond yields are rising as well. Their previous opposition is unsustainable and maybe not publicly, but they will not oppose QE. The Dutch – well, in my opinion, Holland is the only sensible country in the Euro Zone and one interpretation of the Dutch PM comments that countries who don’t meet their commitments get kicked out, is that they understand that QE is inevitable. On the other hand, the proponents for QE include France, Italy, Spain et all, given the state of their economies, which are ll getting worse. Given the current voting system at the ECB ie 1 country 1 vote (which will be changed in due course – a German demand, which will have to be met), QE is inevitable. In addition, a number of the 6 member ECB board are changing which, with Draghi at the helm, will make QE easier to vote for. In total, there are 23 voting members who vote on monetary policy decisions – the 17 countries within the Euro Zone and the 6 ECB members. Little discussed is Slovenia, a recent addition to the Euro. 10 year bond yields are around 7.0%, last I checked. Never underestimate a totally unexpected event to force a fundamental change in policy. There are numerous other reasons which suggest that QE is coming. Set out below are some of them. To date, Germany has worked with France to propose policy in the Euro Zone. France is clearly in favour of QE. Germany cannot and does not want to be seen as the sole leader of the Euro Zone – even though they are – they need French support, as a minimum. Today, an unnamed senior French official stated that “France was confident that he ECB will take the necessary measures to ensure the stability of the Euro Zone” Germany and its band of merry men cannot go it alone – their resultant currency will be a supercharged Swissy and the Germans have clear and recent evidence of what has happened in Switzerland – who by the way, have introduced QE – OK for different reasons. However, if the Swiss do it – political cover perhaps. Mrs M repeated her support of the Euro/Euro Zone today and, in addition, conceded that Germany would have to cede some Sovereignity to make it work; Germany’s opposition party, the SPD are more Euro Zone friendly than Mrs M’/the CDU – it’s only her marginal and insignificant political partner, the FDP, who are vehemently opposed – based on current polls, they are unlikely to gain any representation, so why bother listening to them – their anti Euro Zone rhetoric has not worked. Furthermore, Mrs M is not a lame duck – she is still popular in Germany, which allows her some flexibility. Sure, the opposition, combined with the Greens are ahead, but not by an awful amount. However, if she wants to go radical and support QE, she better do it sooner, rather than near the 2013 elections – thereby giving her time to “work her electorate”. The EFSF is not up to its task, as is becoming patently obvious – well if France gets it………. Mr Junker stated today that details relating to the EFSF will be released by the end of the month – don’t hold your breath. The ECB is and will remain the only player capable of turning round the situation within the Euro Zone; International criticism of the Euro Zone is ever increasing – whilst not critical, the rhetoric is rising, given the potential negative impact on global economy. It will be difficult for the Euro Zone to continue to ignore international criticism; The Euro Zone is likely to witness social unrest (OK not as yet in the important countries, because it’s its winter, but wait until summer), unless there is a change ie QE. Austerity is important, but the public will not take it forever, without some hope of growth in the not to distant future; Euro Zone banks are close to imploding. The need to raise capital is resulting in these banks selling assets (particularly non Euro assets and remitting the proceeds – hence one of the recent reasons why the Euro has held up, which otherwise should be trading closer to US$1.20). However, if banks reduce lending in the Euro Zone, we really will have catastrophe on our hands. It is rumoured that UniCredit has requested that the ECB assist Italian banks far, far more – how long before Spanish banks (who are much, much worse off), make the same panic request; Draghi, who has taken over, is a much more market savvy operator than Trichet (though this would not be difficult) and whilst he has to “manage” the Germans, given hat he is Italian, he certainly does not want to have a Euro collapse on his CV. In addition, my first impressions are that he is skillful, though back room, operator – notice that comments by Draghi have been few and far between – if only Euro Zone/other ECB officials would follow this example; Discussions as to a Portuguese haircut (possibly as much as 40%) is coming. Wait for the impact of that news. ESSENTIALLY, THERE IS NO CREDIBLE AND/OR WORKABLE PLAN B, as I keep banging on. I have hated/been short (in the past) the financial services sector, particularly in Europe as you know – is it time to buy Euro Zone financials (banks, insurance companies), do you think. Personally, I have and I believe a nibble, at the very least, is looking particularly interesting. Just read that super Mario (the latest Italian PM) has appointed a bunch of technocrats in his Government – no surprise. Interestingly, he has appointed himself as Finance Minister – hope he does better job than he did when he was an EU Commissioner. The key is whether he can get enough of the Italian political parties to back him – especially as that lunatic Berlusconi is still around and itching to stage a come back. Amusingly, Mr B advised an Italian newspaper (his own Currently in India – the alleged high tech EM. Unfortunately, the guys who provide broadband seems to have forgotten about this claim, though it may just be Goa. However, it does impact my ability to send out notes – you lucky people. Better US economic data yesterday – retail sales/confidence – just confirms the recent trend. Inflation data out today – core up +0.1%, CPI down -0.1% – YOY CPI +3.5% and core +2.1%. Interestingly, WTI is back above US$100 and the gap between Brent and WTI is narrowing – reflecting stronger US economy?. Better September forex inflows into the US as well – no great surprise. In the UK, higher (though less than forecast) unemployment and fast falling inflation, accompanied by further (and increasingly non Markets are all over the place today. However, I remain bullish – on the face of it crazy, I know, but given my (lucky, I suppose) performance YTD, gives me some flexibility. However, this remains a trading market and if the facts (confirmation of no QE in the Euro Zone) change (which I don’t believe), well………. Excellent note by Credit Suisse in respect of Euro Zone/QE. They agree with me, but are more cautious, I must admit. Goodbye from a sunny and very warm (85 degrees) Goa – its easier to communicate by smoke signals (sorry, corny joke) than work with this broadband connection. |

| Posted: 16 Nov 2011 06:33 AM PST Here are my morning reads:

What are you reading? |

| CPI little changed but oil now at $100 Posted: 16 Nov 2011 05:58 AM PST Oct CPI fell .1% vs expectations of flat but core CPI rose .1%, in line with estimates. The y/o/y gain is 3.5% headline and 2.1% ex f&f. To put the 3.5% rate in perspective, avg hourly earnings in Oct rose just 1.8% y/o/y and the national average for a 1 yr CD is .35% according to Bankrate.com. Energy prices fell by 2% while food prices rose only .1%. Owners Equivalent Rent, 25% of CPI, rose .2% but interestingly, Rent of Primary Residence rose .4% for the 2nd month in the past 3. Landlords having pricing power and that will start to filter into OER. Vehicle prices fell by .4% and commodities overall fell by .4%. Medical care rose .5%, the biggest rise since Feb and apparel prices rose by .4%. Bottom line, notwithstanding a lackluster economy not just in the US but elsewhere, inflation is remaining sticky (aka, stagflation) and with crude oil now back to $100, CPI readings will be heading higher in the months to come. |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment